Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

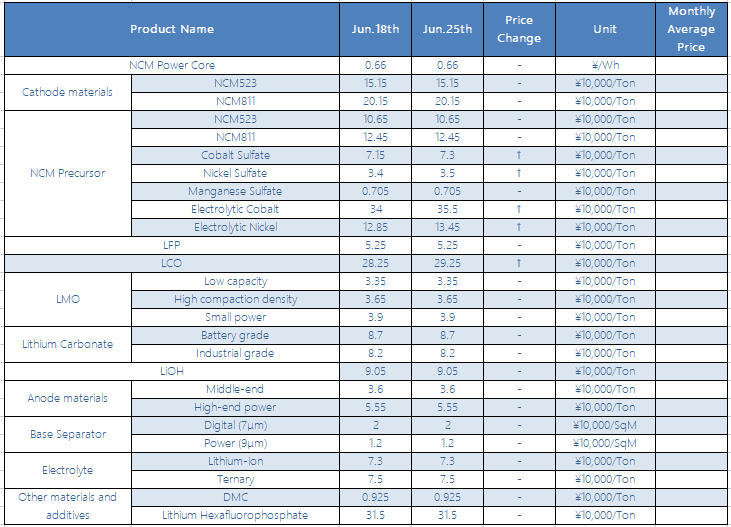

In the recent battery market, low-end digital products have continued to slump, and high-end digital products have little impact; new production capacity of leading companies has continued to climb; power batteries have performed well with lithium iron phosphate batteries superimposed on energy storage, and the proportion of ternary high nickel has continued to increase; It is estimated that the traditional two-wheeler sales season in the third quarter will drive the increase of related batteries.

Lithium iron phosphate (LFP):

Lithium iron phosphate has been relatively stable in the near term. From the perspective of cost, due to the greater impact of the limited electricity production of yellow phosphorus, near the high water period, business operations have resumed, and the price of yellow phosphorus has fallen and stabilized; from the market side, the new production capacity of some enterprises is about to be launched, and the demand for the precursor iron phosphate is also increasing. The mismatch between the expansion speeds of the two becomes the focus of the second half of the year; in terms of energy storage, the suspension of new large-scale cascade gives a good stimulus to utilization projects or the demand for energy storage batteries. In terms of price, the current mainstream power-type lithium iron phosphate is quoted at 50,000 to 55,000 yuan/ton, which will remain high in the short term.

Ternary Material:

This week, the domestic ternary materials market has been operating steadily for the time being. From a market perspective, downstream demand has grown steadily, driving the price gap between lithium hydroxide and lithium carbonate to continue to widen. The quotations of some electro-hydrogen products in bulk are approaching 100,000 yuan/ton, and the market outlook is very bullish. In the second half of the year, the supply of lithium concentrate, an important raw material, is still tight. Global new mines are expected to be put into operation for a long time. The peak season for new energy vehicle production and sales and the release of new production capacity for enterprise expansion are imminent. The prices of ternary materials, especially high nickel products, are affected by cost. In terms of price, the current price of nickel 55 type ternary material is between 147,000-152 000/ton; the price of NCM523 digital type ternary material is between 150,000-155,000/ton; the price of NCM811 type ternary material is between 199,000-204,000/ton. Between tons.

NCM Precursor:

The price of nickel and cobalt metals at the raw material end has risen this week, and the cost pressure is expected to be transmitted to downstream precursor products in the short term. From the market point of view, nickel ore supply is showing a gradual recovery trend. However, due to the recent high ocean freight rates and the port’s policy requirements for epidemic prevention of ships traveling in Southeast Asia, the price of ore remains high, and the current supply is still in short supply, which supports the domestic price of nickel. The cobalt market rebounded this week, with increased inquiries for cobalt products, superimposed on the boost in demand for inventory in the second half of the year, the outlook is good, and the transaction center of gravity range rose slightly. In terms of price, the quotations of conventional 523 ternary precursors this week ranged from 105,000 to 108,000/ton, an increase of 10,000/ton from the same period last week; the quotation of cobalt sulfate was between 71,000 - 75,000/ton, compared with the same period last week The price of nickel sulfate was increased by 15,000/ton; the price of nickel sulfate was between 34,000 - 36,000/ton, an increase of 10,000/ton from the same period last week; the price of manganese sulfate was between 6800-7300/ton.

The overall negative electrode material market has not changed much recently, and production and sales have continued the trend of the previous month. According to statistics from ICCSINO, the domestic anode material output in May was 53,500 tons, basically the same year-on-year, and a 135% increase from the previous month. In terms of downstream demand, the demand for power batteries has been steadily improving, energy storage has performed well, and the demand in the digital market has returned. Some battery manufacturers said that the company’s orders have fallen by about 20% this month. It is expected that demand will be met as the digital market peak season in the second half of the year. The raw material market has not changed much this week. The prices of low-sulfur coke and needle coke have stabilized, but the low-priced supply of needle coke has basically withdrawn from the market, and coal-based coke prices are showing signs of rising.

Electrolyte:

The electrolyte market has not changed much this week; the electrolyte is still very tight, and the price of lithium salt continues to rise, and the 6F quotation has reached 400,000. Seeing this trend, 6F will continue to climb; the new VC capacity has not yet been launched, and the shortage of materials makes the situation difficult for companies. It will be ideal if the supply chain can be eased before the end of the year. Through this shortage, from the perspective of enterprise development, the market outlook is still to sign long-term orders in the industrial chain to ensure supply security; the first-tier enterprises have begun to move toward industrial chain integration; the second and third-tier of the market must also follow.

Separators:

This week, the production and sales volume of the domestic separator market continued to rise, and the head separator companies maintained their full production. In the third quarter, with the resurgence of lithium iron phosphate batteries, the market for electric two-wheelers and power tools continued to improve, and the demand for dry-process separator is expected to further increase. Semcorp shares announced that Shanghai Semcorp, the company’s holding subsidiary, signed a cooperation agreement with the Jintan District People’s Government of Changzhou City and the Management Committee of Jiangsu Jintan Economic Development Zone. It plans to invest in the construction of aluminum-plastic film projects and lithium battery isolation films in Jincheng Science and Technology Park.

CONTACT US

CONTACT US ICC APP

ICC APP