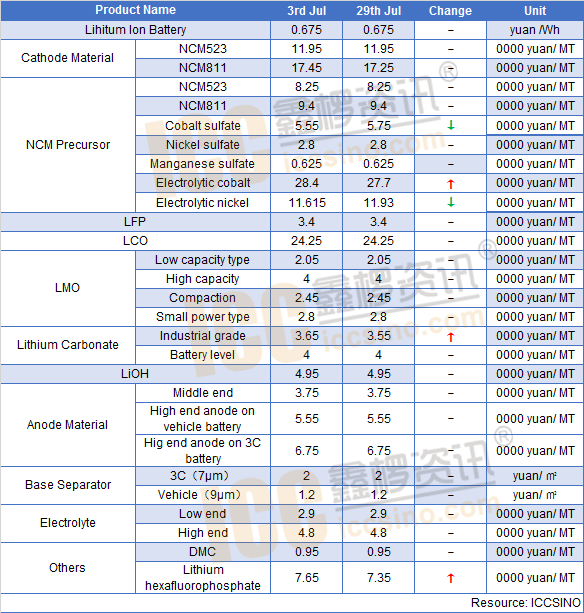

Lithium ion battery:

Recently, the overall performance of lithium battery market was good. It is expected that the month on month growth of battery output in September will be about 10%, which has changed from recovery stage to growth stage.

Looking back on the market, although there is not much increase in the production and sales of lithium batteries this year, the demand for authenticity is obviously increasing from the perspective of supply structure, whether it is electric vehicles, bicycles or ESS. The peak season at the end of the year is worth looking forward to.

Cathode

NCM & NCA:

This week, the price of ternary materials in China was stable. In terms of downstream demand performance, with the continuous recovery of operating rate of China’s mainstream power battery enterprises, the demand for power type ternary materials has continued to warm up. Some manufacturers said that the recent single crystal high voltage system ternary material orders are good, the increase is obvious compared with the previous few months. In terms of digital market, affected by the downturn of overseas demand and the impact of competitive products, the low-end 5-series ternary material shipment performance is not good, especially the price of nickel 55 ternary material is particularly low, and the transaction price of some small orders is only about 100000 yuan / ton this week.

NCM & NCA precursor:

Although China's ternary precursor prices showed a certain upward trend last week, it failed to continue this week as nickel prices weakened again. During the week, the price of ternary precursors remained weak and stable, and the prices of some models of ternary precursors were inverted.

In terms of cobalt sulfate, although the upstream cobalt metal received good news, it did not exceed market expectations. Therefore, the rebound power of cobalt metal price was insufficient, and the price of cobalt sulfate also showed a negative decline. Nickel sulphate prices remained stable this week and did not follow the fall in nickel prices.

LMO:

This week, the price of LMO continued to maintain stability. Most manufacturers of LMO said that the price rise of lithium carbonate did not pull the price of LMO, and the price remained low in the short term. In terms of market supply, according to the feedback of LMO enterprises, the overall market demand in August and September was good, and the supply also reached a new high; and the demand of electric two wheeled vehicle battery market and digital battery market increased steadily, and the short-term trading atmosphere of LMO market was good.

Lithium carbonate:

This week, lithium carbonate prices was stable. The price of industrial grade lithium carbonate in Jiangxi Province was slightly increased in the early stage, but the cathode material enterprises were not willing to accept it, and they were still looking for low-cost sources; the industrial grade lithium carbonate in Salt Lake area basically changed little. Although the market demand of battery grade lithium carbonate is obviously improved, the market supply is also at a high level, and the price continues to maintain stability in the short term.

Anode:

The market of anode materials was good, and the orders of mainstream anode manufacturers are increasing. The power and small power markets are still the main growth points of market demand recently. At present, the price of China’s needle coke is at a historical low level. Most manufacturers are in a deficit state. The operating rate of China’s coal-based needle coke in August was only 10%. It is expected that the China’s needle coke price in the future will increase. Generally, the market volume of anode materials are increasing and prices are stable. It is expected that the output of anode materials will be the peak of this year in September.

Battery separator:

Recently, the production and sales volume of China’s separator’s market continued to rise. Some separator enterprises reflected that the downstream demand increase was obvious, and the supply of base film was in short supply, especially the leading enterprises had reached the full production state.

In terms of market negotiation price, the cost control of downstream battery enterprises remained unchanged. It is expected that in the short term, the China’s separator market will be prosperous in both production and sales, but the price is difficult to go up; in the medium and long term, the separator capacity concentration will continue to increase, and the price is expected to stabilize in the future.

Electrolyte:

Recently, due to the tight supply of raw materials and the price rise of lithium hexafluorophosphate, the current quotation of electrolyte has generally increased by 3000-5000 yuan / ton compared with last month, which is the first increase in the electrolyte market since this year. Under the support of the raw material market, electrolyte manufacturers have entered a substantial rise stage for small clients. Raw material market, solvent prices continue to be high, electrolyte manufacturers home delivery, is expected to continue the current trend this month. Lithium hexafluorophosphate manufacturers are currently stopped quotation, no goods can receive new orders, the price is expected to rise in the future.

CONTACT US

CONTACT US ICC APP

ICC APP