Lithium ion battery:

The lithium battery market is in the busy season, the production arrangement of mainstream enterprises has exceeded the peak level of last year. The production proportion of LFP has significantly increased compared with last year.

Recently, it is rumored in the market that the head enterprises will give up 8 series ternary battery. According to ICCSINO, it is not true. The production arrangement of high nickel enterprises is still at a high level, and a considerable proportion of them are supplied to overseas markets.

Considering the safety and cost, LFP are more popular this year, driving the short-term improvement of LFP market. However, from the perspective of technical planning, the trend of high nickel has not changed, and enterprises don’t need worry too much about the choice of technical routes.

Cathode

NCM & NCA:

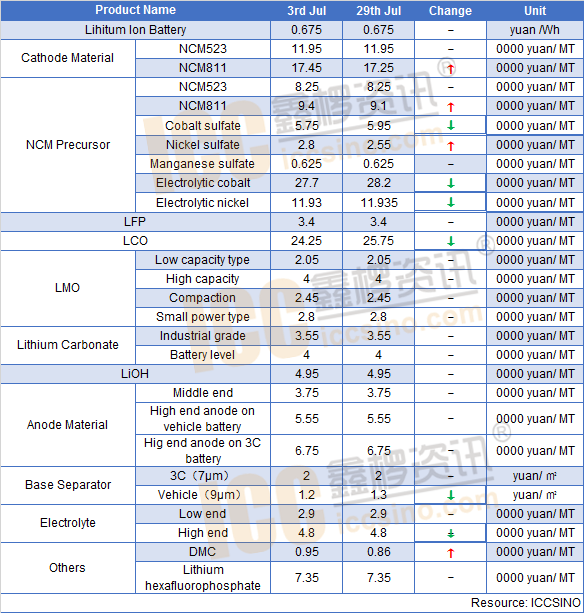

Although the price of upstream metal raw materials is still fluctuating this week, the price of ternary cathode material is mainly stable. From the perspective of market demand, downstream battery factories are not willing to stock up, especially in the consumer market, the demand is slightly lower than expected. Affected by this, China’s polycrystalline 5-series ternary materials are oversupply, and the market competition is fierce.

For other ternary material systems, the demand for single crystal 5-series and 6-series ternary materials is considerable, while the shipment of high nickel ternary materials maintains a small growth.

NCM & NCA precursor:

This week, the prices of ternary precursors in China remained stable, and the price of high nickel ternary precursors increased most significantly due to the price of nickel sulfate. Thanks to the continuous growth of overseas market demand, the China’s leading ternary precursor enterprises generally performed well, while the small and medium-sized ternary precursor enterprises started slightly worse. In terms of sulfate market, nickel sulfate price showed a strong performance this week, as the upstream metal nickel price continued to rise due to the non-power market demand; cobalt sulfate showed a small decline this week, because the downstream of cobalt sulfate was mainly battery materials, and the current demand side of battery material market was not that much. This week's price of manganese sulfate market was stability.

LFP:

LFP is still in the incremental stage, and it is expected to reach the peak within the year from September to October. However, due to the fierce market competition, the price of LFP has been kept at a low level. In the first half of the year, the leading enterprises have been operating in deficit. The bottom of the price has been basically formed, and it is expected to be stable in the future.

LMO:

This week, the price of LMO was basically stable, and the price of industrial grade lithium carbonate of raw materials was raised. In the short term, the price of LMO was not pulled back, but the price of LMO was restrained from further falling. Although the downstream order volume is relatively enough recently, the current situation of market oversupply is difficult to improve.

Some enterprises believe that although the price of raw materials is rising, and LMO enterprises have the willingness to raise the price, it is still difficult for the price of LMO to follow the rise, and the short-term price is still stable.

Lithium carbonate:

This week, lithium carbonate prices was stable. With the further recovery of the demand for ternary materials in August, the order volume of battery grade lithium carbonate increased greatly.

The supply of mainstream lithium carbonate plants was in short supply, and some enterprises wanted to raise the price of lithium carbonate. However, at present, the market supply of battery grade lithium carbonate is still large, and the inventory is not fully digested, so the price of battery grade lithium carbonate is not expected to rise in the short term.

The price of industrial grade lithium carbonate is relatively stable recently. Due to the shortage of supply in Jiangxi Province, the price of industrial grade lithium carbonate was slightly raised in the middle of the month, while the price of industrial grade lithium carbonate in Salt Lake area remained stable in the short term.

Anode:

The market of anode materials continued to improve recently. According to ICCSINO, the output of China’s anode materials in August increased by 21% month on month and 62% year on year. The output growth was significant, and the performance of leading enterprises was particularly well.

Product prices tend to be stable. It is estimated that the market growth rate in September will remain at about 13%, and the increment will mainly come from the vehicle power battery market, especially the demand of head battery manufacturers.

Battery separator:

In September, China’s battery separator production and sales are expected to grow. Among them, the production arranged by Enjie in September was about 13% higher than that in August, and Sinoma technology basically entered the state of full production.

The production and sales of other separator enterprises have increased as well. The reason is that the demand of China’s two wheeled electric vehicles is hot, and the performance of European power market is good, which promotes battery enterprises to increase separator purchase plan obviously, but their willingness to reduce price is still not reduced. In addition, some separator enterprises reduce their price for gaining more volume, which lead the separator market confusion.

Electrolyte:

According to ICCSINO, China’s electrolyte output in August was 24400 tons, with a month on month increase of 14.6% and a year-on-year increase of 46%. In September, the electrolyte market ushered in the first rise of this year, mainly due to the rising prices of raw materials, solvents and lithium hexafluorophosphate. At present, the quotations of electrolyte manufacturers are generally increased by about 3000 yuan / ton.

The liveliest market this month is raw materials. Under the influence of high price and tight supply of raw material propylene oxide, the price of solvent has not only increased rapidly, but also appeared a lively scene of centralized door-to-door delivery. The lithium hexafluorophosphate market also ushered in an upward opportunity. From June to July, China’s 6F inventory was basically digested. In August, the market basically showed a balance between supply and demand.

From the end of August to the beginning of September, the price of lithium hexafluorophosphate rose for the first time, with an increase of about 5000 yuan / ton. It is believes that the increase will last for a period of time. Overall, the electrolyte market in September will usher in a rare price rise with the promotion of solvent, lithium hexafluorophosphate and demand support.

CONTACT US

CONTACT US ICC APP

ICC APP