Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

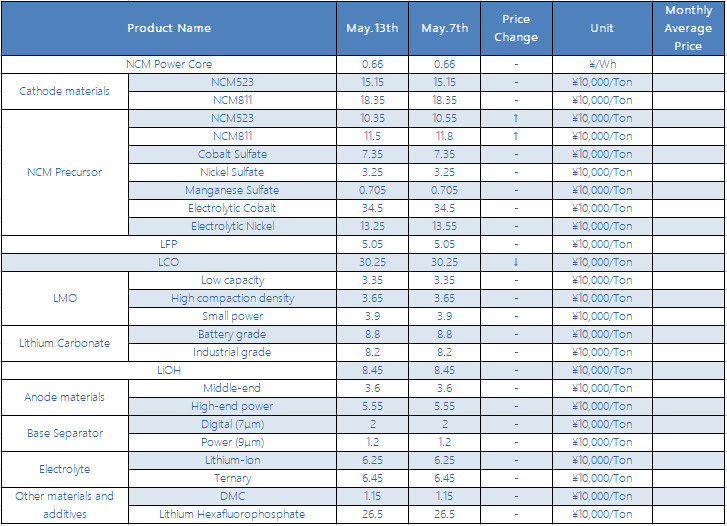

The production and sales of the battery market remain at a high level. Recently, news of price increases by head battery companies has been reported in the market. It is understood that the price of domestic vehicle power batteries has not changed much. OEMs have more indirect compensation through commercial policies and guarantees and incentives, while overseas energy storage prices have increased. The metal price linkage mechanism is mostly adopted. As the price of raw materials continues to rise, the increase in the price of battery cells is a normal transmission.

Lithium iron phosphate (LFP):

Lithium iron phosphate has been relatively stable in the near future, and its supply has continued to fall short of demand, and its price has remained at a range of 50-55 thousand per ton. In terms of raw materials, it is difficult for lithium carbonate to fall after a slight decline from its high level, and it is mainly stable. The overall shortage of iron orthophosphate is even greater than that of lithium carbonate, and some manufacturers are willing to raise prices. In the short term, it is expected that lithium iron phosphate will continue to maintain a steady state of volume and price increase.

Ternary Material:

With the recent increase in the cost of raw materials, the price of ternary materials has basically stabilized and may rise slightly in the short term. From a market perspective, the terminal demand for power batteries is still strong, and the top companies have saturated orders and shipped well. It is understood that due to the strong demand for lithium resources in cathode materials, lithium salt companies have relatively low inventories recently, and discussions are active. The price of lithium hydroxide rises as the high nickel market boosts the center of gravity. In the short term, some models of ternary materials may be quoted. Rebound. In terms of price, the current price of nickel 55 type ternary material is between 145,000-150,000/ton, the price of NCM523 digital ternary material is between 150,000-155,000/ton, and the price of NCM811 type ternary material is between 190,000-199,000/ton.

NCM Precursor:

This week, the raw material prices fluctuated, and the domestic ternary precursor prices remained stable for the time being. From the market point of view, Liqin’s HAPL wet process project on OBI Island was officially put into operation recently. The tension in the supply pattern of metal nickel resources is expected to ease, and nickel prices are under pressure to adjust; the cobalt market still lacks momentum, and digital consumer demand is lower than expected. With the advancement of high-nickel materials, the demand for cobalt has fallen accordingly. It is expected that the weak cobalt market will not change much in the second quarter. In terms of price, this week’s conventional 523-type ternary precursors are quoted at 103,000-108,000/ton, cobalt sulfate is quoted at 71-76 thousand/ton, nickel sulfate is quoted at 320,000-330,000/ton, and sulfuric acid Manganese is quoted at 6,800-7,300/ton.

Recently, the production and sales of anode materials have continued to improve. Graphitization is still the focus of various purchases. Advance payment and price increase make the processing of small and medium-sized anode manufacturers at a disadvantage in the competition for graphitization foundry resources. Judging from the exchange situation of the 14th Anode Materials and Raw Material Market Summit Forum hosted by ICCSINO, a small amount of production capacity can be put on the market at the earliest around November, and full relief is expected in the second half of 2022. The raw material market has entered a callback stage, the price of needle coke has remained stable, and overseas supply is tight. In terms of demand, power batteries, energy storage, small power, electric tools all performed gratifyingly, but the digital market did not perform well. Overall, it is expected that various negative electrode manufacturers will still be eye-catching in May.

Electrolyte:

The electrolyte is still running at a high level this week, and the production of electrolyte is still subject to the lack of VC. Lithium iron phosphate uses VC more and more tightly; the price of solvents remains unchanged. The prices of VC and 6F are rising steadily; the price of VC traders is around 500,000, and the price of 6F is around 250,000 to 280,000. Generally speaking, in the third quarter, VC has new capacity to ease the market tension, and the short-term price of 6F will not come down; the overall market is still stucked in VC, resulting in production failure; the current electrolyte factory usually arranges production according to the VC's take-up quantity.

Separators:

This week, the production and sales volume of the domestic separator market continued to increase, and leading separator companies maintained full production. In terms of prices, the market is looking forward to rising sentiment, but the major separator companies have not yet adjusted their prices. The pace of expansion of separator enterprises is accelerating. Cangzhou Mingzhu intends to invest in the construction of "200 million square meters of wet-process lithium-ion battery separator project" in Cangzhou, which will mainly build two wet-process lithium-ion battery separator production lines; Nanjing Lithium Membrane, a subsidiary of Sinoma Technology plans to build a "1.04 billion square meters of lithium-ion battery separator production line per year" in Nanjing, mainly to build 4 single-line production lines of 80 million square meters per year, 8 single-line production lines of 100 million square meters per year of lithium-ion battery base film production lines and 6 oil-coated diaphragm production line with a single-line production capacity of 50 million square meters per year.

CONTACT US

CONTACT US ICC APP

ICC APP