Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium iron phosphate (LFP):

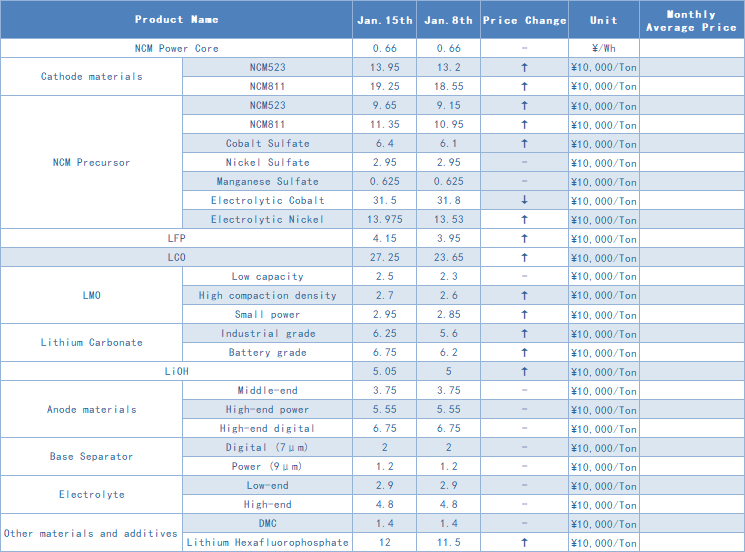

The LFP industry continues to be in short supply. Tier 1 companies have reached maximum orders and new capacity has not been released for the time being. At present, companies do not accept storage orders with low prices in order to guarantee the power orders. In terms of price, the power-type LFP reported more than ¥40,000/ ton, which is well-accepted by most battery factories. Most of them no longer bargain with the iron-lithium factory, but to ensure the supply.

Driven by the skyrocketing price of raw materials, the cost of domestic NCM materials has risen sharply recently. Affected by this, domestic NCM materials companies have generally raised their quotations this week, and the prices of NCM materials of various models have generally risen above ¥5000/ton. Some NCM materials companies have turned to wait and see and recently suspended external quotations. In terms of price changes in the market outlook, the upward trend in the price of raw materials such as cobalt and lithium is still rising. Cathode material factories can only follow up, while the pre-holiday stocking demand of downstream battery factories will support the price of cathode materials. The price of domestic NCM cathode material will continue to be strong prior to the spring festival.

This week, driven by the cost of raw materials such as lithium carbonate and manganese dioxide, LMO manufacturers had to raised their market quotations. The increase was still not as high as the increase in raw material costs, therefore, some large battery cell factories locked orders. A small number of downstream battery cell customers cannot accept the rise in the price of lithium manganate, and a small number of factories may take holidays in advance. The overall market transaction atmosphere is rather plain.

The price of lithium carbonate continued to rise this week. With the increase in the price of lithium carbonate, the market supply continues to remain tight. Near the end of the year, the willingness of cathode material companies to stock up has been further strengthened, and the situation of locking orders and stocking up has become obvious. Lithium carbonate factories in places such as Sichuan and Jiangxi mainly focus on the implementation of previous orders for the lack of supply. Manufacturers and traders in Qinghai have begun to provide some high-priced sources of goods. With the high demand coupled with tight supply of lithium carbonate and reluctance to sell, the price of lithium carbonate will continue to remain strong in the short term

The anode material market has continued to improve recently, and the production plans of most companies are basically the same as in December. The anode lithium battery market has entered a rapid rise since August, and the continuous increase in demand has stimulated the raw material market to gradually increase. As of January, the low-sulfur coke has increased by ¥2,350/ton, and the needle coke has increased by about ¥1,500/ton. Graphitization has been increased by about ¥1,500/ton, and the general increase in raw material and OEM prices has doubled the cost pressure of anode manufacturers. The market growth for 2021 is optimistic, so that carbonization and graphitization in the market is currently tense, and is expecting continuous rise after the Spring Festival.

This week, orders from domestic separator companies still have a certain increase. In order to meet the order needs of domestic head battery companies, SEM Corp., Gellec Hebei and Sinoma Tech. have increased the capacity and speed of new wet process separator production; at the same time, BYD dry process separator procurement volume kept increasing, bringing a continued growth of output in its major suppliers. It is expected that the domestic separator production in January will still have room for a slight increase. At present, downstream battery companies are resistant to the price increase of separators, and the price of the separator is unlikely to push up in a short term. We can only see a slight increase in transaction prices in small orders.

Electrolyte:

Recently, electrolyte companies are in a sweet misery. As they receive vast payment from downstream users, and the number of companies requesting goods has increased significantly, and even some have made advanced payment for delivery. However, electrolyte manufacturers have been very cautious in receiving goods recently. The price of 6F has continued to reach new highs. The transaction price of new orders has exceeded ¥120,000/ton. VC has been so in short supply that all manufacturers must buy goods as soon as they are released, and the price has risen to ¥200,000/ton. The skyrocketing price of raw materials has made electrolyte manufacturers cautious in taking orders before the holiday and rarely sign new orders. Some manufacturers said that they plan to increase the price of new orders after the Spring Festival.

CONTACT US

CONTACT US ICC APP

ICC APP