Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

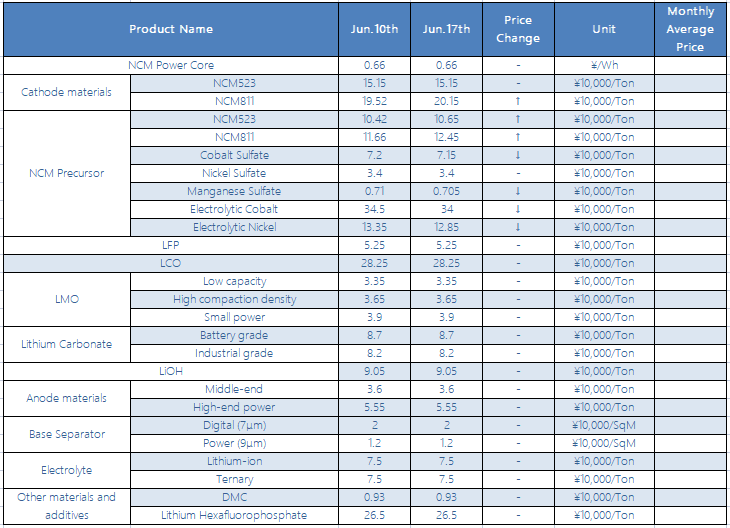

Lithium iron phosphate has been relatively stable recently. From a cost perspective, some yellow phosphorus companies have gradually recovered, leading to a continuous decline in the price of yellow phosphorus; from the market side, the output of lithium iron phosphate batteries in the power market has reached a new high and exceeded ternary batteries for the first time. In the future, the demand for lithium iron phosphate for power batteries will continue to increase. All lithium iron phosphate companies are operating at full capacity. The energy storage market is relatively stable. In terms of price, the current mainstream lithium iron phosphate quotation is 50,000 to 55,000 yuan/ton, and the price of lithium iron phosphate keeps an uptrend in the short-term.

Lithium iron phosphate (LFP):

Lithium iron phosphate has been operating smoothly recently. From the supply side, the leading enterprises of lithium iron phosphate are all operating at full production. From the market side, last week Apple was in preliminary discussions with CATL and BYD on battery supply for electric vehicle projects, and tended to use production. Lower-cost lithium iron phosphate batteries, the energy storage market is mainly stable. In terms of prices, the current quotations of mainstream lithium iron phosphates such as Defang Nano and Beterui are between 50,000 yuan and 55,000 yuan/ton, and prices will still increase in the future.

Ternary Material:

This week, the quotation center of some models of domestic ternary materials has been raised. From a market perspective, the demand for high nickel continues to be popular. The rising prices of precursors and lithium hydroxide have increased the production costs of enterprises. The high nickel ternary bulk order shipment price is higher. With the approaching of the traditional peak season for half a year, the demand for upstream raw materials will also further increase. The corresponding product prices may be adjusted due to changes in supply and demand. However, it is expected that the overall price will remain high in the short term. In terms of price, the current price of nickel 55 type ternary material is between 147,152 thousand/ton, an increase of 2 thousand/ton from the same period last week; the price of NCM523 digital ternary material is between 1.5-155,000/ton; NCM811 type is between 199-204,000/ton, an increase of 15,000 yuan/ton from the same period last week.

NCM Precursor:

This week, the price of nickel and cobalt metal at the raw material end fluctuated downwards, the price of nickel salt was firm, and the cost of precursors moved upward. From the market point of view, Vale announced on the 16th that Canada’s Reed Creek Mine was put into operation. The medium and long-term nickel supply has increased significantly. The downstream demand has supported the price of nickel sulfate, and the possibility of a fall is small. The high-nickel precursor has a relatively high upward trend. Strong, the external quotations of precursor companies are generally raised. The time for the concentration of nickel ore projects is expected to come around the fourth quarter. The alleviation of raw metal supply is expected to be transmitted to the downstream; domestic cobalt prices fluctuated and weakened this week, and market inquiries after the holiday Increasing, but limited by the shortage of chips, corporate purchasing sentiment is general, market transactions are relatively flat, and it is expected that there will be little change in the short term. In terms of price, the quotation of conventional 523 type ternary precursors this week is between 105,000 and 108 thousand/ton, an increase of 10,000/ton from the same period last week; the quotation of cobalt sulfate is between 70-73 thousand/ton, compared with the same period last week. Decrease by 0.05 million/ton; nickel sulfate is quoted at 33,000-3.5 million/ton, and manganese sulfate is quoted at 0.68-0.73 million/ton.

Recently, the overall anode material market has not changed much. In addition to normal production of major manufacturers, accelerating expansion is also a very important task at present. Which new capacity comes out first can seize more market share. According to statistics from ICC Xinju Information, by the end of 2021, TOP8 anode material manufacturers are expected to increase their production capacity by 470,000 tons compared with the previous year, which will effectively alleviate the current tight supply in 2022. The focus of the market in the near future is still graphitization.

Electrolyte:

This week, the electrolyte maintains a high level of operation. The first echelon has a long-term guarantee and the impact is relatively small. The second and third echelons arrange production according to the amount of VC that can be obtained; the solvent price has dropped. DMC price quoted 0.9-0.9500, EMC quoted 1.9 -19,500; if VC’s new production capacity goes online, the price of 6F will be higher. The current price of 6F is quoted at 350,000 to 400,000; Yongtai Technology Announces: Annual output of 20,000 tons of lithium hexafluorophosphate and 1,200 tons of related additives and 50,000 tons of hydrofluoric acid The total construction period of the project is three years, waiting for environmental protection approval.

Separators:

This week, the domestic diaphragm market continued the tight balance of supply and demand, and the major diaphragm companies maintained their full production status. In terms of market transaction prices, this week's diaphragm prices remained stable. Driven by the strong demand in downstream markets such as new energy vehicles, digital, energy storage, electric two-wheelers, and power tools, diaphragm companies are actively expanding production, and the newly added wet and dry diaphragm production capacity will be put into production in the second half of the year. Shanghai SEMCORP signed a contract with Ultium Cells, LLC on the purchase of lithium battery isolation membranes. It was agreed that Ultium Cells, LLC will purchase more than US$258 million of lithium battery isolation membranes from Shanghai SEMCORP from the date of signing the contract to the end of 2024.

CONTACT US

CONTACT US ICC APP

ICC APP