Lithium ion battery:

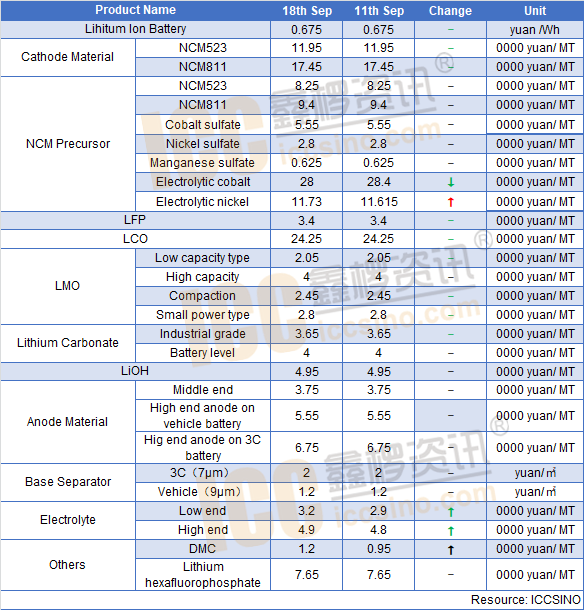

Chinese lithium ion battery market was good this week. Many battery manufacturers were in full production status. From the perspective of downstream market, NEV, 2&3 wheel market, ESS markets performance was decent. Overall lithium ion demand in 2020 was driven by customer side instead of business side, which indicates that industry structure is improving. ICCSINO estimates that the whole lithium ion market growth would be lower than expectation.

Cathode material:

NCM: Chinese NCM price was stable this week. But ICCSINO estimates that NCM price is expected to grow since on one hand downstream demand is increasing, on the other hand, lithium salt price is expected to rebound recently. According to ICCSINO, Indian has gradually recover customs clearance for Chinese exports, which has brought positive effects on low-end Ni55 ternary material demand. Overall Ni55 ternary material was over supply. ICCSINO estimates that Ni55 NCM price would be more weakening than NEV NCM price.

NCM precursor: NCM precursor price was stable. Despite of demand growing, the overall performance of sulfate materials is relatively weak. Especially for cobalt sulfate materials, although news of purchasing and storage was reported last week, the market reaction was not strong, resulting in the recent decline in the price of cobalt sulfate. Although nickel sulfate performs slightly better than cobalt sulfate materials, there is no possibility of another rise in the near future after the nickel price drops. In terms of manganese sulfate, the price continued to be stable this week, with little impact on the price of ternary precursors

LMO: The price of lithium manganate has not changed much this week. Although most lithium manganate manufacturers have a strong willingness to raise prices, short-term supply of lithium manganate is relatively large, and low-price competition orders prevail in the lithium manganate market. In particular, major downstream battery manufacturers have severely lowered prices and lowered the overall market. Transaction price, short-term price increase of lithium manganate is difficult.

Lithium carbonate: Recently, due to the large number of orders from large battery-grade lithium carbonate manufacturers, although they have maintained full production, some manufacturers’ deliveries are still tight. The quotations of battery-grade lithium carbonate have been slightly raised compared with the previous period; while industrial-grade lithium carbonate has been affected by Nanshi in Jiangxi. The production line was overhauled, and the supply was reduced compared to the previous period, but the overall demand remained unchanged. The price of industrial-grade lithium carbonate and battery-grade lithium carbonate in Jiangxi only differed by 1,000-2,000 yuan; the price of industrial-grade lithium carbonate in the salt lake region remained relatively stable.

Anode material:

Recently Chinese anode material market continued to be good. Chinese anode shipment situation reached expectation sincer downstream NEV market demand was good in September. Chinese low-sulphr coke price has continued to increase since August, with an increase of 37%. Therefore, Chinese low-end synthetic anode material price was under pressure. Another raw material needle coke price increased slightly and many needle coke enterprises were at a loss. In terms of price, Chinese low end anode material price was 19000-25000 yuan/MT. Middle end anode material price was 32000-48000 yuan/MT. High-end NEV anode material price was 50000-68000 yuan/MT. High end 3C anode material price was 60000-85000 yuan/MT. Chinese new energy vehicle battery enterprises are at the stage of increasing production. ICCSINO estimates that Chinese anode material marker would continue to strengthen in October.

Separator:

This week, the production and sales of the domestic diaphragm market are still hot, and downstream battery companies are highly enthusiastic about diaphragm procurement, but their willingness to keep prices down remains unchanged. According to the statistics of Xin Lu Information, the domestic diaphragm supply is expected to increase to about 310 million square meters in September, which is still about 10.1% month-on-month growth. Leading companies are still on the way to expand production. Enjie's horizontal expansion again, Hebei Jinli's new production line is expected to be put into operation at the end of the month, and Huiqiang New Energy's new production line is gradually increasing. This shows that the domestic diaphragm supply will reach a peak in October.

Electrolyte:

The electrolyte market continues to improve as a whole in the near future, and prices are still increasing. Some manufacturers' prices have increased by 5,000-8,000 yuan/ton from the same period last month. The main driving force for the increase comes from the raw material market. At present, it is difficult to find solvents. The electrolyte factory has begun to pick up the goods. This week, the DMC price continued to rise to 1,1000-13,000 yuan/ton. The price of lithium hexafluorophosphate has risen. At present, all manufacturers have stopped quoting and receiving orders. It is expected that the market outlook will continue to increase, and the mainstream price is now 75,000-80,000 yuan/ton. With the promotion of raw materials and the support of demand, this electrolyte adjustment is bound to be implemented.

CONTACT US

CONTACT US ICC APP

ICC APP