Lithium Ion Battery

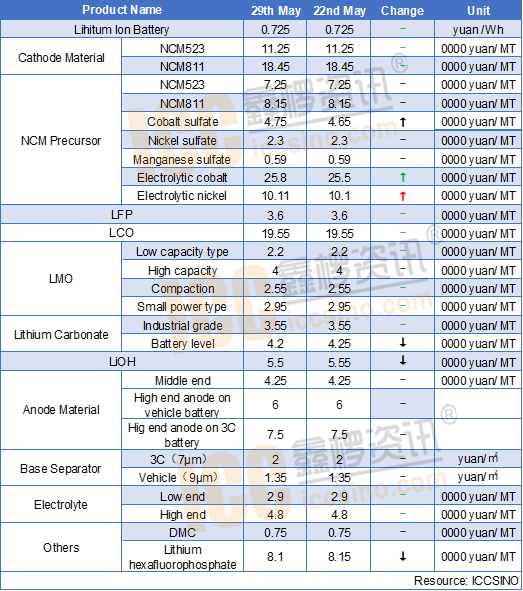

Lithium ion market was gradually recovering. For downstream demand, new energy vehicle demand was not satisfactory. Whereas, ESS market performance was quite good. Furthermore, Volkswagen's shareholding in Goxuan event has obviously boosted the confidence of the entire industry. Price was stable, LFP module battery is 0.6yuan/wh. NCM module battery was 0.8-0.85 yuan/wh.

Cathode material

NCM: Chinese NCM market was warming up compared with April. From supply side, high nickel supply shipment was slow. Some battery enterprises prefer Ni65 and Ni55, which was driven by e-bike and low end digital demand. However, price was low because products are relatively low-end. Some quotation was below 90000 yuan/MT.

NCM Precursor: market was stable this week because downstream demand was not good. Cobalt sulfate price increased due to raw material price going up. Nickel sulfate and manganese sulfate prices were stable.

LCO: LCO performance was quite good both on production and prices, which was driven by high-end 3C products. However, with 3C market turning weakening, ICCSINO estimates that LCO would show declining in June.

LFP: LFP market was good this week, which is driven by ESS market growth. According to ICCSINO, traditional battery enterprises like CATL and Guoxuan have got ESS orders. ICCSINO estimates that LFP market would continue to grow next month.

Anode material:

Anode material market was stable in May. Overall demand both in China and overseas was not decent. In Chinese demand market, vehicle battery and 3C market was weakening. Comparatively ESS market performance was good, whereas competition was very strong. Anode material on ESS was reported around 20000 yuan/MT. Affected by slow production recovery in US and Europe, export orders were hit. Chinese low-end anode products reported 21000-25000 yuan/MT, middle-end anode products reported 35000-50000 yuan/MT, high-end anode products on vehicle reported 50000-70000 yuan/MT, high-end anode on 3C products reported 60000-87000 yuan/MT. ICCSINO forecasts that market would remain current situation in June.

Separator:

Separator market was weakening this week and price competition was very fierce. Separator market performance was good on ESS orders.

Electrolyte:

Recently electrolyte market was not good and price showed decline in May. There is limited room for continuing price cut down. Solvent price began declining. DMC performance was lower than expectation and price reported 7200 yuan/MT. Hexafluorophosphate this month is still moving downwards. The mainstream price is now 73,000 yuan / ton, and some spot prices have below 70,000 yuan/ton. On the whole, the electrolyte market in May performed mediocrely. It is expected that the short-term electrolyte market will not improve much.

CONTACT US

CONTACT US ICC APP

ICC APP