Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

This week, the battery maintains a high level of operation, the production capacity of leading companies continues to climb, and the power battery maintains a full production state. Competition has become a chain-to-chain competition. The supply chain is bound to each other, and it will be difficult to compete without binding. CATL has released sodium-ion batteries, a diversified technological path, which provides an important guarantee for battery resources.

Lithium iron phosphate (LFP):

At present, the impact of power rationing in Yunnan remains, and the price of yellow phosphorus remains stable; the price of front-end phosphoric acid has risen, the supply and demand of mainstream process raw material iron phosphate is tight, and the center of gravity of external quotations rises slightly, and there is a certain time difference between transmission to the downstream; the price of superimposed lithium carbonate continues to be high. The downstream lithium iron phosphate leading companies are currently operating at full production, and the market is bullish in the later period; the energy storage market is temporarily maintaining stable operation. In terms of price, the current mainstream power-type lithium iron phosphate is quoted at 52,000 to 56,000 yuan/ton.

Ternary Material:

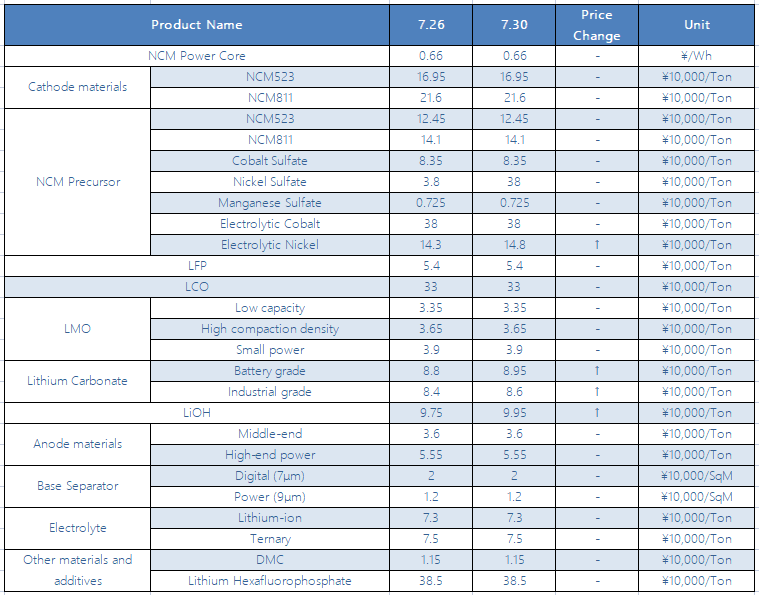

The ternary material market has not changed much this week, and the fluctuations in the front-end raw material market have not yet been transmitted to the downstream. From the perspective of the market, the prices of lithium carbonate and lithium hydroxide at the raw material end are gradually rising again, and the stocks of material manufacturers are tight, and follow-up long-term orders are often negotiated; the recent fluctuations in raw metal nickel have been significant, and the subsequent supply-side negative factors have materialized the uncertainties, and the production cost pressure of high nickel materials is relatively high, and it will maintain a high level of operation in the short term. In terms of price, the current price of nickel 55 type ternary material is between 159,000 and 164,000/ton; the price of NCM523 digital type ternary material is between 165,000 and 170,000/ton; the price of NCM811 type ternary material is between 213,000 and 219,000/ton.

NCM Precursor:

This week, the front-end raw material nickel increased significantly, and the ternary precursor market remained stable at a high level. Global mining giant BHP Billiton signed a nickel supply agreement with Tesla, and Toyota also announced the mass production application of "bipolar nickel-metal hydride batteries" in hybrid systems. The superimposed supply-side nickel ore shipments in Southeast Asia were affected by the weather and the epidemic. The price of nickel are gaining momentum; domestic cobalt prices have fluctuated and stabilized this week, the impact of chip shortages is still there, and digital consumer demand has not changed much. Precursor manufacturers are currently operating at full production, mainly supplying long-term orders, and adding new production capacity will basically be launched in the second half of the year. In terms of prices, this week’s conventional 523 type ternary precursors are quoted at 122000-127000/ton; cobalt sulfate is quoted at 80000-87000/ton; nickel sulfate is quoted at 37500-38,500/ton; sulfuric acid Manganese is quoted at 7000-7500/ton.

Lithium carbonate: Recently, the prices of lithium carbonate and lithium hydroxide continue to show an upward trend, mainly due to the shortage of overseas spodumene ore supply, the market's speculation on the supply gap of lithium concentrate and the expected reduction in the supply of salt lake lithium carbonate after the third quarter, plus lithium concentrate costs are rising, and the demand for cathode material companies such as downstream lithium iron phosphate and ternary materials is not decreasing. The superposition of various factors will continue to boost the prices of lithium carbonate and lithium hydroxide.

Recently, the supply and demand atmosphere in the domestic anode material market is tight. After the power supply in Inner Mongolia is once again tight, the graphitization gap has been enlarged again, and the price has risen again. It will be reflected in two months. In the raw material market, the price of low-sulfur was affected by Daqing Petrochemical's overhaul, and the overall price increased by about 600 yuan/ton; in the aspect of needle coke, the price of high-quality needle coke increased, especially the price of imported coke. Cost drives the strong willingness of negative electrode manufacturers to increase prices.

Electrolyte:

The electrolyte has not changed much this week. Due to the increase in the production capacity of the head battery plant, the demand for the electrolyte has continued to rise; while the new capacity of lithium hexafluorophosphate has not yet been launched, and the price is maintained at around 400,000. Long-term order lock-in gives priority to satisfying top customers, strong demand superimposed on the increase in exports, solvents continue to be tight, and prices continue to be high. Generally speaking, the production capacity of battery factories has climbed relatively fast, and the electrolyte shortage will continue until the first half of next year.

Separators:

This week, with the successive release of new capacity of battery factories, the demand for separator has increased significantly. The production and sales of major separator companies continue to climb, and the capacity utilization rate is close to saturation. Some battery factories intend to sign supply guarantee agreements with separator companies to lock the supply capacity of the separator. In terms of separator prices, price increases are still dominated by small orders, while prices for large orders remain stable. LG Chem has made frequent moves recently. Following the announcement of a joint venture with Japan’s Toray to build a wet-process separator plant in Europe, on the 29th, it agreed to acquire LG’s lithium-ion battery separator business.

CONTACT US

CONTACT US ICC APP

ICC APP