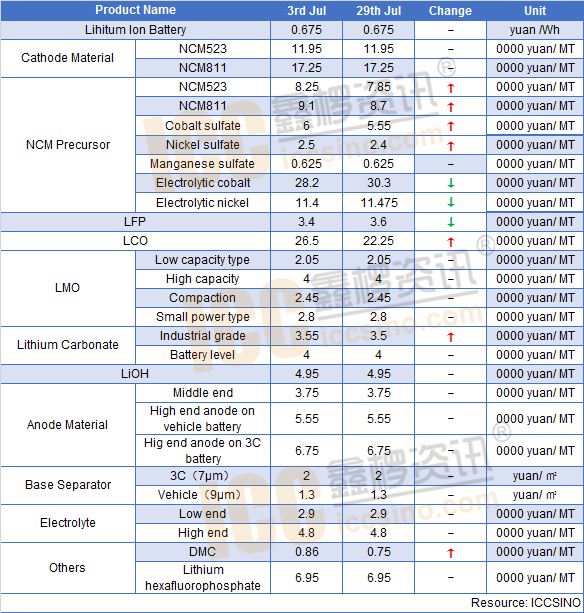

Lithium ion battery:

This week, the market of new energy vehicles, bicycles and ESS kept improving. The peak season of digital batteries has not come as expected. Recently, the high-voltage power battery of CATL began to be installed and used on a large scale. The cell density is close to 8 series products, and the cost can be reduced by nearly 10 percentage points. It is welcomed by downstream automobile enterprises. Some models have clearly switched from 8 series to 5 series, which will exert pressure on high nickel batteries in a short time. However, overseas battery companies are still optimistic about high nickel batteries, and the product system is pushing towards high nickel.

Cathode

NCM & NCA:

With the weakening trend of upstream metal raw material prices, China's ternary material prices also turned into a volatile pattern this week. However, after the price of ternary materials became stable, the downstream demand did not improve. Many battery companies were worried that the material prices would fall again in the future. Therefore, the willingness to wait and see was slightly stronger recently. Only a small number of battery factories just need to enter the market to prepare goods, and the turnover is not large.

NCM & NCA precursor:

Compared with the ternary cathode material, the price of ternary precursor is more seriously affected by upstream raw materials. So, the price of ternary precursor still rose slightly this week.

Many ternary precursor enterprises are still worried that the future price of sulfate will rise again, so the willingness to ship goods is not strong recently, and the quotation is generally on the high side. The cobalt sulfate market began to return to rationality this week, and the quotations from traders were loose, but the overall price was still on the high side. The willingness of downstream precursor manufacturers to receive goods was general, and the market supply and demand sides were slightly deadlocked. The price of nickel sulfate and manganese sulfate has little change. As far as the future market is concerned, the price of nickel sulfate is still expected to have certain space.

LFP:

LFP market continues to show a trend of increasing in volume and decreasing in price. The ESS and bicycle market is still relatively hot. At the same time, after entering August, the new energy vehicle market has begun to turn better, and LFP is expected to increase significantly in the later period. With the hot sales, the price of LFP still hasn't improved. This week, the mainstream quotation of power products has been reduced to 32000-36000 / T, and the price reduction in small market segments is more serious.

LMO:

The price of LMO was stable. The battery demand of electric two wheeled vehicles has continued to be good since August, the demand for digital batteries has gradually recovered, and the orders of various enterprises are sufficient; moreover, due to the recent correction in the price of industrial grade lithium carbonate, some downstream battery enterprises have begun to lock in the order of LMO. The price of LMO is mainly stabilized in the short term, and it is possible that the price of LMO will rise with the price of raw materials.

Lithium carbonate:

This week, the price of battery grade lithium carbonate remained stable, and the price of industrial grade lithium carbonate in Jiangxi Province increased slightly. With the improvement of downstream demand, the recent shipping volume of battery grade lithium carbonate market feedback is significantly better than the previous period, and the price is basically stable. Industrial grade lithium carbonate in Jiangxi benefited from the increase of market demand for LFP and LMO, and some cathode enterprises thought that the price of industrial grade lithium carbonate had reached the bottom, and the price might rise again. Some enterprises began to prepare inventory and the short-term supply was relatively tight. The manufacturers raised the quotation of industrial grade lithium carbonate.

Anode:

In August, China's anode material market continued to improve. This month, the orders of top enterprises were expected to record high, and the order volume began to increase substantially. After more than half a year's game, the product price began to enter a stable period. The price of raw material needle coke is hovering at a low level, and it is basically in a state of loss in the whole industry, which is difficult to maintain for a long time. As a result, the actual operating rate of China’s needle coke is only about 30%.

battery separator:

Recently, China’s separator market continued to rise both in produce and sales. With the end of the transition period of the new national standard for electric bicycles, the acceleration of lithium electrification, the continuous promotion of tower 5g ESS project and the continuous improvement of new energy vehicle production and sales, the market demand of dry wet separator increased significantly. According to ICCSINO, China’s separator output in July was about 220 million Ping, an increase of 15% compared with June, basically reaching the peak of last year's output. It is expected that the China’s separator production will maintain a growth rate of about 10% in August.

Electrolyte:

In August, the order situation of electrolyte market was good, especially the demand of power battery market improved significantly compared with H1. It is expected that the positive trend will continue in the next few months.

In terms of product price, the low level remained stable, but since the end of July, the price of propylene oxide, a solvent raw material, has risen rapidly, with an increase of more than 3000 yuan / ton. As a result, the price of solvent has been continuously refreshed since August. Some manufacturers have stopped offering to the outside world. As of this week, the high price of solvent has stabilized, and now the price of solvent has generally increased by about 20%. The inventory of the lithium hexafluorophosphate of each company has been basically digested to a reasonable level. The demand for electrolyte is also rising, and manufacturers are optimistic about the future market. Generally, the price of solvent has generally risen, and the price of lithium hexafluorophosphate is expected to rise. The downstream demand is also increasing, and some manufacturers of electrolyte are optimistic about the future market.

CONTACT US

CONTACT US ICC APP

ICC APP