Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

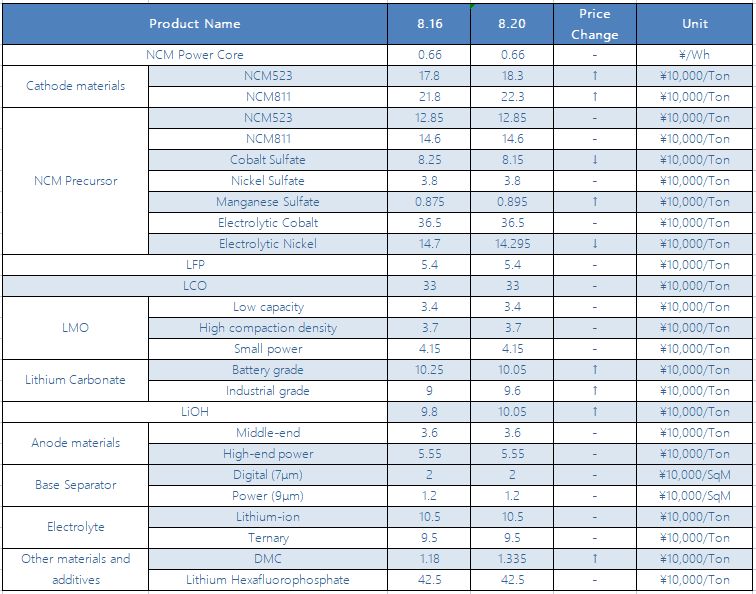

There was little change in the battery market this week, and the production capacity of leading companies continued to climb. Due to the tight supply of materials; the low-end digital category saw a sharp decline. In July, lithium iron phosphate batteries performed well. Domestic vehicles were 5.8GWH; greater than the ternary of 5.5 GWH; In July, the production and sales of new energy vehicles reached 284,000 and 271,000 respectively, representing a month-on-month increase of 14.3% and 5.8%, and a year-on-year increase of 170% and 160%. From January to July 2021, the production and sales of new energy vehicles reached 1.504 million and 1.478 million, respectively, a year-on-year increase of 200%.

Lithium iron phosphate (LFP):

At present, the yellow phosphorus and phosphoric acid markets at the raw material end are temporarily operating stably, and the downstream terminal’s demand for lithium iron phosphate continues to be fierce. Combined with the 347th batch of "Announcement on Road Motor Vehicle Manufacturers and Products" issued by the Ministry of Industry and Information Technology and previous data, models equipped with lithium iron phosphate batteries is getting higher and higher, and the promotion of some hot-selling models is superimposed. There is still a large increase in the demand for lithium iron phosphate in the second half of the year. Recently, as the price of lithium carbonate continues to rise, the price of lithium iron phosphate may resume increasing at the end of the month. The energy storage market is temporarily operating steadily. In terms of price, the current mainstream power-type lithium iron phosphate is quoted at 52,000 to 56,000 yuan/ton.

Ternary Material:

This week, the ternary materials market showed an upward trend. From the perspective of the market, the supply and demand of lithium carbonate and lithium hydroxide are tightening again, and companies have a clear mindset of holding goods. In addition to leading manufacturers to stock up in advance, it is increasingly difficult for small and medium-sized enterprises to obtain goods. At present, the main force of ternary material production is concentrated on the head. Due to the continued high price of lithium salt and the expected supply gap, the company’s external quotations have been raised again; and this makes ternary materials, which are inherently high-cost and price volatile, and the competitive advantage of other products continues to weaken. In terms of price, the current price of nickel 55 type ternary materials is between 165000-169000/ton, an increase of 5000/ton from the same period last week; the price of NCM523 digital ternary material is between 171000-175000/ton, which is higher The price of NCM811 ternary materials was between 220,000 and 226,000 per ton, which was an increase of 5,000 per ton over the same period last week.

NCM Precursor:

The domestic ternary precursor market was generally stable this week. The price of nickel sulfate is relatively stable; the cobalt market continues to be sluggish, and cobalt sulfate continues to decline slightly. The demand in the digital consumer market has not improved, and the proportion of suspension of some companies has further increased; manganese sulfate continues to rise, and the supply shortage still exists. The precursor production enterprises maintain normal production as a whole, focusing on the delivery of long-term orders. In terms of prices, this week’s conventional 523-type ternary precursors were quoted at a price of between 126,000 - 131,000 per ton; the price of cobalt sulfate was between 79,000 - 84,000 per ton, a decrease of 10,000 per ton from the same period last week; the price of nickel sulfate was at 37500 - 38,500/ton; manganese sulfate is quoted between 8700-9200 million/ton, an increase of 200/ton from the same period last week.

Recently, the supply of anode materials in the anode material market continues to be tight, and power curtailment and environmental protection in Inner Mongolia continue to increase. Some manufacturers have stopped production due to environmental inspections this week, and major anode manufacturers and major customers are under great supply pressure. Product prices are temporarily stable, but small and medium-sized clients have shown signs of rising. Low-sulfur coke stabilized this week, and the price of calcined coke was around RMB 5,700/ton. Overall, the demand for power continues to improve, but the new capacity of negative electrodes and graphitization has not been able to keep up, and the tight market supply will continue this year.

Electrolyte:

The electrolyte market continued to improve this week, with new orders generally quoted at around 100,000. Shida Shenghua has started the overhaul this week and will continue until the end of early September. Some solvent manufacturers in the Northeast will also arrange for overhauls. Solvents will continue to increase this week, with an increase of about 10% from the beginning of the month. The quotations in the mainstream market of hexafluorofluoride are between 41-45. Affected by the rush of the top manufacturers, the purchase price of small factories has been pushed up to 460,000-470,000. Yongtai Technology VC made a small amount of trial production, but it was still a drop in the bucket, and the price of Tim continued to rise to more than 400,000 yuan. Generally speaking, the trial production went smoothly and the output reached 300 tons in October. There is no big problem, so it can give the electrolyte factory a sigh of relief. This year, the electrolyte is still the most popular material in the material market.

Separators:

This week, the domestic separator market continued to improve. The capacity utilization rate of major separator companies remained at a high level, and the separator market continued to be tight in supply and demand. Sinoma Technology expects to have a base separator production capacity of 1.5 billion square meters by the end of the year, and the construction of the Nanjing base production capacity is also accelerating. Sinoma Technology has achieved initial results in the development of the overseas separator market. Korean customers have stabilized batch supply, and Japanese customers have completed certification and are currently supplying small batches.

CONTACT US

CONTACT US ICC APP

ICC APP