Needle coke is an essential object of research in modern energy fields, and its unique properties and broad application prospects have attracted the industry's attention. To provide new ideas and solutions for the sustainable development of the needle coke industry, ICCSINO, under the guidance of the China Carbon Industry Association, held the 14th International Needle Coke and Application Market Summit Forum on November 29, 2023, in Sanya, China. The summit forum brought together more than 300 professional experts and scholars from the global needle coke industry to discuss the latest research results, development trends, market conditions, and industrial applications in depth.

The conference started with a welcome speech by Ms. Lian Ping, General Manager of ICCSINO. Speaking on the occasion, Ms. Lian said: ICCSINO has hosted the Needle Coke and Application Market Summit Forum for 14 consecutive years since 2010, which is dedicated to promoting the development and innovation of the Needle Coke industry. ICCSINO's research field covers the two application directions of needle coke, from needle coke to graphite electrode to electric furnace steelmaking, from needle coke to anode material to lithium battery to new energy vehicles, energy storage. She hoped that through the discussions and exchanges held at the conference, research in this field could be further deepened and more contributions made to developing the needle coke industry and enterprises.

The conference started with a welcome speech by Ms. Lian Ping, General Manager of ICCSINO. Speaking on the occasion, Ms. Lian said: ICCSINO has hosted the Needle Coke and Application Market Summit Forum for 14 consecutive years since 2010, which is dedicated to promoting the development and innovation of the Needle Coke industry. ICCSINO's research field covers the two application directions of needle coke, from needle coke to graphite electrode to electric furnace steelmaking, from needle coke to anode material to lithium battery to new energy vehicles, energy storage. She hoped that through the discussions and exchanges held at the conference, research in this field could be further deepened and more contributions made to developing the needle coke industry and enterprises.

After Ms. Lian's speech, the first keynote speaker of the summit was Mr. Sun Qing, honorary vice president of the China Carbon Industry Association. He brought a keynote speech on China's carbon industry's current situation and prospects. In his remarks, Mr. Sun mentioned that under the influence of the economic environment, most enterprises face the three pressures of overcapacity, "demand shrinkage, supply shock, and expectation weakening." In the carbon industry, vicious competition is spreading, and it is necessary to strengthen market self-discipline with enterprises as the main actors and contain it. Upstream and downstream aspects:

Petroleum Coke: The trend for petroleum coke continued to decline in the first half of the year, with a flood of imports from overseas affecting domestic coke. It also fluctuated in the third quarter amid weak supply and demand.

Needle Coke: Needle coke producers are under significant operating pressure as raw material prices are firm and downstream demand weakens, leading to market price pressure.

Steel: Demand in the steel industry has been sluggish this year; prices have been weak, profits have plummeted, and losses have widened. The decline in the proportion of arc furnace steel production, with the utilization rate of arc furnace steel production hovering around 38 percent in September, is directly transmitted to the carbon industry, where the market price of graphite electrodes has declined, and the area and amount of losses have increased.

Electrolytic Aluminium: In the first half of the year, the consumption of electrolytic aluminum was 20.5878 million tonnes, an increase of 4.2 percent year-on-year. In the first three quarters of this year, the aluminum price fluctuated at a high level frequently, and sometimes the amplitude was relatively large, which was transmitted to the cost of carbon products for aluminum, which also declined. However, the overall impact on the market of prebaked anodes and cathodes for aluminum was not too significant.

Industrial Silicon: Industrial silicon production was 1.68 million tonnes in the first half, and annual production is expected to reach 3.46 million. Production is increasing, driven by the photovoltaic industry, but prices continue to decline due to the economic environment, which translates into lower sales volumes for carbon electrodes used in coal-fired furnaces and lower selling prices.

Anode Materials: Shipments of anode materials were 720,000 tonnes in the first half, an increase of 33 percent year-on-year. Due to the severe overcapacity of anode materials, especially in the year's second half, new capacity was gradually released, disordered competition emerged, and price games were played out. Benefits for production enterprises declined, but the impact was mainly on small and medium-sized enterprises and large-scale enterprises. Although profit margins fell significantly, the overall economic benefits remained acceptable.

