Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

The continued price increase of raw materials has affected power batteries. Since the end of March, battery manufacturers have begun to issue price adjustment inquiry letters to vehicle manufacturers in an attempt to increase prices. From the perspective of the power battery industry, price increases will inevitably hit the demand side, and ultimately curb demand, which is not good for the long-term development of the industry. In terms of production, mainstream companies are limited by raw materials and cannot be fully opened. This unprofitable process will continue for some time.

Lithium iron phosphate (LFP):

Lithium iron phosphate rose steadily and slightly. The price of raw materials has risen again recently, and the transaction price of lithium iron phosphate in April has gradually risen. At present, low-priced resources have almost disappeared. From the demand side, iron and lithium will be in hot demand throughout the year, and the supply side will be mainly released in the second half of the year, so the shortage will continue in the second quarter.

NCM Material:

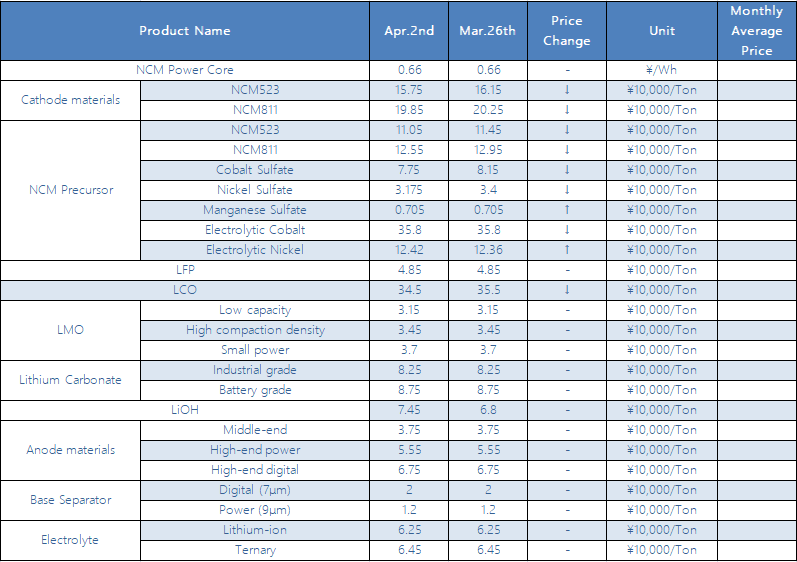

This week, the domestic ternary material prices continued their downward trend, and the prices of all types of ternary materials fell by about 5,000 yuan/ton. On the market side, demand in the power sector is still hot, but with the full production of leading battery factories, it is expected that the driving role of domestic power battery demand on ternary materials will be weakened in the short term; on the digital side, the recent market transactions are still sluggish, but with the decline in the price of ternary materials, subsequent market demand is expected to gradually pick up.

NCM precursors:

Domestic ternary precursor prices continued to fall this week, and the quotation of conventional 523 type ternary precursors has fallen below the first line of 110,000 yuan/ton, mainly due to the rapid decline in sulfate prices. In terms of nickel sulfate and cobalt sulfate, the prices both declined this week. Among them, the price of cobalt sulfate dropped significantly. In particular, the price of cobalt sulfate products produced from partially recycled materials has fallen to around 70,000 yuan/ton.

Lithium Cobalt Oxide:

Recently, the domestic price of lithium cobalt oxide has dropped rapidly. The mainstream domestic price of lithium cobalt oxide has fallen below 340,000 yuan/ton, a decrease of more than 100,000 yuan from the highest price during the year. On the one hand, it is affected by the continuous downward impact of the price of cobalt tetroxide. It has been dragged down by the expected decline in end market demand. In terms of cobalt tetroxide, the mainstream quotation in the market this week is still around 310,000 yuan/ton, but according to some manufacturers, the recent shipment of cobalt tetroxide is slightly lower than expected. There are already transaction prices below 300,000 yuan/ton in the market.

Recently, the production and sales of the anode material market have continued to improve, and graphitization has become a choke point for large and small anode manufacturers, and the obtained graphitization resources determine the shipment volume. At present, major factories have started to purchase graphitization plants and started graphitization capacity competition, and OEM prices continued to rise; raw material prices were high, and the focus of transactions continued to rise. At present, anode material manufacturers have a strong willingness to increase prices. Some manufacturers have adjusted their shipment prices in April, with an increase of about 10%, mainly small and medium-sized battery cell manufacturers.

Electrolyte:

The short supply of electrolyte in the market has not been alleviated in the near future. The shortage of VC supply is still the focus. However, a VC supplier in Shandong has entered the commissioning stage. If all goes well, it is expected that the shortage of VC supply will be alleviated around May. The price of lithium hexafluorophosphate is stable, currently around 200,000 yuan/ton, with a few high prices at 230,000 yuan/ton. Insufficient supply of VC prevents the production of electrolyte and suppresses the rise of lithium hexafluorophosphate. It is expected that the price of lithium hexafluorophosphate will remain high and stable in the past two months. However, as the supply of VC increases, its price may still increase within a narrow range. In general, electrolyte will still be one of the most troublesome materials for battery cell manufacturers, and the prices of small factories are constantly being refreshed.

Separators:

This week, the overall supply increase in the domestic diaphragm market is limited, but downstream demand is still strong, the order schedule of head separator companies is still tight, and the transaction price of mainstream separator orders has remained stable. After being awarded the 3.34 billion yuan separator order from Northvolt, Senior Materials intends to invest no more than 2 billion yuan to build a plant in Sweden. After the new plant is completed in 2025, it will become the European headquarters of Senior.

CONTACT US

CONTACT US ICC APP

ICC APP