ICCsino Price: Lithium salt continued to be crazy in October, and the cost of battery cells approached the high level at the beginning of the year

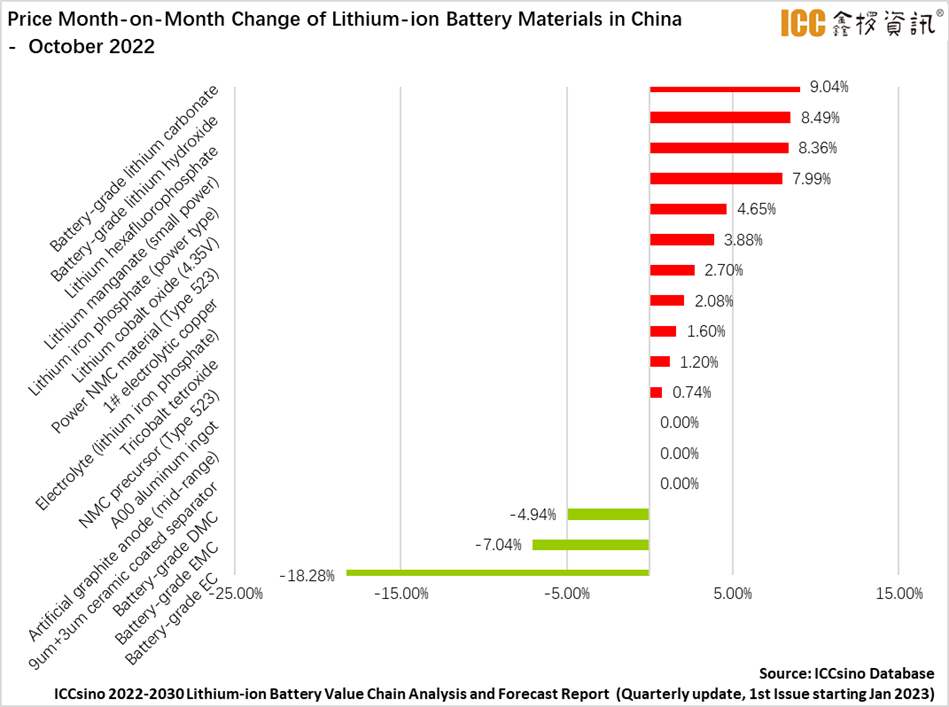

After the National Day, in the case of the demand in the downstream power energy storage field is still strong, lithium salt continues to rise in price, the average quotation price of battery-grade lithium carbonate and lithium hydroxide at the end of the month came to 580,000 yuan / ton and 557,000 yuan / ton, respectively, up more than 8% from the beginning of the month, driving cathode materials, lithium hexafluorophosphate and other related products to rise simultaneously. In addition, due to the new project input of electrolyte solvents at this stage, the overall market is expected to be oversupplied, and the price has fallen more obviously.

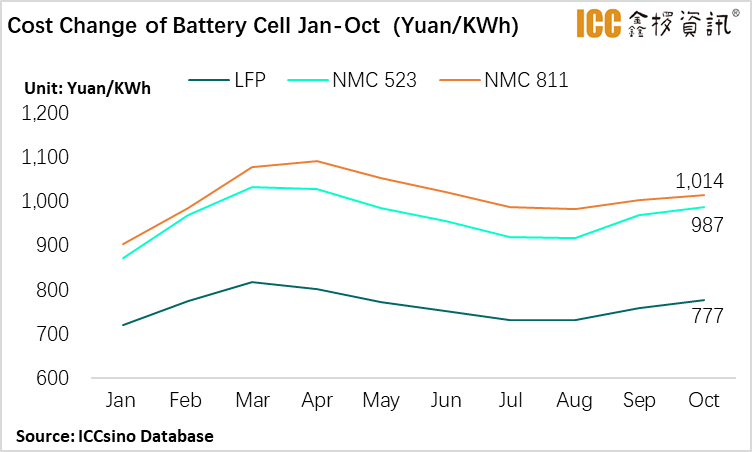

Affected by this, according to the ICCsino lithium-ion battery database, the production cost of batteries in different systems continued to rise in October and continued to approach the high level at the beginning of the year.

Specifically:

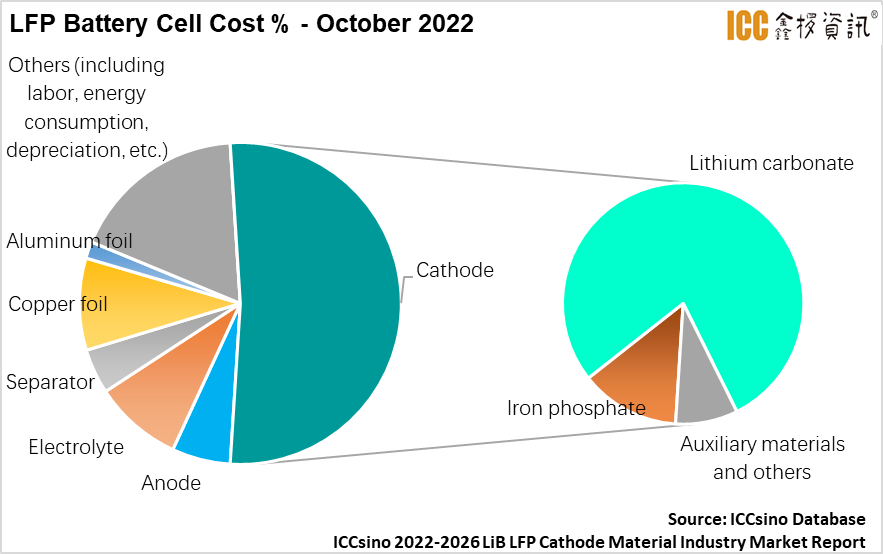

The average production cost of lithium iron phosphate cells in October was 776.54 yuan/kWh, an increase of 2.5% month-on-month. After the Holiday, the prices of raw materials such as phosphoric acid and monoammonium phosphate rose and fell, the cost pressure of iron phosphate eased, and the price fell limited with the support of downstream demand. Due to the seasonal reduction of lithium carbonate at the salt lakes, the maintenance of some enterprises at the mine end, the overall new production capacity is limited, driven by the continued strong downstream demand, the material cost has increased simultaneously, and the quotation of lithium iron phosphate at the end of the month has reached about 170,000 yuan / ton.

