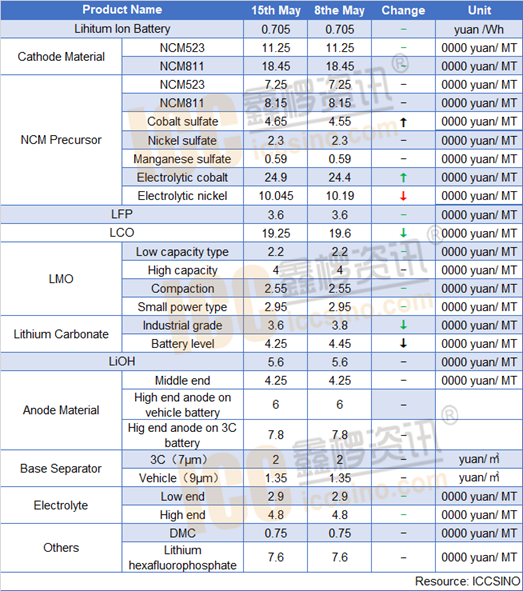

Lithium ion battery

The sluggish demand for new energy vehicles has led to the continued slump of vehicle battery market. In recent days, battery companies have focused on energy storage and small power markets, and the increase is relatively obvious. The recently issued national mandatory standard for electric vehicles requires that the system will not fire or explode within 5 minutes after the battery cell thermally loses control, causing heated discussions. According to the feedback from various companies, this standard is more for the battery. It can be solved by adding a fire-retardant coating or a heat-insulating plate, which is not difficult, so it will not affect the existing battery material system.

Cathode Material

NCM: The situation of the domestic ternary materials market this week is still flat, and prices are still at a low level this year. In terms of downstream demand, sales of new energy vehicles are gradually picking up. However, due to the high battery inventory of battery factories, the recovery trend of terminal demand has not yet been reflected in the positive electrode market. In the non-power market, the current domestic demand situation is still not optimistic, but some material companies said that with the lifting of the closure of overseas countries ’policies, domestic export orders for power tools and other products are expected to recover in late May, or will drive some digital ternary Material demand picked up.

NCM Precursor: Affected by the poor demand of NCM, this week's domestic ternary precursor market shipments are still not good. However, the price of NCM precursor materials is relatively strong, and there may be a rebound in the future market, because some upstream raw materials have come out of the rebound this week. The rebound in domestic electro-cobalt prices this week stimulated cobalt sulfate manufacturers to raise their quotations and ship shipments. Although the market turnover has not improved, the manufacturers have a strong willingness to set prices, and subsequent prices may continue to rise. In terms of nickel sulfate and manganese sulfate, prices have not changed much this week.

LFP: In May, vehicle battery market demand did not improve, energy storage orders continued to increase. With the increase in energy storage battery production by companies such as EVE and Ruipu New Energy, the demand for LFP remained at a high level. TLFP output this month is expected to exceed 9,000 tons, a positive year-on-year. The price level has not changed much, mainly weaken and stable.

LMO: This week, LMO market was flat, and the downstream market was differentiated. The orders for small power and some cylindrical consumer batteries were relatively good. However, due to the impact of the overseas infection, the soft pack market has reduced its demand for lithium manganate. Market supply remains stable, and the price of LMO is consolidating at a low level.

Lithium Carbonate: Lithium carbonate prices continued to be weak this week, with prices falling slightly. Demand for lithium iron phosphate in May is expected to decline from April, while the ternary material market has not improved for the time being, and the overall market demand is still weak. The supply volume is not reduced, and some enterprises have high inventory. In order to alleviate the pressure on inventory and capital, many companies are forced to lower their shipment prices, and short-term market prices continue to remain low.

Anode Material:

This week, Chinese anode market continued to operate stably, and the output of leading companies was expected to increase slightly during the month, especially the orders from the small power and energy storage market segments are worth looking forward to, but the demand for power batteries is still recovering slowly At present, there are still uncertainties in export orders. The negative electrode market in May is expected to continue in April, but the head enterprises will still have a small increase, and the output of small and medium-sized manufacturers is expected to rise and fall.

Separator:

This week, Chinese separator market supply is stable, and the downstream power market demand is slowly recovering. Among them, the production shutdown of CATL in May, and the operating rate of leading manufacturers is still only about 50-60%; But Chinese digital, small power and energy storage market demand is optimistic. In the meantime, the orders of the diaphragm companies present a situation of joy and worry. According to ICCSINO, in April, the shipment volume of Semcorp was about 60 million square meters, 20 million square meters were sold overseas.

CONTACT US

CONTACT US ICC APP

ICC APP