Carbon still has a bright future, but the industry reshuffle is inevitable. The realization of the dual-carbon goal will boost the development of the carbon industry, and the high-quality growth of the carbon industry itself is accelerating from large to strong.

The second speaker at the conference was Professor Ma Zhaokun from the School of Materials Science and Engineering at Beijing University of Chemical Technology. He brought us a report on preparing carbon fibers based on pitch. He pointed out that China is a significant producer of asphalt, and developing general-purpose asphalt and mesophase asphalt-based carbon fibers is the only way to create high-value materials.

The third speaker at the conference was Mr. Sun Qi, Deputy Chief Engineer of Liaojin Branch of China Kunlun Engineering Co. He brought a report on the possibility of needle coke device to produce ordinary coke. The predecessor of the Liaojin branch of China Kunlun Engineering Co. was the China Petroleum Jinzhou Petrochemical Design Institute and Jinxi Petrochemical Design Institute, which was established in 1962. It was incorporated into China Kunlun Engineering Co., Ltd. in 2020 and reorganized into China Kunlun Engineering Liaojin Branch in 2021. The Liaojin branch employs 312 people, including 120 senior engineers and 115 engineers. It has 135 registered practitioners with various qualifications, such as national first-class registered architect, national first-class registered structural engineer, and national first-class registered chemical engineer.

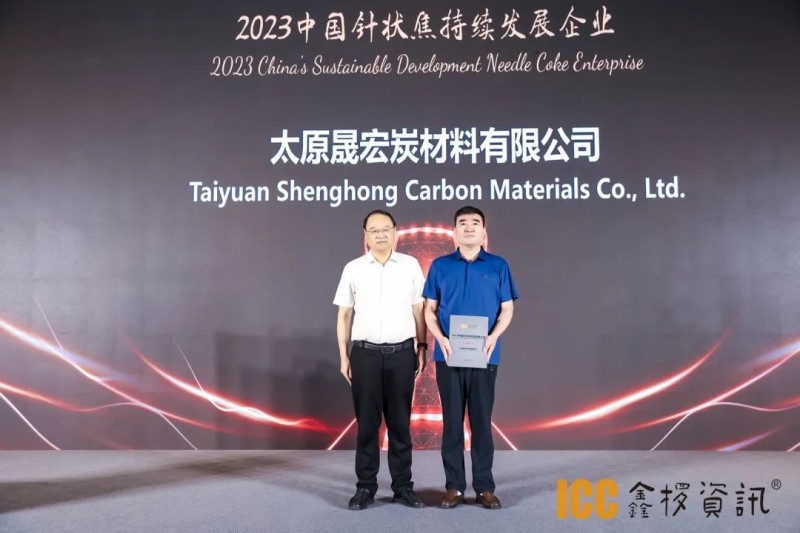

The conference also established an exciting awards ceremony for selecting outstanding companies in needle coke, petroleum coke, and graphite electrodes.

Here is the list of award-winning enterprises (in no particular order)

2023 Global Quality Brand of Needle Coke

Shandong Yida New Materials Co., Ltd.

Shandong Jingyang Technology Co., Ltd.

Shandong Lianhua New Materials Co., Ltd.

Weifang Fumei New Energy Co., Ltd.

2023 China Needle Coke Annual Competitive Brand

Liaocheng Zhonghe Energy Technology Co., Ltd.

Shandong Yiwei New Materials Co., Ltd.

2023 China Needle Coke Sustainable Development Enterprise

Taiyuan Shenghong Carbon Materials Co., Ltd.

*Li Xinping, Secretary of the Party Committee and Chairman of Kaifeng Pingmei New Carbon Materials Technology Co., Ltd., presented awards to the award-winning enterprises

2023 China Needle Coke Newcomer Enterprise

Luoyang Honglian New Materials Technology Co., Ltd.

*Li Xinping, Secretary of the Party Committee and Chairman of Kaifeng Pingmei New Carbon Materials Technology Co., Ltd., presented awards to the award-winning enterprises

2023 China Needle Coke Quality Design Institute

China Kunlun Engineering Co., Ltd. Liaojin Branch

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

2023 China Needle Coke Quality Import and Export Enterprise

Beijing Fangda Carbon Technology Co., Ltd.

