Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

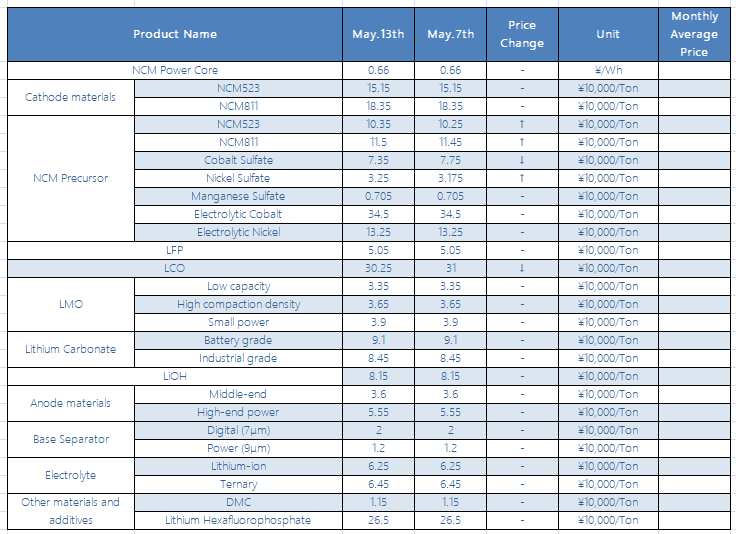

After May Day, the battery market has not changed much, and both prices and shipments have entered a stable period. From the perspective of the production rhythm of battery companies, unlike the continuous growth in the second half of last year, there has not been much increase since the second quarter of this year, and it has basically maintained the high level in the first quarter. It is understood that the new production capacity of some companies has entered the commissioning stage, and it is not far from large-scale heavy production.

Lithium iron phosphate (LFP):

Lithium iron phosphate was relatively stable in May, mainly because the price of raw material lithium carbonate dropped from a high level, and the cost pressure was eased. The company's product quotation can be stabilized. Judging from the quarterly reports successively released by iron-lithium companies, the overall profitability of the industry has improved significantly. This year, under the premise that the volume and price are guaranteed throughout the year, this year's profits are relatively considerable.

Ternary Material:

The domestic ternary material market prices remained stable this week, and the overall quotation did not change much. From the perspective of the market, the leading companies basically maintained their full production status, and shipped orders according to orders. The output of other companies also climbed slightly, and the terminal demand for power batteries is improving. In addition, due to the recent frequent fluctuations in the prices of upstream raw materials, downstream customers have a strong wait-and-see sentiment. It is expected to maintain stable operation in the short term. In terms of price, the current price of nickel 55 type ternary material is between 145,000-150,000 yuan/ton, the price of NCM523 digital type ternary material is between 150,000-155,000 yuan/ton, and the price of NCM811 type ternary material is between 190,000-199,000 yuan/ton

NCM Precursor:

Affected by the continuous increase in nickel prices during the previous period, the center of gravity of nickel sulfate quotations shifted upward this week, driving the price of some precursor materials to rise. From a market perspective, nickel ore supply is expected to gradually recover with the end of the rainy season in Southeast Asia, alleviating the current domestic supply and demand tensions, and prices are expected to gradually return to a volatile trend; the raw cobalt market is still weak, and 3C mobile phones and digital consumer electronics are affected by the Indian epidemic, as a result, terminal demand has declined significantly, dragging down the recovery of the cobalt market, and it is expected that it will continue to fluctuate downward in May. In terms of price, the quotations of conventional 523 type ternary precursors this week are between 101,100 and 106,000/ton, an increase of 10,000 yuan/ton from the same period last week, and the quotation of cobalt sulfate is between 71,000 and 76,000 yuan/ton, compared with last week, fell by 4,000 yuan/ton over the same period.The price of nickel sulfate was between 32,000 and 33,000 yuan/ton, which was an increase of RMB 700/ton from the same period last week. The price for manganese is around 6800-7300 yuan/ton.

Recently, the overall anode material market has not changed much. The top companies are always strong, and the output has increased within a narrow range. According to statistics from ICCSINO, the domestic anode material output in April was 52,700 tons, an increase of 4% from the previous month. Leading companies continue to have incremental orders, but due to insufficient graphitization capacity in the industry, the room for output to increase is relatively limited. In general, the market will continue the April trend in May, with little change in output and stable prices. Small and medium-sized anode material manufacturers are at a disadvantage in grabbing resources for graphitization foundry, and output will decline.

Electrolyte:

Recently, the electrolyte market has begun to be turbulent again. In addition to the continued tight supply of VC, the price of lithium hexafluorophosphate is rising again, and the current high price is around 300,000. At present, the price of lithium hexafluorophosphate raw materials has risen sharply, and the supply will also decline from last month, mainly due to production failures and maintenance of individual manufacturers. In view of the fact that the price of raw materials has risen again and the impact of the overall supply shortage, the price of electrolyte is also increasing. At present, the price of electrolyte is relatively affordable, except for some leading companies. The purchase price of small and medium-sized battery manufacturers has generally been 65,000-70,000 yuan/ Ton. Overall, the electrolyte market is expected to be in a tight supply and high prices throughout the year.

Separators:

This week, the domestic separator market continued to be in a tight balance between supply and demand. Head separator companies continued to produce full production, and the output of small and medium separator companies also increased slightly. In terms of prices, the mainstream transaction prices of the separator are stable, and the leading separator companies have no price adjustment plans for the time being. Based on LG Chem’s patented safety-enhanced separator technology, LG Electronics produces separator at its plants in Cheongju, Chungbuk, Poland. Taking into account the professionalism and synergy of the business in this field, it is considering selling it to LG Chem, which has separator technology.

CONTACT US

CONTACT US ICC APP

ICC APP