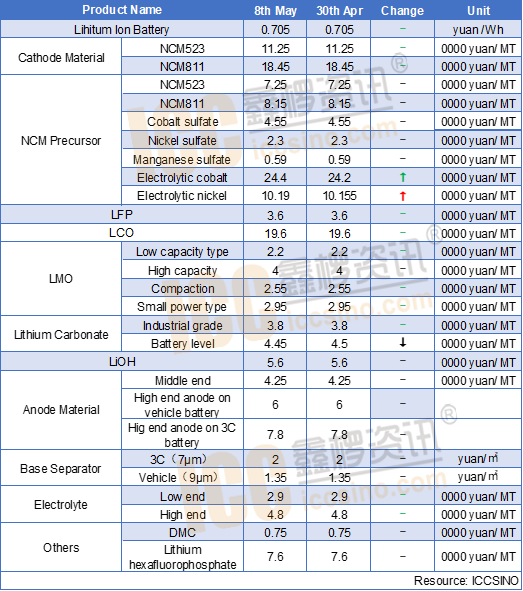

Lithium Ion Battery

Lithium ion battery market has not changed much in May, and power batteries are still dominated by digesting inventories. The demand for new energy vehicles has been lower than expected. Sales of cars in April have been close to the same period last year, while new energy vehicles was still Y-O-Y down by more than 30%, making it difficult to start demand for power batteries. At present, the main operating companies of energy storage and small power companies have a relatively higher operating rate and perform better than the same period last year. Overall, the focus of enterprises this year should be in the non-power sector.

Cathode Material

NCM: After entering May, Chinese domestic demand for NCM materials is still not dominant, and the operating rate of many leading NCM materials companies remains below 50%. The continued sluggish downstream demand also makes domestic ternary material prices perform poorly. It is still at a low point for several years, and there is a risk of continued decline in the short term. From the perspective of the shipment of various types of ternary materials, driven by the slight recovery of the start of operation of some power battery factories, the order of nickel-type ternary materials for power 65 is relatively good, and the demand for other high nickel and 5 series ternary materials is generally Not as expected.

NCM Precursor: Affected by the poor downstream demand, the recent domestic NCM precursor market shipment situation is relatively light, and some small precursor manufacturers have almost fallen into a state of suspension, and this situation is expected to continue for a full month in May. In terms of upstream raw materials, the prices of cobalt sulfate and nickel sulfate have stabilized recently, but there is a possibility of a rebound in the price of cobalt sulfate in the future market, because there is a risk of shortage in the supply side of overseas cobalt mines and the demand for cobalt tetraoxide, another downstream of domestic cobalt sulfate products Performed well.

LFP: The overall performance of LFP in May is still not good. From the perspective of demand, power purchase orders have not improved, and energy storage is slightly better, but it cannot meet the power gap. In addition, due to the generally high output of iron-lithium enterprises in March-April, leading to an obvious inventory backlog, some enterprises began to cut production to digest inventory. The price is also steadily weakening, and the phenomenon of dumping goods at low prices has increased.

LMO:LMO price this week is weak and stable. On the demand side, some manufacturers said that the orders for consumer batteries in May were lower than expected, and the overall market demand was poor. On the supply side, leading enterprises still maintain full production. Although some manufacturers have reduced production, the total supply has not declined significantly, and the contradiction between supply and demand is difficult to improve in the short term. Lithium manganate prices have been at historically low levels and remain weak and stable in the short term.

Lithium Carbonate: Since entering May, lithium carbonate market is still poor. Due to the large output of some early manufacturers of LFP, there may be signs of volume reduction in May, while the market demand for ternary, lithium cobalt, lithium manganate, etc. has not improved significantly, and the short-term demand for lithium carbonate may further weaken. The market supply is relatively sufficient. Although the price has fallen below the cost line of most enterprises, it does not rule out the possibility of some manufacturers selling at low prices. The short-term market price is still weak.

Anode Material:

In the first week after the May Day holiday, anode material market continued to diverge in April. The head companies still expected to have different levels of growth in May production and sales. Companies with a relatively high order of exports to the US market still have a large Uncertainty, some SMEs have performed mediocre, and shipments have reached the average of last year, which is considered a good performance. Product price: The mainstream price of negative electrodes has basically bottomed out in May, but the price of some low-end products has not been ruled out. The negative electrode market in May is expected to continue in April, and the overall market is still not performing well. The individual companies that ship are dazzling, and most companies are not as good as the same period last year.

Electrolyte:

Entering the electrolyte market in May is still tepid, and the shipment situation is still unsatisfactory. The main tone of the power battery market continues the trend in April. The overall digital market is also a downward trend. The planned volume in May allows individual manufacturers to ship less than April this month. In terms of the raw material market, for the price of solvents that are quickly drawn before the holiday, although the electrolyte manufacturers have pressure in the first week after the holiday, they have not yet fully transmitted it to the electrolyte market, which makes the increase in solvent prices insufficient and lacks support. . In the lithium hexafluorophosphate market, in view of the poor shipment status of the electrolyte market, the raw materials are purchased on demand, and the operating rate of some enterprises of lithium hexafluorophosphate manufacturers is only maintained at about 70%, and the price is stable at a low level. Overall, the electrolyte market will continue to be weak and stable soon, with weak demand and low-end digital market price wars.

Separator:

Returning after the holiday, the construction of the Wuhan diaphragm company has returned to normal, and the overall supply in the domestic market has increased. However, some downstream power battery companies have been affected by the overseas epidemic. The purchase volume of the diaphragm has been reduced. ; In contrast, the domestic demand for digital, small power and energy storage markets is acceptable. According to dry-separation companies, downstream orders are gradually increasing. With the gradual resumption of overseas car companies and the implementation of domestic new energy vehicle subsidy policies, the overall demand for the diaphragm market in the second quarter will still show a slow recovery trend

CONTACT US

CONTACT US ICC APP

ICC APP