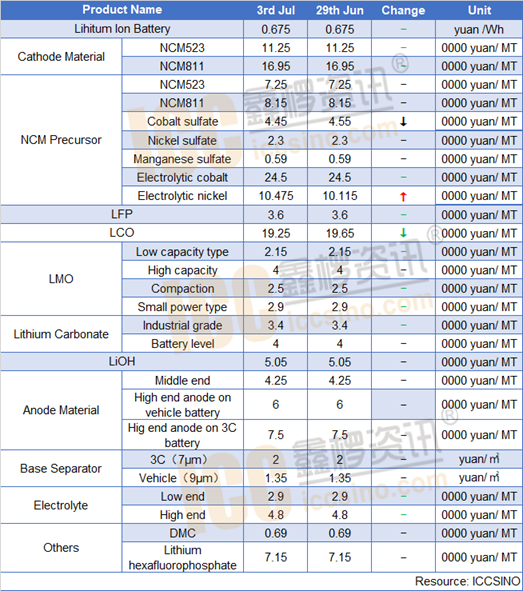

Lithium ion battery:

Vehicle power lithium ion market is warming up, whereas there is still a gap far from 2019. Prices have declined, for example, NCM module price was 0.75 yuan/wh, with 15% decline compared with last year. Therefore, enterprises’ operating income would decline. According to ICCSINO, mainstream enterprises’ gross profit level still be maintained at around 30%. The most important thing at this stage is to ensure the operating rate and reduce the level of depreciation and amortization.

Cathode

NCM & NCA: NCM market was stable. From the perspective of demand, new energy market is gradually recovering. ICCSINO estimates that leading NCM enterprises might benefit from EV orders. Whereas medium and small size NCM enterprises’ performance was not very satisfactory and expected to get orders from European, US and South-east Asian consumption market.

NCM & NCA precursor: NCM & NCA market was stable. Downstream demand from NCM & NCA enterprises was weakening, which restricted NCM & NCA precursor enterprises purchase raw material like nickel sulfate. With cobalt supply eases, Chinese cobalt sulfate price decreased and expected to maintain weakening trend.

Anode material:

Anode material market was expected to grow in July, but there was no significant growth as end of 3rd July. In terms of downstream demands, new energy vehicle and ESS market would grow slightly, 3C and small power market would maintain stable. Leading anode enterprises got orders from new energy vehicle battery enterprises. Medium and samll size enterprises got orders from 3C, small power and ESS battery enterprises. Anode price was stable. Chinese low-end anode material was 19000-25000 yuan/MT. Medium-end anode was 35000-50000 yuan/MT. High-end anode on new energy vehicle was 50000-70000 yuan/MT. High-end anode on 3C was 60000-87000 yuan/MT. In summary, there would be supply growth in Chinese anode market in July and growth would be concentrated in tier 1 & tier 2 enterprises.

Separator

Chinese separator supply increased in June, which was driven by ESS, e-bike market etc. According to ICCSINO, CATL’s separator purchase was lower than expectation in June. In July, separator enterprises’ scheduled production increase since demand is growing. ICCSINO estimates that Chinese separator market would accelerate in Q3 2020, nevertheless price might be weakening.

Electrolyte:

Recently electrolyte market is growing, but priced were weakening and have already hit the bottom. Raw material prices were quite low as well. Lithium hexafluorophosphate and solvent prices were stable. According to ICCSINO, most enterprises are optimistic about orders in July. In summary, ICCSINO estimates that electrolyte demands would grow and prices would maintain stable.

CONTACT US

CONTACT US ICC APP

ICC APP