Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

Mainstream power battery manufacturers continue to reach full production, and demand in the energy storage market exceeds expectations. The operating rate of the digital mid-to-low-end market has declined due to material supply and price factors, but it has not impacted the high-end market. The production and sales of leading digital manufacturers are still maintaining stability. It is expected that the entire lithium battery market will not fluctuate much this month, and the new production capacity of leading manufacturers will be put into production one after another, which will put considerable pressure on the material procurement department.

Lithium iron phosphate (LFP):

Lithium iron phosphate has been operating smoothly recently. From the supply side, the leading enterprises of lithium iron phosphate are all operating at full production. From the market side, last week Apple was in preliminary discussions with CATL and BYD on battery supply for electric vehicle projects, and tended to use production. Lower-cost lithium iron phosphate batteries, the energy storage market is mainly stable. In terms of prices, the current quotations of mainstream lithium iron phosphates such as Defang Nano and Beterui are between 50,000 yuan and 55,000 yuan/ton, and prices will still increase in the future.

Ternary Material:

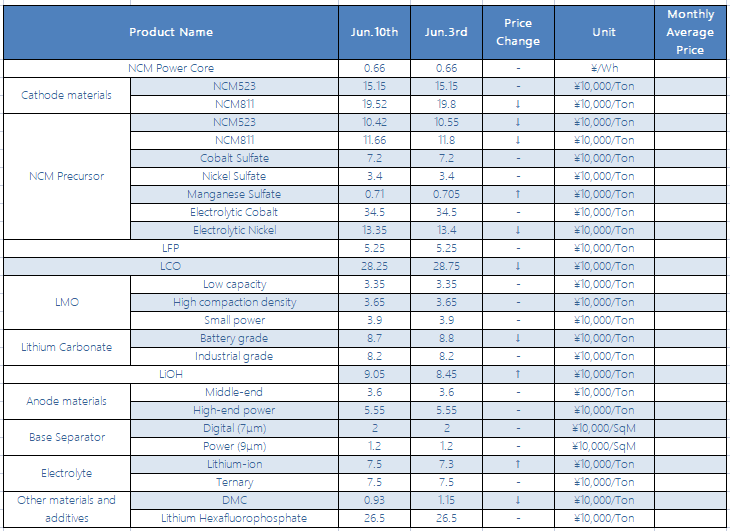

This week, the domestic ternary material market was operating smoothly, and the high nickel type continued to rise. From a market perspective, the demand for high nickel materials is strong, and the expansion of new production capacity by enterprises is accelerating, while the low raw material inventory and the increase in external extraction have formed a solid support for the rise of lithium hydroxide prices, superimposed on the strong upstream nickel salt prices, and the focus of high nickel quotations has been raised. ; On the other hand, the digital consumer market has not seen a significant improvement, and the demand is expected to improve, but the actual transaction is relatively flat. In terms of price, the current price of nickel 55 type ternary material is between 14.5-15 million/ton, the price of NCM523 digital type ternary material is between 1.5-155,000/ton, and the price of NCM811 type ternary material is between 196,000 and 204,000/ton, an increase of 2 million yuan/ton compared to the same period last week.

NCM Precursor:

The price of cobalt and nickel at the raw material side fluctuated and stabilized this week, and the domestic high-nickel ternary precursor market is improving. From the market point of view, the structural shortage of nickel is still present at this stage, the tight supply has helped the price of nickel salt to firm, and the downstream atmosphere is bullish. Precursor companies are currently expanding their new production capacity as planned, and the overall demand for overseas power is relatively strong. It is expected that the conventional precursors in the market will continue to operate steadily in the later period, and the high nickel type will continue to rise. The domestic cobalt market price stabilized this week, the demand for cobalt for power ternary and digital terminals was weaker than expected, and corporate purchasing sentiment was general. However, due to product inventory considerations in the traditional digital peak season in the second half of the year, the third quarter may usher in a rebound . In terms of prices, this week’s conventional 523 type ternary precursors are quoted at 1.03-10.8 million/ton, cobalt sulfate is quoted at 70-74 thousand/ton, nickel sulfate is quoted at 33-35 thousand/ton, and sulfuric acid Manganese is quoted at 0.68-0.73 million/ton.

The negative electrode material market has continued to improve recently. The overall output of major factories has not changed much. The graphitization bottleneck is still difficult to alleviate in the near future. From the changes in the production of major factories last month, we can see the ferocity of each graphitization capacity grabbing competition. Product prices have stabilized, and there is a high probability that there will be no significant changes this year. The raw material market has also stabilized this week. The price of low-sulfur coke has begun to stabilize, and users have begun to pick up goods one after another. In terms of needle coke, the cost of coal-based coke is high, and the price is even upside down. This has greatly affected the enthusiasm of coal-based manufacturers to start operations, or will cause the supply of needle coke to decline. Overall, the negative electrode market is expected to have little change this month from the previous month.

Electrolyte:

The electrolyte maintained its high level this week. The price of ternary electrolyte was RMB 70-80,000, the price of lithium iron phosphate electrolyte was RMB 72-7.8 million, and lithium hexafluorophosphate continued to rise. The latest price was basically at RMB 350,000, and some were quoted at 40. The price of solvents has been adjusted due to the addition of new production capacity, and the maintenance of industrial-grade DMC has risen due to the red square, and the maintenance of Zhongke Hui'an has increased. It is difficult for wealthy people without long-term contracts to buy VCs. The market outlook can only look at the progress of VCs' new capacity.

Separators:

CONTACT US

CONTACT US ICC APP

ICC APP