Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

Recently, the battery has maintained a high level, and the new production capacity of leading companies has continued to climb. The production and sales data of domestic new energy vehicles in June exceeded expectations, with sales exceeding 250,000; the sales of new energy vehicles in Europe reached 900,000 from January to June this year. It is expected to exceed 2.2 million vehicles. Driven by Tesla and BYD, the market share of lithium iron phosphate continues to climb. Due to the tight supply of materials, priority is given to the supply of power batteries, and the low-end digital category has experienced a significant decline.

Lithium iron phosphate (LFP):

In recent days, due to the impact of power rationing in Yunnan, the operating rate of yellow phosphorous production enterprises has dropped significantly, and prices have climbed again. Some orders have exceeded 30,000 per ton; the supply and demand of mainstream process raw material iron phosphate has tightened, and the downstream lithium iron phosphate has been expanding aggressively. The existing production capacity of the company is basically full, and the new production capacity is on the rise. In the third and fourth quarters, ensuring the stable supply of front-end raw materials has become the focus of everyone's attention. The market is bullish in the later period; the energy storage market is temporarily maintaining stable operation. In terms of price, the current mainstream power-type lithium iron phosphate is quoted at 52,000 to 56,000 yuan/ton.

Ternary Material:

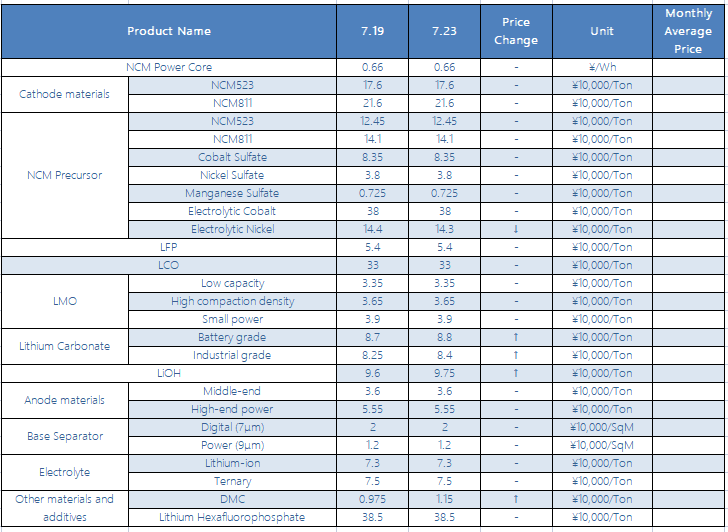

Affected by the fluctuation of the front-end raw material market, the transaction center of various types of ternary materials generally moved upward. From a market perspective, entering the third quarter, leading companies have gradually released new high nickel production capacity, increasing demand for front-end raw materials and lithium hydroxide, and supply-side resources are tight, nickel salt and other prices have been raised and transmitted downstream. The cost pressure of production enterprises has risen, and it is expected to maintain a high level of operation in the short term. In terms of price, the current price of nickel 55 type ternary material is between 159,000 and 164,000/ton, an increase of 25,000/ton from the same period last week; the price of NCM523 digital ternary material is between 165,000 and 170,000/ton, which is higher The price of NCM811 ternary materials was between 213,000 and 219,000 per ton, which was an increase of 5,500 per ton over the same period last week.

NCM Precursor:

The price of nickel sulfate at the raw material end was raised again this week, and the quotations of precursor products followed the market. The downstream demand superimposed on the structural shortage of the raw material supply side is still there, and the nickel salt market is improving; South Africa's logistics is suspended, and the risk of tight supply of cobalt raw materials in the short term will increase. However, considering the length of shipping and the development of other transportation channels, the overall impact is limited. At present, the market prices of cobalt sulfate and nickel sulfate are high, and the precursor producers are not willing to make profit. In terms of prices, this week’s quotations for conventional 523 type ternary precursors ranged from 122 to 127 thousand/ton, an increase of 6500/ton from the same period last week; the quotation of cobalt sulfate was from 80 to 87 thousand/ton, compared with the same period last week. The price rose by 0.05 million/ton; the price of nickel sulfate was between 3.75-38,500/ton; the price of manganese sulfate was between 0.7-0.75 million/ton.

Lithium manganese oxide:

Affected by the continuous increase in downstream demand, in order to ensure the stability of the supply of raw materials, some manufacturers of lithium iron phosphate and other manufacturers have begun to stock up, and the demand for lithium carbonate has increased significantly; and in terms of the supply of lithium carbonate market, manufacturers with sufficient raw materials have already reached full production state, and the expected supply in the later period is still tight. The market is generally optimistic about the market outlook. The price of lithium carbonate began to rise after a lapse of a quarter this week, and the upward trend is expected to continue

The overall production and sales of anode materials have not changed much recently, and the variables are mainly reflected in raw materials and graphitization. This week, Daqing stopped production for overhaul, and prices rose within a narrow range; the graphitization of Inner Mongolia area power curtailment increased again, and the drop in OEM production fell again. It is expected that the negative electrode shipments will be reflected in the next one or two months. The contradiction between supply and demand will further intensify.

Electrolyte:

The electrolyte market has not changed much this week. The quotation of lithium hexafluorophosphate remains at around 400,000. The new production capacity of leading domestic and foreign companies continues to rise, and the market has been in a state of tight supply; overseas demand is also increasing, resulting in a relatively biased price increase in EC and DEC in solvent, superimposed on the fact that some companies entered the maintenance cycle in August, it is expected that the market will continue to be tight. On the whole, it is difficult to change prices throughout the year, new capacity has not been added, and demand continues to increase, and prices remain high.

Separators:

This week, the domestic diaphragm market continued to maintain a tight balance between supply and demand. Head diaphragm companies continued to reach full production, and the output of small and medium diaphragm companies maintained a slight increase. In terms of price, the price of large diaphragm orders is still dominated by stability, and the price of small and medium orders has risen. LG Chem teamed up with Japan’s Toray to establish a joint venture battery separator plant. According to Korean media reports, LG Chem plans to establish a joint venture with Japan’s Toray in Europe to produce lithium battery wet separators.

CONTACT US

CONTACT US ICC APP

ICC APP