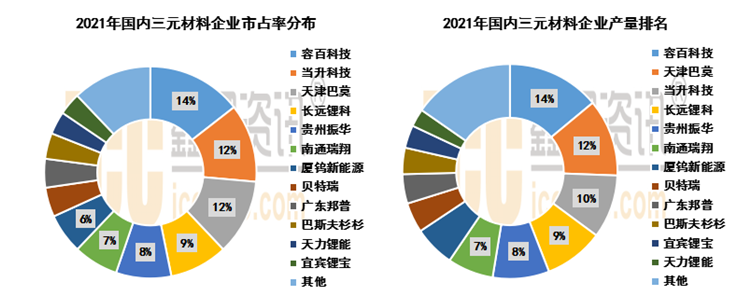

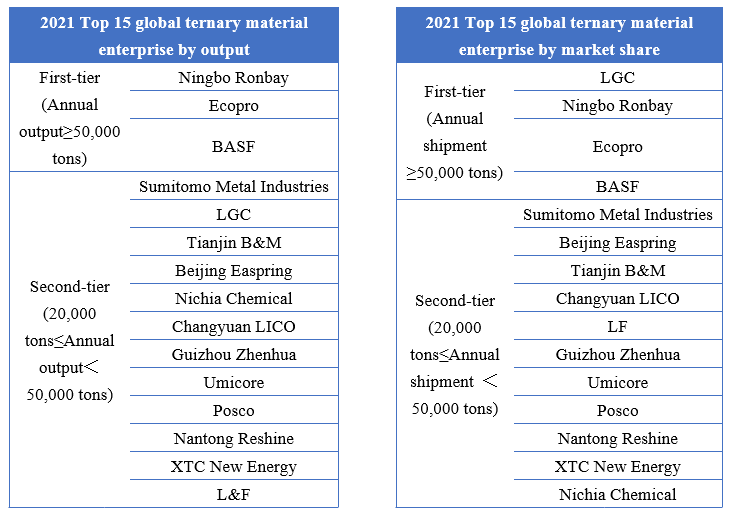

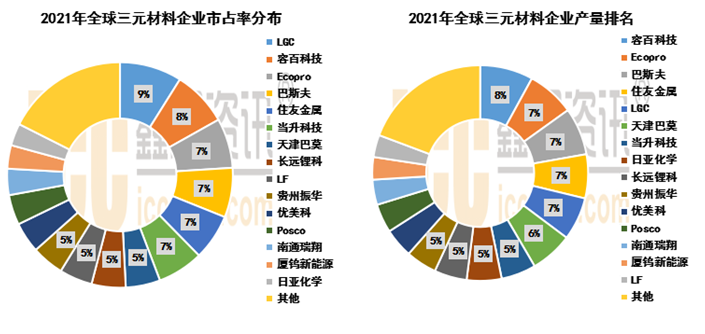

On the enterprise level, the concentration of domestic ternary material industry increased significantly in 2021, with the concentration rate of top 5 (CR5) enterprises by output surpassing 50%. Against a backdrop of LFP resurgence and progress in high-nickel application, leading enterprises have stayed ahead of the market by leveraging their scale of production capacity, customer structure, technological superiority and other advantages, gradually solidifying their leading position, and competition has become even more heated.

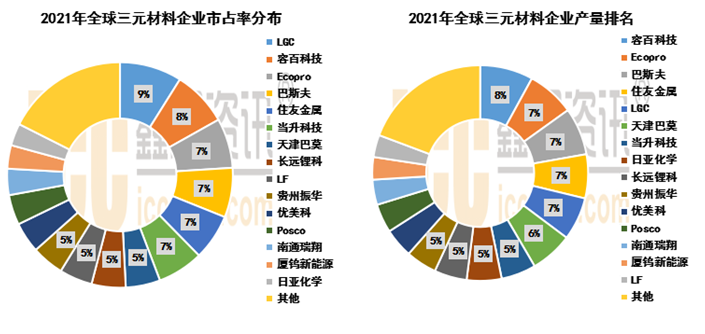

Note: 1. Market share is measured by shipment

2. Enterprise output doesn’t include the part by way of outsourcing

3. The data is for reference only. It is subject to company announcement.

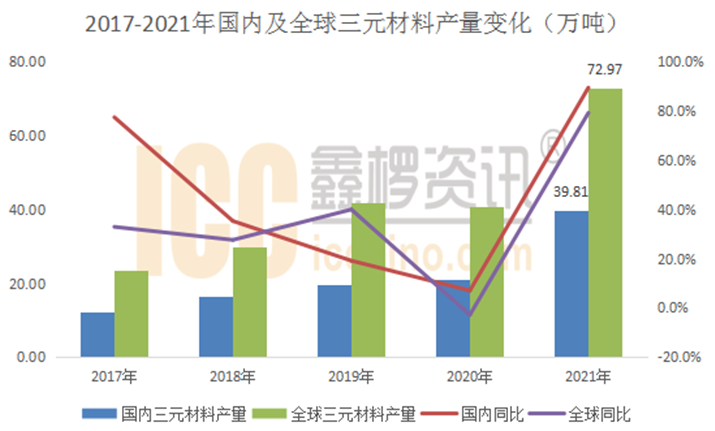

It is worth noting that while the year-on-year growth of annual ternary material output was quite outstanding in 2021, the excessive planning from earlier years has long caused severe oversupply. There wasn’t much expansion plans for ternary materials in 2021. With high-nickel products gaining more recognition in the end market, coupled with LFP cutting into the low-to-medium market, leading ternary material enterprises are gradually leaning towards high-nickel products in their new capacity planning. In 2021, China’s total ternary material production capacity registered 832,000 tons, an increase of 23.4% year-on-year.

Worldwide, ternary material sphere is still dominated by multiply strong players. In 2021, the COVID-19 pandemic, supply-demand mismatch in industrial chain, policies and other factors had affected overseas and domestic enterprises differently. Domestic enterprises have emerged as a main force driving the growth of global ternary material market, contributing to 54.6% of world supply.

Note: 1. Market share is measured by shipment

2. Enterprise output doesn’t include the part by way of outsourcing

3. The data is for reference only. It is subject to company announcement.

In the rapid development of the industry, individual advantages and core competitiveness are vital key for company to stand out and gain a firm foothold. In 2021, in addition to leading enterprises making rapid progress, there are also many "new faces" jumping into the leading ranks with fast growth in the ternary material market. BTR and Yibin Libode are among them, both presenting impressive performance. BTR’s deep cooperation with SKI and EVE, the demand surge from related supply chain, and the launch of its new capacities have driven up both BTR’s production and sales. Moreover, the high-nickel ternary material project jointly invested by the three companies is expected to go into production as scheduled in 2022. As for Yibin Libode, by virtue of its advantage in raw materials and downstream customers’ acceptance of its products, the company has successfully entered the supply chain system for CATL, which provides further guarantee for its production and sales and significantly strengthens its operation conditions.

Afterword

Under the guidance of policies, the new energy industry still has huge development potential. Although the competition remains fierce in the ternary material market even after years of reshuffle, enterprises with advantages in technology, scale and customer structure will occupy a leading position that will be more evident in the next two years. Overall, for 2022, it will mainly still be the existing leading enterprises that leads the market. The country’s ternary material output is estimated to reach 537,300 tons in 2022, and the global output is estimated at 982,700 tons.

CONTACT US

CONTACT US ICC APP

ICC APP