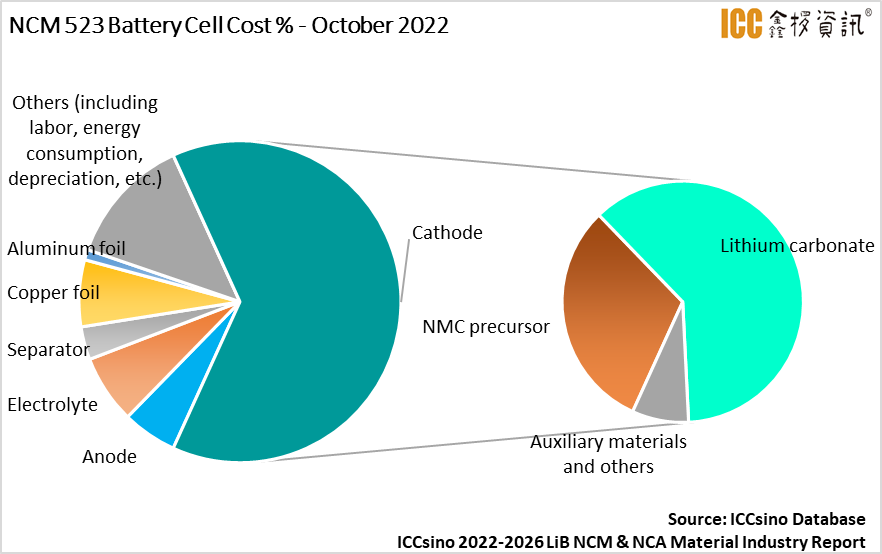

In terms of power NMC 523 cells, the average production cost per kWh of power NMC 523 cells in October was 986.98 yuan/kWh, an increase of 1.8% month-on-month. In October, nickel prices stabilized, and under the condition of continuous tight supply and the comparatively strong demand, nickel sulfate is stable and strong. Cobalt prices were weaker than expected due to external market conditions and overall demand, and prices rose and fell after the Holiday. In addition to the synchronous impact of lithium carbonate price increases, conventional medium- and low- nickel NMC keeps quite stable as the price transmission is relatively weak due to the difference in acceptance of downstream customers

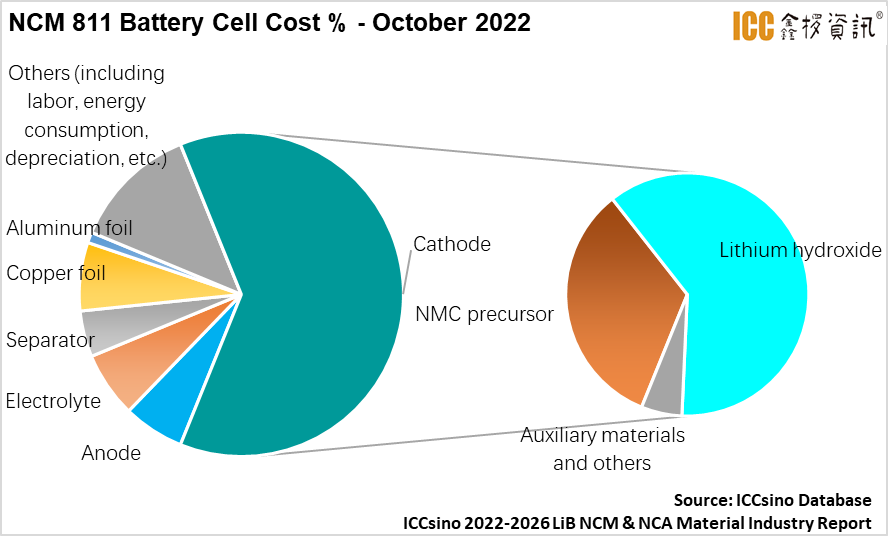

In terms of power NMC 811 cells, the average production cost of power NMC 811 cells reached 1013.63 yuan/kWh in October, an increase of 1.0% month-on-month. At this stage, nickel monocrystalline and high nickel product orders continue to be released, and the continuous improvement of material penetration rate has increased the demand for lithium hydroxide for NMC materials, which has promoted the price gap between lithium hydroxide and lithium carbonate to shrink.

November outlook:

From the perspective of month-on-month expectations, due to the impact of the epidemic, the sales of electric vehicles in October may be lower than expected, and battery companies are currently operating at a good level of production. However, it is worth noting at this stage that considering the time cycle of power battery raw material stocking, product production, vehicle battery installation and other factors, the rush to battery installation market driven by the expiration of domestic subsidies at the end of the year may gradually show demand differences in different links of the industrial chain in November, downstream inventory consumption accelerates, and material procurement sentiment may tend to be cautious.

【Brief Introduction of ICCsino Database】

CONTACT US

CONTACT US ICC APP

ICC APP