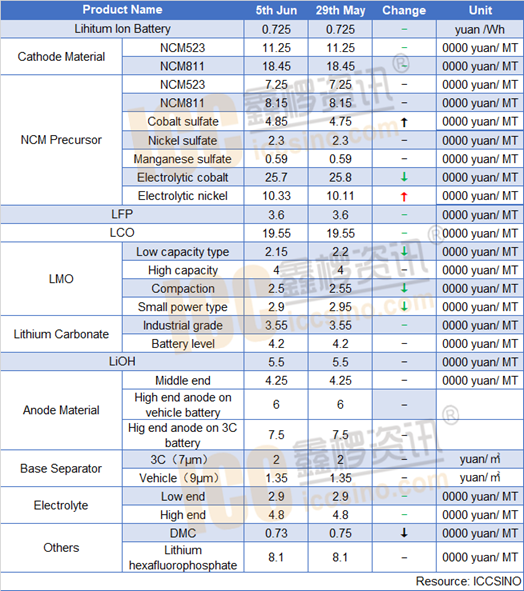

Lithium ion battery

Lithium ion market overall performance was good that is driven by ESS, whereas new energy vehicle market was weakening. BYD Han EV was officially released in May, which is installed with LFP blade batteries, whose battery pack energy density would reach 140wh/kg.

Cathode material

NCM: Chinese NCM market was stable this week. In terms of downstream demand, small power market performance was good. In low-end 3C market, price war was fierce, some Ni 55 NCM price was around 90000 yuan/MT. ICCSINO estimates NCM output in Jun is expected to grow due to leading battery enterprises got new orders.

NCM precursor: There was no dominant changes in Chinese NCM precursor market this week. NCM 523 precursor price was around 75000 yuan/MT. Cobalt sulfate price rebounded slightly that reached over 50,000 yuan/MT due to tight supply in Chinese market. Whereas some cathode material willing to purchase NCM precursors directly instead of cobalt sulfate.

LFP: LFP market was good driven by energy storage base station and low-speed vehicle demand. In terms of price, price gap between vehicle LFP and ESS LFP is widening, since ESS LFP has lower request standard for LFP and price competition is very fierce, whereas vehicle power LFP price is relatively expensive.

LMO: Recently LMO market was weakening and price declined due to lithium carbonate price decrease in Jiangxi city, China. According to ICCSINO, LMO demand is expected to grow driven by growing demand from mobile power and 2-wheel vehicle market.

Lithium carbonate: industrial-grade lithium carbonate price was stable. Growing downstream demand of NCM and LFP might bring new opportunities to lithium salt market, whereas lithium carbonate is current in oversupply pattern. ICCSINO estimates that lithium carbonate market would remain weakening.

Anode material:

Anode market was stable this week. Chinese domestic demand is gradually warming up driven by new energy vehicle and ESS. Overseas (outside China) anode demand was still weakening. In terms of price, Chinese anode price was stable. Whereas for overseas anode market, it's in the price negotiation period and there might be changes. ICCSINO forecasts that anode market in June would maintain same level compared with May.

Separator:

Chinese separator market was stable this week. Dry process separator demand was good which was driven by ESS market. Nevertheless, wet process separator market showed decline caused by weakening demand from vehicle battery market. ICCSINO estimates that Chinese separator market would continue to maintain current status in June.

Electrolyte:

Chinese electrolyte market was stable this week and price competition was quite fierce. ICCSINO estimates that electrolyte market would recover with vehicle battery market gradually recovers.

CONTACT US

CONTACT US ICC APP

ICC APP