Daqing High-tech International Industry and Trade Co., Ltd.

Tianjin Jingang Xinbo International Trade Co., Ltd.

Shanghai Xinmo Industry Co., Ltd.

Jiangsu Zhiyan International Trade Co., Ltd.

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

2023 China Petroleum Coke Quality Supplier

Rizhao Huina International Trade Co., Ltd.

Daqing High-tech International Industry and Trade Co., Ltd.

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

2023 Global Graphite Electrode Excellence Brand Award

Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

Liaoning Dantan Technology Group Co., Ltd.

Jianglong Carbon Group

Yingkou Desheng Carbon Co., Ltd.

Shanxi Juxian Graphite New Materials Co., Ltd.

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

2023 China Graphite Electrode Excellence Brand Award

Zhongyi Group (Jilin) New Energy Technology Co., Ltd.

Qinghai Shengxiang Electrode Products Co., Ltd.

*Cao Yalin, Plant Manager and Chief Engineer of Langxi Hongtai Steelmaking presented awards to the award-winning enterprises

2023 China Graphite Electrode Export Achievement Award

Henan Huaruo Import and Export Trade Co., Ltd.

Jiangsu Zhiyan International Trade Co., Ltd.

Beijing Longyue Mining Co., Ltd.

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

2023 New Carbon Materials Intelligent Equipment Excellent Supplier

Luoyang Jianguang Special Equipment Co., Ltd.

Weifang Jinghua Powder Engineering Equipment Co., Ltd

Hunan Huaxia Tebian Co., Ltd.

*Lian Ping, General Manager of ICCSINO, presented awards to the award-winning enterprises

After the ceremony, Cao Yalin, plant manager and chief engineer of Langxi Hongtai Steel, presented a report on the market situation and development prospects of electric furnace steelmaking in 2024. Talking about the market situation for steel products in 2024, he believes that China's crude steel output is expected to rebound slightly this year after two consecutive years of decline, thanks to a sharp increase in external demand and a stabilizing domestic market. But in the long term, he still believes that China's per capita steel consumption has primarily peaked. The demand ceiling limits the price upside under the real estate drag. Profits at the midstream smelting end are under pressure from both sides, with aggressive destocking alleviating the short-term supply-demand contradiction, but the long-term pressure at the capacity end remains. After crossing the demand inflection point and entering the platform region, the logic of the three new industry mainstays, likely to be the main drivers for the next two years, is also gradually becoming clear. While the economy grows, domestic steel consumption is "in step." However, international experience shows that steel consumption is not without limits. After passing the peak, the elasticity of steel consumption is expected to decrease. From the bottom up, property's contribution to steel demand growth has entered the negative contribution region. The nature of the counter-cyclical adjustment of the infrastructure also dictates that its sustainability is relatively limited. Demand points in the manufacturing sector are somewhat scattered, making it difficult to form a concentrated driving force, and it is difficult to hedge the decrement sufficiently.

The last speaker of the morning was Qian Yi, a black researcher from ICCSINO, the organizer. He brought a keynote report on the turning point for steel carbon in 2024. Qian first presented the market trends in 2023. He noted that China's graphite electrode prices continue to bottom out in the first half of 2023, with an average annual cost of 195,000 yuan for the UHP600, down 50,000 yuan from 2022. In the third quarter, after a slight rebound in needle coke, electrode manufacturers became more willing to raise prices, and the market for furnace steel also started to pick up in the fourth quarter, with market conditions tending towards the third quarter of 2020.For the first three quarters of 2023, demand for graphite electrodes for furnace steel and brown corundum declined slightly, while demand for industrial silicon, yellow phosphorus, titanium slag, and other products increased somewhat. The reduction in losses and production reductions at our furnace steel plants were the primary reasons for the decrease in graphite electrode prices in the first three quarters. From January to October 2023, China's crude steel output rose 1.4 percent year-on-year to 874.7 million tons, but the proportion of furnace steel dropped 0.16 percent to 8.71 percent. In 2023, the average price of rebar in China fell by 500 yuan per tonne year-on-year to 3,901 yuan per tonne, and the trend of steel prices and the ratio of furnace steel was generally in line. China exported 225,700 tons of graphite electrodes in the first three quarters of 2023, up 3.1 percent year-on-year. Regarding export structure, UHP electrodes still account for about 70 percent of total exports. Regarding the trends in 2024, Qian analyzed the three aspects of supply, demand, and price and believed that they would all usher in a turning point.

