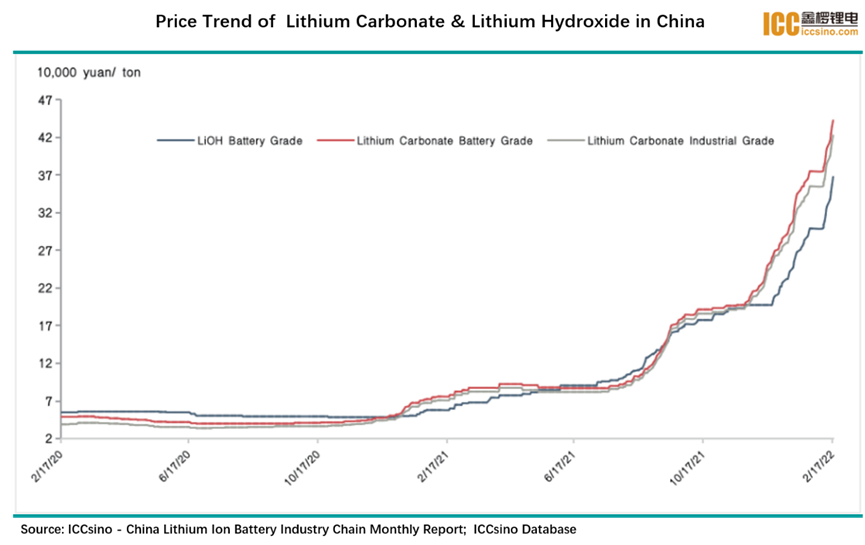

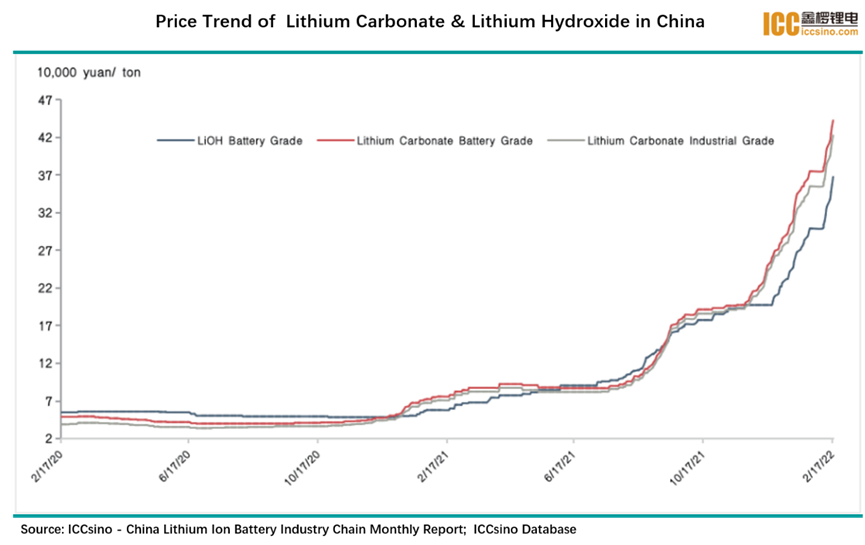

Lithium Carbonate:

At the end of 2021 and the beginning of 2022, the lithium smelters took turns for maintenance, and the total output of lithium carbonate in February was basically the same month-on-month. In Jiangxi, Nanshi Lithium was shut down during the Spring Festival due to the shortage of natural gas supply, resulting in a large drop in production; Ganfeng Lithium's lithium carbonate production line completed maintenance and fully resumed production in February; Yichun Yinli Lithium's production line was overhauled during the Holiday and the output was somewhat reduced.

In Sichuan, the production of various companies has basically returned to normal, but the number of days in February is less, so the output has declined slightly.

In Qinghai, the impact of natural gas supply has gradually weakened, but Qinghai Lithium and Zangge Mining are still affected and reduced, and the total market supply has only increased slightly compared with January.

In terms of downstream demand, most cathode material companies did not reduce their demand despite of the Spring Festival Holiday. At the beginning of the month, they actively stocked up due to the continuous jump in the price of lithium carbonate, which led to an apparent increase in the demand for lithium carbonate, and thus the market supply gap was even more difficult to fill, which further promoted the price of lithium carbonate. By the end of February, the market price of battery-grade lithium carbonate was nearly 500,000 yuan per ton, a new record high. Many battery and lithium iron phosphate companies said they could no longer afford it and boycotted high-priced lithium carbonate. Despite of this, the demand for lithium carbonate did not decline significantly in March, and the supply of smelters was still hard to satisfy the downstream demand. Most of the smelter production returned to normal in March, and the output is expected to increase in the coming months.

Lithium Hydroxide:

In February, the total output of lithium hydroxide decreased by 13% month-on-month, and the decline in output was primarily attribute to Sichuan Yahua and Ganfeng Lithium. Total lithium hydroxide production fell due to fewer days in February. Sichuan Yahua started to stop production for maintenance a few years ago before the beginning of 2022, and resumed production in the middle of February, resulting in a significant reduction in production. Ganfeng Lithium also faced maintenance problems, and the old production line began maintenance in February, with a slight reduction in production. Chengxin Lithium production line failed during this period, so its output did not meet expectations. While Tianyi Lithium's new production line just began to climb production, with its production increase in February was very limited. Therefore, the total market supply fell sharply.

The downstream demand is basically the same as that in January. However, due to the serious inversion of lithium hydroxide and lithium carbonate prices in the early stage, the leading battery companies have increased their production plans for nickel-rich products in March, and the demand for lithium hydroxide stocking has increased, which resulted in a tighter supply of lithium hydroxide and also a rapid rising of lithium hydroxide price.

CONTACT US

CONTACT US ICC APP

ICC APP