Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

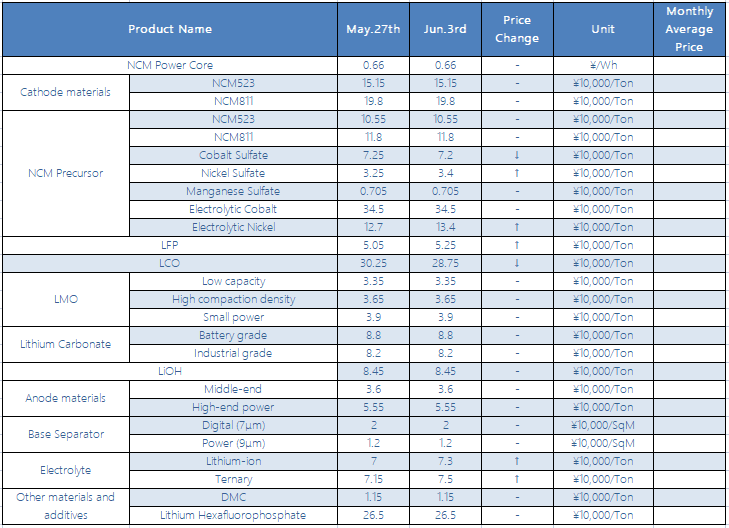

The battery market has not changed much. The overall trend of power batteries continued in the second quarter in June, with saturated production dominating, and the raw materials were still Achilles' heels that restricted production. The digital battery market is sluggish. The price increase of battery cells after the rise in cost has obviously suppressed downstream demand, and the impact of summer off-season is superimposed, and the overall situation is weak.

Lithium iron phosphate (LFP):

Lithium iron phosphate has been relatively stable in the near future, and the supply is still in short supply. The quotations of mainstream lithium iron phosphates such as Defang Nano and Beterui are between RMB 50,000 and RMB 52,000 per ton. In terms of raw material supply, domestic salt lake lithium extraction has entered a period of seasonal production increase and Lanke’s increase in production has led to an increase in supply, historical spodumene stocks have continued to be digested to increase supply, spodumene imports have remained normal, and direct imports of lithium carbonate have increased significantly. However, from the perspective of demand, although domestic electric vehicles have gradually improved compared with the previous month, digital demand has continued to decline since entering the off-season. The price of lithium iron phosphate is expected to be stable in the near future.

Ternary Material:

This week, the domestic ternary material market has been operating smoothly, and the high-nickel type still has an upward trend. From a market perspective, the upstream nickel salt price is firm, and the low-level inventory of companies supports lithium hydroxide. The downstream power market continues to increase the demand for power ternary, especially high nickel ternary, and the overall operation is improving, and the price of high nickel is still rising. In contrast, the demand for conventional ternary products in the small power and digital markets is flat, and the inventory of digital finished products continues to negatively feedback battery companies’ orders. In terms of price, the current price of nickel 55 type ternary material is between 145000-150000 million/ton, the price of NCM523 digital type ternary material is between 150,000-155,000/ton, and the price of NCM811 type ternary material is between 194,000-202,000/ton. Between tons.

NCM Precursor:

This week, the raw material end cobalt and nickel prices fluctuated and fine-tuned, and the domestic ternary precursor market was temporarily stable. From the perspective of the market, the Canadian nickel mine in Vale, Brazil, was temporarily suspended due to labor disputes, while the Liqin project in Indonesia was officially put into operation. Overlapping the high matte nickel product supply market from Castle Peak in October, the structural nickel shortage in the long-term tends to alleviate, but now the stage is limited by the supply side, and nickel prices still have a trend of volatility and rebound; domestic cobalt prices have stabilized weakly, terminal demand has not shown any significant improvement, downstream purchase willingness is not high, and the wait-and-see mood is strong. In terms of price, the quotations of conventional type 523 ternary precursors this week ranged from 103000 to 108000/ton, and the quotations of cobalt sulfate ranged from 70 to 74 thousand/ton, a decrease of 5,000 yuan/ton from the same period last week, and the quotation of nickel sulfate Between 33,000 and 35,000 / ton, an increase of 5,000 yuan / ton from the same period last week, manganese sulfate is quoted between 6800 and 7,300 / ton.

The production and sales of negative electrode materials have not changed recently, and the competition for graphitization production capacity of major manufacturers continues to be staged. This problem is basically unsolved before the fourth quarter. The raw material market has not changed much this week. The prices of needle coke and petroleum coke have not changed for the time being, but the cost pressure of low-priced needle coke is greater, and it is difficult to find low-priced high-quality supplies. In the downstream market, the demand for power batteries is still the biggest bright spot. The full production of leading companies will continue, but under the influence of extreme shortage of some raw materials, the operating rate of some small and medium data manufacturers has declined. Overall, the negative electrode market will continue to perform well this month.

Electrolyte:

VC continued to be tight this week, hexafluoride continued to reach a new high, and the average price reached 300,000, which once again pushed up the price of electrolyte. The price of ternary electrolyte was 70,000-75,000/ton; the price of lithium iron phosphate electrolyte was 70,000-75,000/ton. Ton. Leading companies have long-term order guarantees and are relatively unaffected; second- and third-tier companies can only arrange production according to the amount of VC they can get; traders also have fewer VCs and are expensive. The solvent market is expected to be relatively stable, and VCs can only rely on their own capabilities, and the market demand for hexafluoride is still rising; the tense situation is difficult to change within a few months.

Separators:

This week, the domestic diaphragm market continued its positive trend. Enjie's output continued to maintain a small increase, but the supply was still tight, and Senior and Sinoma continued to have limited supply growth at full production. In terms of prices, the current mainstream diaphragm order prices are still basically stable, and price increases are expected to land in the second half of the year. Diaphragm companies have intensively expanded production. After Sinoma Technology and Cangzhou Pearl, Senior Materials announced that it plans to invest 10 billion yuan to build a lithium battery diaphragm project in Nantong Economic and Technological Development Zone. The project is divided into three phases with an annual output of 3 billion square meters. Method diaphragm and coated diaphragm.

CONTACT US

CONTACT US ICC APP

ICC APP