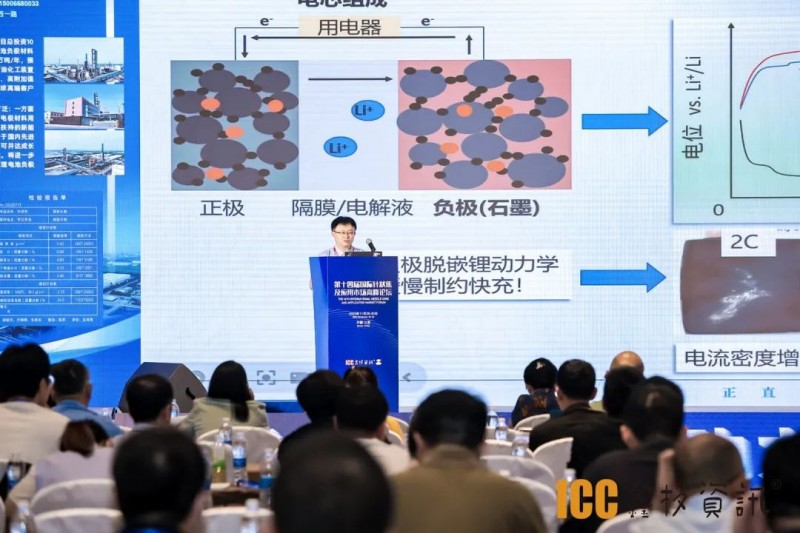

The first speaker in the afternoon was Mr. Ding Xiaoyang, Executive General Manager of Shanghai Shanshan Technology Co., Ltd.. He brought a keynote report on lithium-ion battery Anode materials market trends. In the report, Ding argued that the current demand for Anode materials is highly competitive, which is mainly manifested in:

1. Competition intensifies for graphite product homogenizatio

2. High-quality raw materials for artificial graphite are scarce

3. The capacity of new materials based on silicon and hard carbon continues to grow. In terms of technological iteration, the industry is also showing an accelerating situation: Consumer-grade graphite - fast charging from 3C to 10C, power grade graphite - 4C fast charging era, 10,000 cycles, energy storage grade graphite - low cost, long cycle, new materials based on silicon-silicon oxide to silicon carbon one step leap, sodium-electric hard carbon - hundreds of contenders.

The second speaker was Professor Chen Zhengjie from Kunming University of Science and Technology. He brought a report on research into vacuum-enhanced petroleum coke purification. This report focuses on four aspects: research background, desulfurization by different calcination methods, molecular simulation calculations of sulfur-containing compounds, and ultrasonic acid leaching purification.

The third speaker was Mr. Yang Shusong, manager of the technical department of Jiangguang (Shanghai) Special Equipment Co., Ltd. He brought a report on the automated production system for needle coke. The report focuses on six aspects: the current situation of needle coke production systems, the introduction of needle coke production systems, special equipment, industrial applications, technical schemes for the application of needle coke production systems to existing equipment, and comparison with needle coke pool-type closed-loop production systems.

Shen Jianfeng, deputy general manager of Shandong Jingyang Technology Co., Ltd., brought a keynote speech on the current situation and import and export analysis of China's needle coke market. In the report, he argued that new energy vehicles' production and sales volume will see explosive growth in 2021 due to policy promotion and market demand drive. As one of the primary raw materials for upstream Anode materials, the market demand for needle coke has grown significantly. The proportion of Anode material in downstream consumption of pyrochlore was 46.91 percent in 2021 and increased to 64.06 percent in 2022. The demand for Anode materials has boosted and driven the needle coke industry to usher in a new supply and demand landscape. But by 2023, the proportion of oil-based pyrochlore in downstream consumption of Anode materials has declined due to the slowdown in terminal new energy vehicle growth and the urgent need to reduce costs in the Anode industry chain.

