Lithium-ion battery:

The lithium-ion battery market is running smoothly. Demands from street lamps, ESS, 2&3 wheel and electric vehicles, digital 3C, and other downstream markets are still at the peak level during the year. The battery market is trending from low to high, and the rising trend would continue at least until the end of October. ICCSINO estimates that global lithium battery production will grow by about 15% YoY in 2020, mainly driven by overseas markets while the domestic market is flat.

Cathode materials:

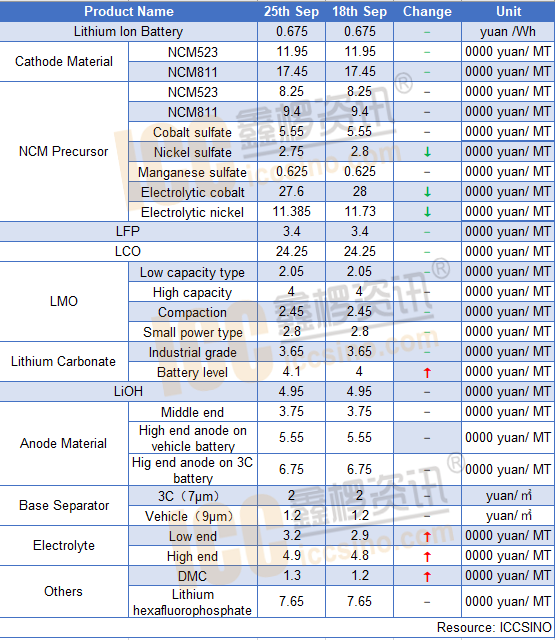

NCM: Chinese NCM price was stable this week. With the domestic lithium-ion battery market picking up, the domestic NCM materials production in September is expected to grow and surpass last year's peak. However, on the domestic supply side, the current NCM production capacity utilization rate is less than 50 percent. Many manufacturers in the market maintain a low-price-competition strategy, which limits domestic NCM prices from rising.

NCM precursor: The market price was stable this week, while trading volume improved, as some manufacturers experienced stockpiling demands before national holidays.

LCO: The market price has not changed much this week. In comparison to the NCM market, the performance prospect of the domestic LCO market improves. Some manufacturers said they are recently operating near full capacity, with orders placed for the next two to three months. In terms of downstream demand, the increasing demand in the first half of 2020 is mainly driven by tablet, notebook, and wearable medical equipment markets. With the arrival of new models' release season, the mobile phone market will boost LCO demand in the second half-year of 2020.

LFP: The market demand remains strong, but prices stay stable. Recently, mainstream battery plants are testing LFP batterie. Against a robust demand this year, LFP prices show no signs of rebounding, competition within the industry is turning intensive, industry professionals generally agree that this phenomenon will continue for quite some time, and small iron lithium plant may struggle.

Lithium carbonate: Battery-grade lithium carbonate prices are slightly higher this week. Manufacture price quotes are getting higher as the low-cost supply significantly reduced compared to the previous period; Although industrial-grade manufacturers intend to raise their price quotes, the prices remain stable right now.

Anode materials:

The Anode materials production plants were under normal production during the National Day holiday. The prices of upstream raw materials have been the most important factors recently. Low-sulfur coke prices rose by RMB 100 / ton this week, a cumulative increase of RMB 600 / ton; The needle coke price is rebounding with some manufacturers gave a price quote of RMB 500-1000/ton.

Since the price of anode materials is already low, the raw materials' cost could put Anode manufacturer's gross margin under pressure. However, the cost pass-through is unlikely due to anode producers' limited bargaining power in the supply chain. Overall, we have a bullish view of the anode materials market in October.

Separator:

The market showed a noticeable sales growth recently. The downstream demands are better than last year, driven by power battery, energy storage, digital products. and two-wheeled electric vehicles. Meanwhile, the watershed between leading and small and medium-sized manufactures is evident. ICCSINO estimates that domestic Separator prices would rise steadily in the Q4.

Electrolyte:

The solvent prices rose steeply in recent periods. DMC is in short supply, and its price has accumulatively increased by about RMB 7000 / ton. Lithium hexafluorophosphate price also continued to rise this week. The transaction price of new orders was around RMB 85,000 / ton, and some manufacturers quoted RMB 90,000 / ton. Rising prices of raw materials and supply deficit strengthened electrolyte manufacturers' pricing power. An electrolyte manufacturer said that they are cautious in accepting new orders without securing the supply and price of raw materials in advance.

CONTACT US

CONTACT US ICC APP

ICC APP