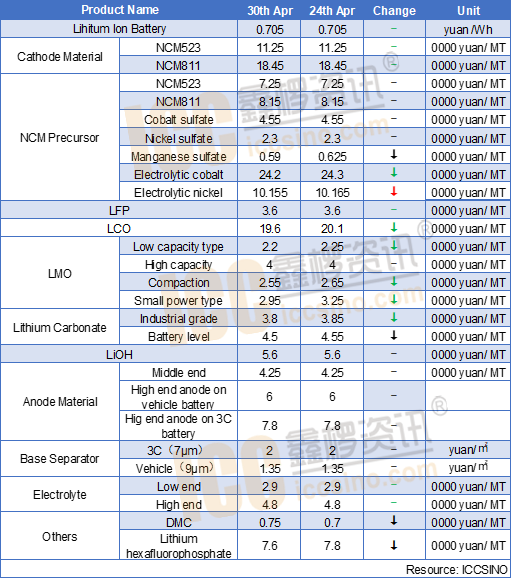

Lithium Ion Battery

Recently battery market has clearly shown signs of improvement, whether it is a new energy vehicle or a small power market. In terms of power batteries, subject to the high inventory of enterprises, the current task of mainstream enterprises is still to digest inventory, and the output is not high. The performance of small power is obviously stronger. With the large-scale transformation of lithium batteries for electric bicycles, new demand has emerged recently, and traditional cylindrical battery manufacturers have ushered in a rare peak season. Maintain stability in price.

Cathode Material

NCM: At the end of the month, NCM orders increased slightly, but the overall operation rate of Chinese NCM market in April was less than expected at the beginning of the month. At present, the demand for the downstream power market is expected to continue to recover in May, which will drive the operating rate of mainstream ternary factories to rebound. The low-end 3C market is difficult to recover quickly in the short term due to its dependence on exports. In addition, the theme of shared motorcycles in China is relatively hot recently. According to ICCSINO, most of the motorcycle batteries currently use NCM mixed with LMO batteries, which is expected to boost Chinese NCM market

NCM Precursor: Affected by the poor start-up of NCM enterprises, NCM precursor market has performed poorly overall. However, the prices of upstream cobalt sulfate and nickel sulfate are relatively strong. In April, the price of domestic ternary precursors did not fall sharply like ternary materials. At present, the mainstream quotation of NCM 523 precursor is still 70,000 yuan/ MT. It is reported that the recent strong price performance of materials such as cobalt sulfate and nickel sulfate is mainly due to the expected shortage of the ore supply side.

LFP: LFP market has been flat recently, mainly due to the fact that demand in vehicle battery market has not improved. From the perspective of order volume, market continue to be weak. In addition, the demand in the fields of bicycles and base stations has performed well, and the growth is very obvious compared with the same period last year, which has become the focus of recent attention of LFP companies. LFP price was stable recently

LMO: This week, due to poor demand in 3C market, LMO market continued to decline. On the supply side, companies such as CITIC Dameng and Hunan Xinda slightly reduced production, but total market supply has not seen a significant decline. Demand for 3C and small power markets has diverged. Among them, the digital market demand has not improved, and some low-end digital battery companies have reduced or converted production. In the small-power battery market, although the number of shared electric bicycle orders has increased sharply recently and the demand for small-power batteries has increased significantly. But LMO price still declined due to the oversupply. It is expected that LMO price will continue to be under pressure.

Lithium Carbonate: Recent NCM and LFP market are not as expected. The demand for lithium carbonate is relatively weak, and the performance of battery-grade lithium carbonate is particularly obvious. Affected by this, the price of lithium carbonate is weakly lowered. According to ICCSINO, with the optimization of the quality of industrial grade lithium carbonate in Jiangxi region and the demand for cost reduction, some low-end ternary materials companies have begun to use industrial grade lithium carbonate instead of battery grade lithium carbonate, battery grade lithium carbonate and industrial grade. The market demand for lithium carbonate continues to diverge, so this year, some production lines of battery-grade lithium carbonate production enterprises have been converted to industrial-grade lithium carbonate. In May, industrial-grade lithium carbonate is expected to perform better than battery-grade lithium carbonate, but prices have continued to be under pressure on the premise that market supply has not decreased significantly

LCO: Although the overall demand of the domestic e-cigarette market showed a downward trend in April, the rebound in demand in other fields such as mobile phone batteries offset the negative impact of the e-cigarette market. Therefore, the overall shipment of the domestic lithium cobalt oxide market in April performed well. In terms of cobalt tetroxide, many leading companies have recently indicated that orders are hot, and the production line is basically full. Although Jinchuan has previously reported news of production cuts, it is more restricted by the supply side of raw materials, but not by the poor downstream orders.

Anode Material:

The overall situation of Chinese anode material market in April has not changed much from that in March. The shipments of anode companies with higher export concentration have fallen by 5-20%. The high concentration of vehicle battery customers also performed poorly. Anode enterprises' shipments to customers who mainly supply small power, ESS and high-end 3C are remarkable, and there have been different degrees of growth. Some small and medium-sized anode manufacturers mainly supply low-end 3C products, but the order volume is falling and price kept decreasing. Anode material prices have been declining since Chinese Spring Festival. Price of anode materials in May generally declined by 5% -10% compared with that of the previous year. At present, domestic low-end anodes are 21000-25000 yuan/ ton, mid-end anode materials are reported at 35000-50000 yuan/ ton, high-end power products are reported 50000-70000 yuan / ton, and for high-end 3C products price are 60000-87000 yuan/ ton. The market demand in May is expected to remain weak, especially the vehicle battery market is expected to continue in April. With the continuous construction of European and American companies, the overseas market demand will be gradually released, and the market is expected to improve in June.

Electrolyte:

Recently, electrolyte market as a whole is weak, the shipment situation is general, and the product prices remain low. It is expected that the shipment of the electrolyte market in May will continue this month. This week, the solvent market was very lively. The industrial grade DMC was raised from 5,000 yuan / ton to 7,000 yuan / ton, and the current price, the solvent price was pushed up this week. The DMC is now reported at about 8,000 yuan / ton. DMC and EMC report 13500-14000 yuan / ton, EC and PC prices have not changed much. However, the prices of electrolyte manufacturers are still being implemented at the beginning of the month. It is expected that they will be transmitted to electrolyte manufacturers after May 1st. Although the current performance of the electrolyte market is not good, the current price is already low, and the cost increase may force some low-priced products. Price increased.

Separator:

This week, Chinese domestic separator market is mainly consolidating and leading separator companies are operating normally. According to the company, Chinese domestic 3C market demand rebounded slightly in April, and the demand for energy storage and base stations is more optimistic. At the same time, major foreign orders have not been affected by the epidemic. Impact, but for the May market, the industry is clearly worried about the demand for power. In the long run, domestic leading companies are still expanding diaphragm production capacity, while constantly expanding overseas markets, and the demand for the global diaphragm market is still optimistic.

CONTACT US

CONTACT US ICC APP

ICC APP