Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium iron phosphate (LFP):

The market demand for LFP continues to be strong. Due to the large number of orders from leading battery factories, the current power LFP companies do not have much idle capacity to offer to second-tier battery manufacturers, resulting in serious shortages. In addition, the price of raw materials is currently rising fast, and the price of LFP is facing continuous upward pressure.

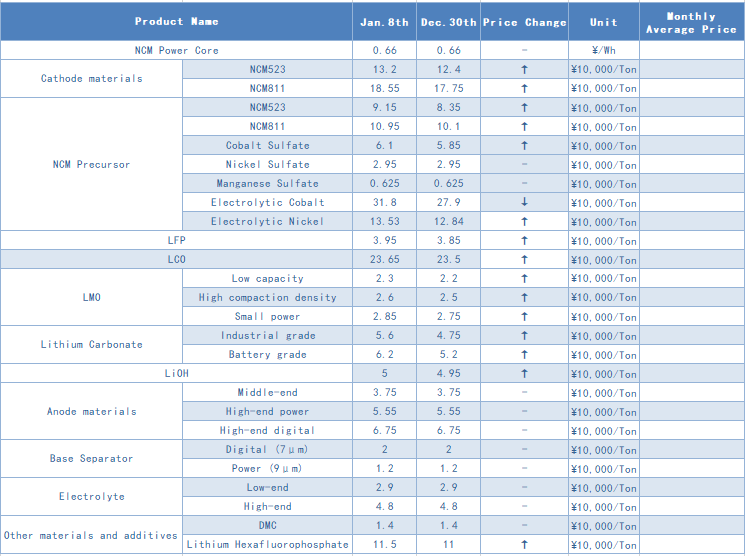

Affected by the strong increase in the prices of various cathode raw materials, the domestic NCM material prices went up sharply this week, and the quotations of various types of NCM materials generally rose by more than ¥10,000 during the week. However, after the sharp increase in the price of NCM materials, market transactions have weakened significantly. On the one hand, the high price limits the enthusiasm of downstream battery manufacturers to purchase, and on the other hand, the cathode manufacturers are concerned that the price of raw materials will further increase in the future and cause losses. Therefore, the willingness to take orders is relatively weak.

This week, the domestic price of NCM precursors also increased sharply, but the relative increase was smaller than that of cathode materials, for the price of NCM precursors was not affected by the surge in lithium salt. During the week, the conventional NCM523 precursor generally reported above ¥90,000/ton, an increase of about ¥8,000 compared to the previous year. The main reason for the sharp increase in the price of NCM precursors is the sharp increase in cobalt sulfate products. It is understood that in the context of the recent sharp increase in the price of electrolytic cobalt, domestic cobalt sulfate quotations have generally been raised by more than ¥60,000/ton. Holders are still reluctant to sell and intend to continue to push up prices. As far as the market outlook is concerned, with the strong performance of cobalt and nickel metal prices, the market has begun to speculate about the suspension of production of a precursor company in Hunan. It is expected that the domestic NCM precursor prices will continue to remain high in the future.

The anode material market has performed well recently. The shipment plan for this month is basically the same as the previous month. Some manufacturers said that due to the impact of the climate and the epidemic, the actual shipment volume is uncertain. According to statistics from ICCSINO, the domestic material output in December was 46,000 tons, an increase of 2% compared to the previous month. This week, the raw material market of low-sulfur coke continued to increase by ¥100-200/ton. Under the strong low-cost appeal of downstream battery manufacturers, the cost pressure is not easy to conduct, causing a strong resistance of anode manufacturers. Some manufacturers with low profits have indicated that they have no plans to make purchase in the near future. Overall, the popularity of the lithium battery market did not cool down in January. Driven by actual demand and stocking, shipments of some manufacturers are expected to reach new highs.

In January, the domestic separator market demand continued to improve, especially the increase in orders for wet-process separators. In terms of market supply, the current output of domestic head separator companies is difficult to meet the order requirements, so some orders have been scheduled to February and March, and the company's spare inventory has basically been consumed. According to industry insiders, even if the demand is so strong, the bargaining power of the separator is not strong, and the transaction price of large market orders is difficult to increase. It is expected that the domestic separator price will still show a stable trend in the first quarter.

Electrolyte:

Recently, the output of the electrode liquid market has continued to record highs. According to statistics from ICCSINO, the sample output of domestic electrolyte manufacturers in December was 29,000 tons. However, the life of the electrolyte manufacturers is not easy, with the price increase of raw materials fluctuating and rising. The tight supply of VC is difficult to reverse in the short term, and the price continues to reach new highs; the price of lithium hexafluorophosphate has reached a new high after the new year, and the current new order is quoted at ¥1.2-125,000/ton. Solvent prices remain stable at a high level. Although the price of industrial-grade DMC has declined, the price of battery-grade solvents has not fallen sharply under the condition that the demand for electrolyte market is improving. In general, the prices of raw materials for electrolyte manufacturers have generally increased, but the costs have not been transmitted to downstream users in a timely manner, which causes negative impact on electrolyte manufacturers.

CONTACT US

CONTACT US ICC APP

ICC APP