Wang Chunmei, chairman of Shandong Yiwei New Materials Co., Ltd., brought a keynote speech on the market development situation and prospects of the needle coke industry in 2023. In the speech, Ms. Wang mentioned that affected by the continuous cost reduction of the downstream sector and the imbalance of supply and demand in the needle coke industry, the needle coke enterprises were forced to make concessions, and the market price continued to fall, and the price of raw and cooked coke fell by more than 35 percent within the year. Cost support is significant in the second half of 2023 as needle coke prices fall towards the cost line and raw/cooked coke prices are weak and stable. In the future, as needle coke capacity continues to expand, competition in the needle coke industry will become more intense, and how to control costs, stabilize quality consistency, and jointly develop research and development will be critical to the survival and development of the company.

Ma Qiang, assistant general manager of Shandong Lianhua New Materials Co., Ltd., brought a report on the future application and development of needle coke in the graphite electrode and Anode materials market. Ma argued that domestic overcapacity has become a fact, and the competitive situation has deteriorated further. The market will gradually eliminate small, weak, and backward enterprises. In the face of risks and challenges, how do you break through? This is the biggest issue that each needle coke enterprise needs to think about!

The final speaker of the conference was Lian Ping, general manager of ICCSINO, the organizer. She brought a keynote presentation on the prospects for needle coke in the lithium-ion battery industry. According to ICCSINO, China will account for 96 percent of the global market share of lithium-ion battery Anode materials by 2022, and its share will continue to climb to 97 percent by the first half of 2023, Lian noted in the report. In 2022, China produced 1.415 million tons of Anode materials, a year-on-year increase of 74.5 percent; Global Anode production was 1.4682 million tonnes, an increase of 67.3 percent year-on-year. Artificial Anode materials dominate the lithium battery Anode materials market with a domestic share of 81.24 percent, while natural Anode materials account for 18.26 percent and others account for 0.5 percent.

At the end of 2022, Anode material manufacturers were overly optimistic about the late-stage market, resulting in a large backlog of semi-finished and finished products. In the first half of 2023, some months saw a slight month-on-month drop in output. Output of Anode materials also increased slightly month-on-month as the destocking rhythm approached its end, and the industry gradually increased its operating rate.

Demand for Anodes is still growing, driven by the downstream lithium battery and new energy vehicle markets. It is expected to reach 4.33 million tonnes in 2027, and the market should not be too pessimistic later.

Regarding the outlook for the needle coke industry, Lian believes overseas needle coke capacity will enter a new phase of construction and expansion, while domestic needle coke capacity will maintain an expansion trend. In the next few years, the increase in needle coke supply will still mainly be in China. By 2028, the domestic needle coke supply is expected to reach about 4 million tons. As a result, over the next 2-3 years, needle coke prices will fluctuate mainly depending on the raw material oil slurry/coal tar and the demand situation, with no bottleneck in needle coke itself.

Regarding later market supply and demand and price outlook for needle coke, Lian believes that cost pressures have also been transmitted to the raw material end of the market over the past two years, as the need for end applications has entered a downward cycle. The graphite electrode market and the lithium battery Anode material market are expected to bottom out around 2025, and the end of the needle coke supply will also usher in a change in the supply and demand landscape. Around 2026, when the supply increase is not significant, the end of demand clears, and product prices are expected to rebound under the driving double positive factors, prices will rise significantly, and the needle coke industry will enter an upward cycle.

Participants at the conference included domestic needle coke industry practitioners and those from France, Japan, South Korea, Russia, and India. The participants exchanged their views on the products through this conference and discussed possible cooperation opportunities. The forum is a platform for product presentation and an excellent opportunity for business communication.

By the end of the session, everyone was satisfied with the in-depth exchange. They look forward to having more opportunities for such exchanges and cooperation in the future. The congress also became an important milestone for the parties to establish contacts and expand their business.

CONTACT US

CONTACT US ICC APP

ICC APP