Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium Battery

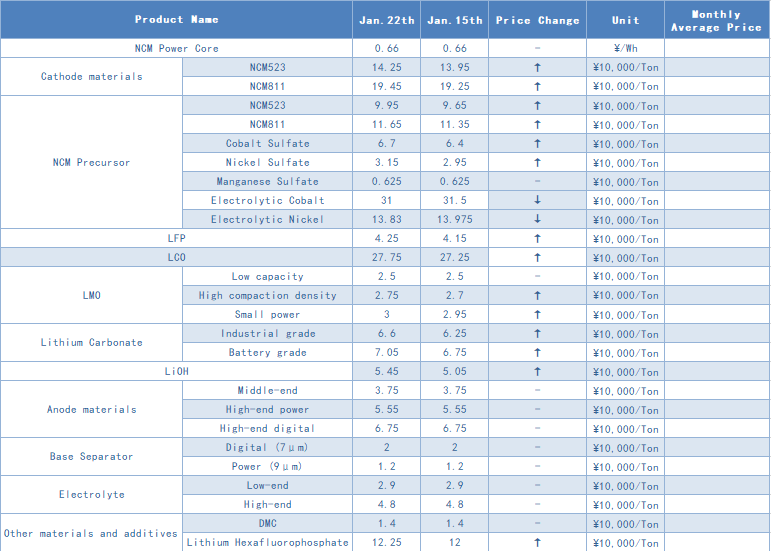

Recently, the price of lithium battery has entered a stage of rhythmical increase. As the upstream raw materials continue to rise, the cost of digital batteries is under huge pressure. Cylindrical battery companies, especially small power industries, have successively issued price adjustment notices, and the 18650 generally increases by ¥0.2-0.3 per unit. In terms of power batteries, there has not yet been a price increase, but it is foreseeable that the cost increase in 2021 will be more obvious, squeezing the profit margin.

Lithium iron phosphate (LFP):

The LFP market is in a supply shortage. Mainstream companies have reached maximum orders of the month and therefore cannot receive new orders. In addition, the price of raw materials fluctuates sharply, so LFP companies generally find it difficult to give reasonable quotations. It is worth noting that with the continued popularity of iron-lithium, iron orthophosphate materials are currently in short supply, and prices are gradually increasing.

The price increase of domestic NCM materials has slowed down this week, and the market quotation has risen slightly by about ¥2 million from last week. Many NCM materials companies have reached maximum production capacity, so they are no longer willing to quote externally in the near future, but only deliver long-term orders. In terms of market transactions, under the influence of the epidemic situation this year, downstream battery factories have mostly maintained normal operations during the holiday season. Therefore, the pre-holiday stocking demand is better than the same period in previous years. Therefore, there are still scattered orders in the market recently, supporting the price of NCM materials. It is expected that domestic NCM material prices will remain strong before the holiday.

The price of lithium carbonate continued to remain strong this week. Some mainstream smelters have stopped giving quotations and receiving new orders due to insufficient delivery. The current market is mainly based on scattered shipments from Qinghai and other traders. Since the NCM materials and LFP markets had better production schedules in January, most companies were willing to stock up and replenish at the end of the year, therefore rising the price of lithium carbonate.

Recently, the anode material market has undergone a smooth transition, and the entire industrial chain is in a state of tight production. However, with the price increase of needle coke, as well as the shortage of resources such as graphitization, carbonization and granulation, the entire market is in a tight state. If most battery manufacturers produce according to previous expectations, it is expected that the price of production related to anode materials will rise in varying degrees after the Spring Festival, which will put pressure on the prices of some low-profit anode products.

This week, domestic head separator companies have gradually increased their new production capacity, however, they still cannot meet the demand for downstream orders. The capacity utilization rate of second-tier separator companies has increased, and some small dry-process separator factories have also begun production, aiming to earn a share in the power stock and small-power market. It is reported that in order to meet the order demand of downstream battery companies during the Spring Festival, some separator factories have also issued incentives for overtime work during the Spring Festival to encourage employees to stick to their jobs. In the short term, the domestic separator market is in a tight supply situation. The current price of separator orders in the first quarter remains unchanged, while orders in the second quarter is expecting price increases.

CONTACT US

CONTACT US ICC APP

ICC APP