Strong recovery of lithium iron phosphate

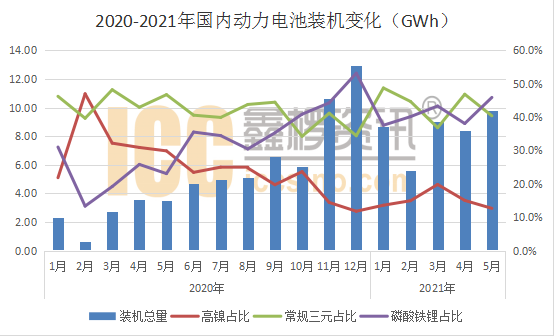

According to the monthly data of power batteries in May 2021 released by the China Automotive Power Battery Industry Innovation Alliance, a total of 4.5GWh of lithium iron phosphate batteries were installed in May, a year-on-year increase of 458.6% and a month-on-month increase of over 40%.

The sales of some models equipped with lithium iron phosphate batteries have injected strong momentum into the market, and the market share of corresponding cathode materials has steadily increased. At this stage, the standard battery life version of the domestic Tesla Model 3 uses the lithium iron phosphate battery of the Ningde era, and the lithium iron phosphate version of the Tesla Model Y is also said to be unveiled in the third quarter of this year; Xiaopeng P7 The lithium iron phosphate version that began to be delivered in May promoted the P7's overall monthly delivery to break historical records in the first month; Volkswagen also released battery and energy solutions on Power Day to start the lithium iron phosphate model cycle.

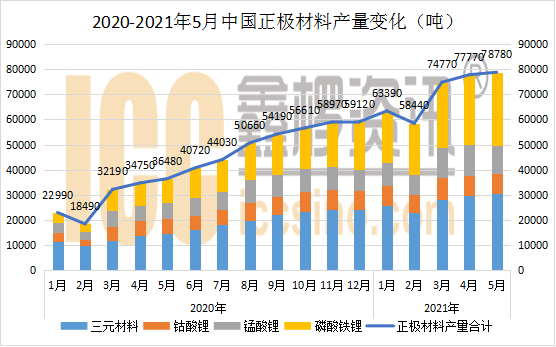

According to the latest statistics from Xinlu Information, the market share of lithium iron phosphate materials has risen to about 35% from January to May 2021, and the total output has reached 123,500 tons, an increase of more than 260% year-on-year, and the concentration of production CR5 has reached 71.39%. .

Data source: ICC Lithium Battery Database

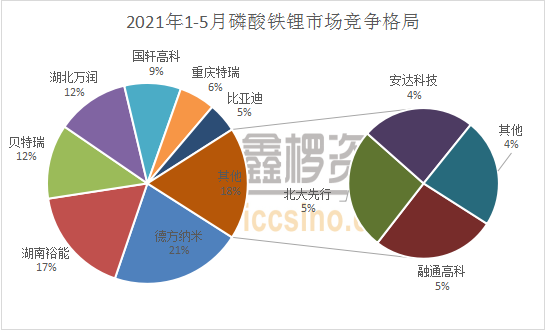

In terms of specific companies, Defang Nano, Hunan Yuneng, and Baterui ranked first in output, ranking the top three in the industry, followed by Hubei Wanrun and Guoxuan Hi-Tech. The market shares of the remaining companies are shown in the following figure:

Data source: ICC Lithium Battery Database

At present, the supply and demand of lithium iron phosphate are tight, and the price of materials is rising. According to the latest price of Xin Li lithium battery on June 24, the current mainstream price of lithium iron phosphate power materials has reached 55,000 yuan/ton. It is worth noting that from 6 Starting from this month, the new lithium iron phosphate production capacity of major leading companies will continue to be invested, and this will continue until the fourth quarter of this year, with a total of 369,000 tons of newly added production capacity. Defang Nano, Beterui, Guoxuan High-tech, Jiangxi Shenghua, etc. Enterprises are the main representatives, and the market structure at this stage may undergo major changes by then.

With the advancement of energy density and manufacturing processes, when mileage anxiety is no longer a “pain point” in the industry, the stability and safety of the battery system have become the focus of users’ attention, and the advantages of the intrinsic characteristics of the material help lithium iron phosphate in the market Make a comeback. According to relevant statistics, from January to May 2021, the installed capacity of lithium iron phosphate batteries in the domestic market is 17.1GWh, accounting for 41.3% of the market; in contrast, the performance of ternary batteries is relatively stable, of which conventional ternary batteries Basically maintain a market share of about 40%, and the proportion of high-nickel batteries, which are the main high-end market, fluctuates at about 15%.

Data source: Shanghai Insurance Data, ICCSINO Information

The gradual rise of high nickel materials

Now that the popularity of lithium iron phosphate is increasing day by day, is the ternary material silent? Obviously not, the internal competition pattern of the ternary market has been slowly changing since last year.

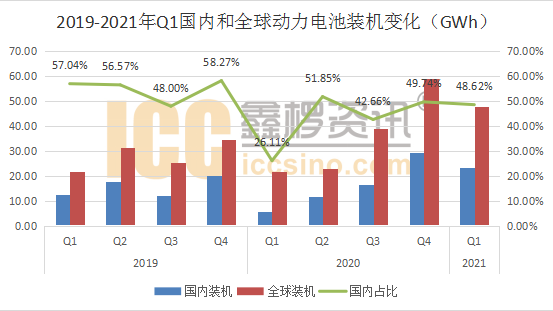

In fact, from a global perspective, the power battery market has also been constantly changing in the past two years. According to relevant statistics, China, as the world's largest new energy vehicle market, has shown a downward trend since 19 (excluding the impact of epidemics and other factors). In the first quarter of 2021, the market share has dropped to less than 50%. Overseas market development The advancement is speeding up.

Data source: SNE, ICCSINO Information

Compared with the domestic recognition of lithium iron phosphate batteries, foreign countries generally show higher acceptance of high nickel batteries. Superimposed on the research and development focus of first-tier international car companies, the domestic demand for corresponding products will increase significantly from the second half of 2020. Nickel materials have also become an important weapon for major companies to seize overseas markets.

In the previous new energy models launched by international car companies at the Shanghai Auto Show for the mid-to-high-end market, in order to meet the higher endurance requirements and the lightweight driving experience of the vehicle, as well as the actual application environment of customers in major overseas markets such as Europe and the United States , High-nickel batteries with better low-temperature performance are favored. The plan for mass production within two years also shows that there is a strong demand for high nickel materials during this period. According to the latest statistics of Xinlu Information, from January to May 2021, the total output of domestic high nickel materials (8 series ternary and NCA) reached 46,400 tons, and the market penetration rate reached 33.8%. The investment in increasing nickel production capacity is expected to exceed 40% in 2021; and in 2020, the market share of high-nickel materials is only about 22%, nearly doubling year-on-year.

Overall, the future competition in the new energy vehicle market is expected to revolve around lithium iron phosphate and high nickel materials. Use safe, cheap and durable lithium iron phosphate batteries to meet the basic needs of users, and high-nickel batteries that adapt to diverse environments and have greater battery life are more used in main sales and high-end models. Both have their own merits, forming effective complementary advantages in the terminal market, and are expected to occupy half of the power battery market in the next five years.

CONTACT US

CONTACT US ICC APP

ICC APP