The lithium battery market has not changed much, and the market demand is improving, but the pressure on the supply of raw materials is great. At present, the downward transmission speed of battery cell prices is significantly slower than the rate of raw material price increases. Only digital and small power products are generally increased by 10-15%. Vehicle power batteries have basically not changed, and the cost pressure still needs to be absorbed by enterprises themselves.

Lithium iron phosphate (LFP):

The market for lithium iron phosphate materials is still improving, and the state of shortage continues. Defang, Wanrun, Yuneng, etc. have successively put new production capacity on the market, but it is still difficult to meet demand. In order to ensure the supply of goods, the battery factory is constantly developing new suppliers, and certain concessions have been made in the certification cycle and standards. At present, the mainstream transaction price of power-type LFP is around 50,000/ton.

NCM Material:

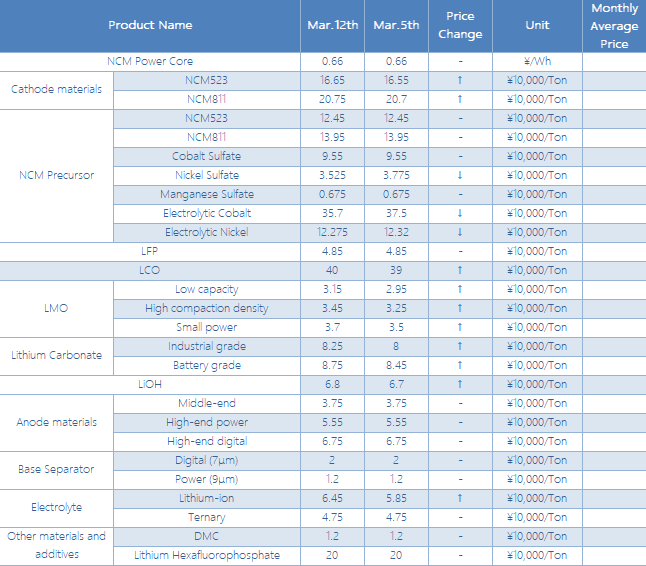

Although the price of NCM precursors has stabilized, the purchase cost of lithium salt is still rising slowly. Therefore, the price of domestic NCM cathode materials maintained a slight increase this week. In terms of the market, after entering March, the demand side of the power battery field has renewed its strength, driving the output of many companies to exceed 3,000 tons; the demand in the consumer field has also gradually recovered recently, but because battery factories mostly maintain order-to-order purchases, the actual performance of market transactions is average.

NCM precursors:

The domestic NCM precursor price stabilized this week, but did not follow the decline in raw material prices. Domestic cobalt sulfate prices remained stable this week, due to the tight market supply pattern; nickel sulfate prices began to fall gradually this week due to excessively high premiums, and have fallen below 36,000 yuan/ton within the week. The price of manganese sulfate strengthened slightly this week and reported to around 7 million yuan/ton.

The anode electrode material market is improving recently, and the first and second echelon companies are basically producing at full capacity. At present, the bottleneck of anode electrode manufacturers is mainly at the graphitization and raw materials. The supply of graphitization capacity is insufficient, and it takes time to expand the capacity. The prices of low-sulfur coke and needle coke at the raw material end continue to rise, and the maintenance plan makes the market supply atmosphere more tense. In terms of price, anode electrode material companies have a strong willingness to increase prices. Under the impact of tight supply, it is more confident to negotiate price increases with downstream customers. It is expected that the price of anode materials will increase in the second quarter.

Electrolyte:

Electrolyte prices have repeatedly hit record highs since the end of the year. The main reason is that the gap in the additive VC has been continuously enlarged. It is expected that the production of electrolyte will reach a new high in March. Some companies lacking raw materials may find it difficult to take orders. This allows electrolyte companies to have more choices in terms of customers. At present, it not only provides a good opportunity for some electrolyte companies to enter the supply chain of large factories, but also greatly improves the cash flow of companies. At present, many manufacturers only accepts cash orders. Overall, the profitability of electrolyte companies has improved significantly.

Separators:

This week, the domestic separator market continued the positive trend of both production and sales. Leading separator companies have maintained full production, and downstream orders are saturated. In terms of market transaction prices, separator prices remained stable this week, and some medium-sized separator companies increased their prices slightly. In addition, driven by downstream markets such as energy storage, electric two-wheelers, and power LFP batteries, the production schedule of dry-process separator for the second-tier separator companies increased significantly in March.

CONTACT US

CONTACT US ICC APP

ICC APP