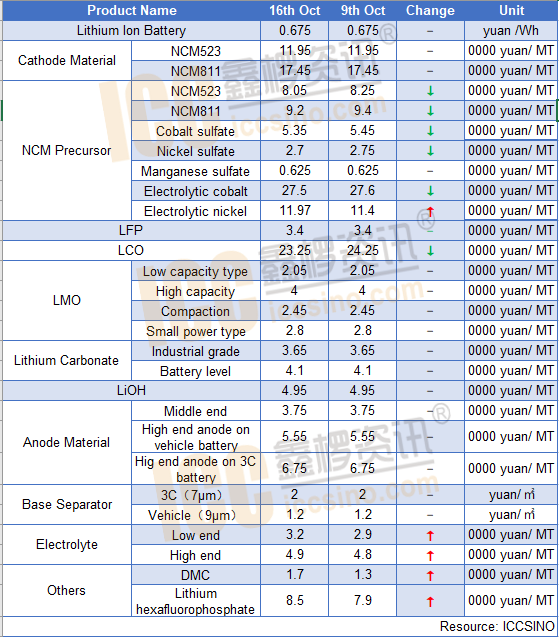

In October, market demand for lithium batteries continues to improve. The production arrangements of mainstream enterprises continued to increase, and overall production and sales had exceeded the same period last year. At the end of this year, driven by demands for outperformance and stockpiling, the peak season is expected to last longer than previous years. Domestic annual production and sales in 2020 are expected to be the same as last year, filling the gap in the first half of the year.

Cathode materials:

NCM: After the National Day, the domestic NCM material prices remained fluctuating, and the market quotations did not change much from before the holiday. In terms of downstream demand, the market demand for power batteries is hot, driving the output of leading NCM manufacturers to continue to increase, and some companies have even reached full production. According to some manufacturers, the order book for October and November is almost full. New orders from small customers will not be accepted recently, and the focus is to take the lead in meeting the needs of large customers. Besides, ICCSINO learnt that some manufacturers are looking for OEMs to ensure enough shipments after their production capacity reaches full production.

NCM precursor: recent price performance of NCM precursors is weak compared to the pre-festival period. At present, the transaction price of conventional NCM523 generally falls below RMB 80,000 /ton. Cobalt sulfate market has maintained a declining trend. However, in the second half of this week, driven by positive news such as strong sales of new energy vehicles at domestic and overseas markets, the market is becoming more bullish on the price. While some traders are trying to raise price quotes, the downstream customers are not accepting that. The market is in a stalemate now. As for Nickel sulfate and manganese sulfate, the prices were stable this week.

LFP: The industry remains in high season. Since October, the capacity utilization rate of the LFP industry has exceeded 80%. The mainstream manufacturers have maintained full production, while some shutdown manufacturers also appear to resume production. The peak season is expected to continue until the end of November. LFP price is still low, with transaction price around RMB 32,000 / ton. Manufacturers are operating at a small profit margin.

LMO: After the National Day, the LMO market still maintained a boom in production and sales, and market prices continued to remain stable. Due to the increase in the purchase price of raw material--industrial-grade lithium carbonate, a few lithium manganate manufacturers want to raise the product price by RMB 300-500 /ton after the holiday. However, most manufacturers are still afraid of the fierce competition due to product homogeneity, so there is not much room for profit. The prices remain low in the short term.

Lithium carbonate: After the National Day, the price of lithium carbonate stabilized in the short term. Most battery-grade lithium carbonate manufacturers have recently maintained full-capacity production, and the order volume far exceeds the month's output. The supply in September was slightly tight, but the previous inventory was still not digested, and some companies that had stopped production resumed production after the holiday. The supply-side recovered, so the rise in battery-grade lithium carbonate prices would be weak in the short-term. As for industrial-grade lithium carbonate, as the market demand for battery-grade lithium carbonate improves, shipments in Qinghai region have increased significantly. The price of industrial-grade lithium carbonate has risen slightly; The price of industry-grade lithium carbonate in Jiangxi region has not changed much.

Anode materials:

The domestic anode material market is still performing well. Some manufacturers have slightly reduced their shipment expectations this month due to the long holiday. However, demands for small power, consumer, energy storage and other products continue to improve. ICCSINO expects that the shipments of mainstream anode manufacturers will remain outstanding. The unstable factor of the anode material market in October is raw material. The price of low-sulfur coke continues to rise. As of the 15th, the cost of Daqing Petrochemical low-sulfur coke has increased by 81.5%. Also, the prices of domestic needle coke have been rising.

Separator:

The domestic negotiated price is stable temporarily, and the industry's production and sales continued to increase. According to ICCSINO, SEMCORP's output in September was 110-120 million square meters, and the output in October would increase to 120-130 million square meters. The separator production lines of leading companies such as Sinoma Technology and Hebei GELLEC were full, and It is reported that some companies start operations 24 hours a day. The domestic separator market has seen a significant increase in supply. However, market competition is fierce and downstream companies have continued to keep prices down, resulting in weak prices. ICCSINO estimates a higher supply but a stable price for the separator market in the fourth quarter.

Electrolyte:

the electrolyte market is still the most outstanding performer in the lithium battery material market. The input prices of DMC and lithium hexafluorophosphate have climbed to new highs.

The market demand for power batteries is strong, and large factories' order volume has reached a single-month high. Driven by high raw material prices and strong demand, electrolyte prices have risen this month, ranging from RMB 12,000 to 20,000 /ton. Except for some unfulfilled orders in the previous period, the current electrolyte market new order prices are basically above RMB 30,000. Overall, ICCSINO expects that the DMC price will remain high this month, and the cost of lithium hexafluorophosphate will continue to rise, reach about 110,000 yuan/ton this month.

CONTACT US

CONTACT US ICC APP

ICC APP