Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

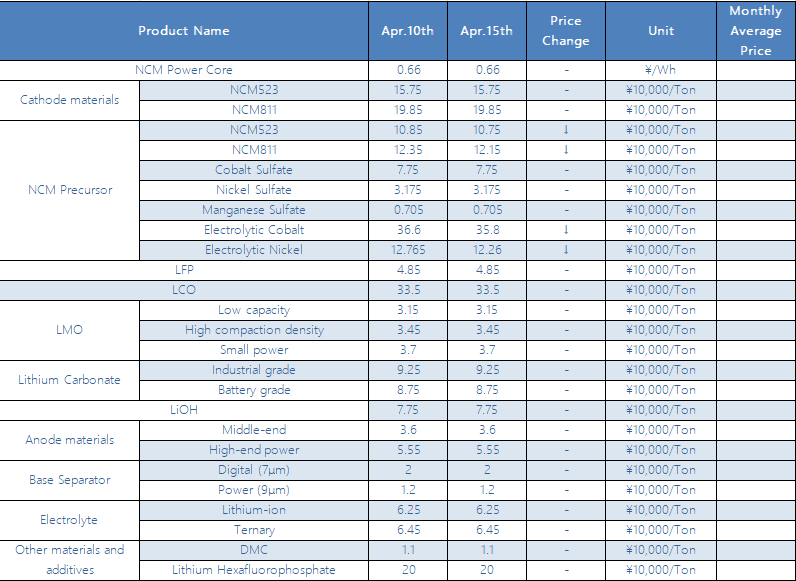

Recently, the demand for small digital batteries has declined. According to company feedback, April, which was the traditional peak season for small digital businesses, did not “boom” as expected. The overall performance was flat, mainly due to the excessive increase in raw materials and the low prices of some downstream customers. Power batteries are relatively stable, and mainstream enterprises are mainly engaged in saturated production.

Lithium iron phosphate (LFP):

The lithium iron phosphate market has not changed much, and mainstream enterprises are mainly producing full production. Recently, the supply of raw material lithium carbonate is relatively sufficient, and the price has peaked at a high level. The pace of stocking of iron and lithium companies has slowed down, and normal shipments have been maintained. In terms of prices, the mainstream sales of power products were around 50,000/ton, and shipments were smooth.

NCM Material:

This week, the domestic ternary material prices stabilized mainly, as the price of ternary precursors slowed down, and the price of lithium salt provided support. In terms of the market, power-type ternary materials are mostly delivered in long-term orders, and the shipment volume is relatively considerable; the shipment situation of consumer ternary materials is slightly bleak, and there are not many transactions. Looking at the market outlook, there is still room for the price of ternary precursors to go down, and there is little room for the rise of lithium salt. Therefore, it is expected that the price of ternary materials still has a certain downside.

NCM Precursor:

This week, the domestic ternary precursor prices fell mainly, and the extent was not large. Only some nickel 55-type ternary precursors had a low transaction price. In terms of market shipments, although the domestic power battery market demand is becoming increasingly saturated, the output of ternary materials from overseas and domestically funded positive electrode factories is still climbing rapidly, driving the rapid growth of domestic ternary precursor production. It is expected that the domestic ternary precursor will increase in the future. The output of bulk materials will approach the 50,000 tons mark. Regarding sulfates, domestic nickel sulfate prices remained stable this week, while cobalt sulfate prices declined slightly, with little overall change.

The anode material market has continued to improve recently. According to statistics from ICCSINO, the output of key domestic anode material companies in March was 50,700 tons, an increase of 12.4% from the previous month. From the production plans of various companies in April, it is expected that there will be a slight increase, mainly Graphitization has become the bottleneck of negative electrode material output in the industry, and major manufacturers are unable to accept orders. Middle and lower anode material manufacturers, especially in the digital market, not only saw a slight decline in high-end demand, but also saw a significant decline in operating rates in the low-end market due to sharp increases in material prices. Overall, the output will continue to increase, but the increase will not be too large, and the price will increase within a narrow range.

Electrolyte:

The electrolyte market has continued the trend of last week recently, and the production and sales of various electrolytes are constrained by raw materials. The price of various raw materials of lithium hexafluorophosphate has increased sharply, and the profitability of manufacturers without raw material inventory in the previous period has narrowed. In addition, the zero-order price of individual manufacturers has reached a new high this month, with a price close to 240,000. In terms of solvents, a major solvent company has recently seen a narrow increase in its price, and its profitability has continued to increase. It is expected that the electrolyte market will maintain its current state throughout the first half of the year, and VC will still be the protagonist.

Separators:

This week, the domestic diaphragm market continued to be in a tight balance between supply and demand. Head diaphragm companies continued to reach full production, and the production levels of small and medium diaphragm companies continued to improve. In terms of price, the transaction price of mainstream diaphragm orders remained stable, and some wet-process diaphragm manufacturers saw small price increases. Sinoma Technology issued an outbound investment announcement, and plans to invest 200 million yuan to establish a wholly-owned subsidiary Sinoma Lithium Separator (Nanjing) Co., Ltd. to undertake the construction and operation of the company's lithium membrane industry industrial base in the Yangtze River Delta region.

CONTACT US

CONTACT US ICC APP

ICC APP