Cathode Material:

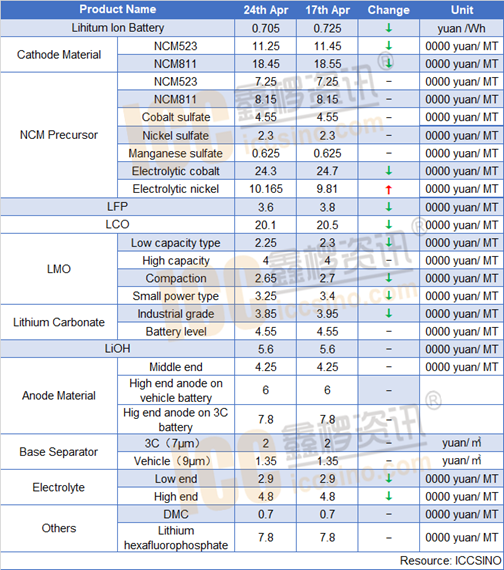

NCM: Overseas (outside China) epidemic has affected Chinese export situation. Recently, many small 3C battery manufacturers have shut down to stop production, resulting in an oversupply of Chinese NCM market. Many NCM companies are forced to reduce prices to increase order volumes due to sales and payment pressure. Some cash prices of NCM523 have been reported below 90,000 yuan / ton. Vehicle power market performed relatively well, and downstream orders were slowly recovering.

NCM precursor: Affected by the weak demand for batteries, recent Chinese NCM precursor market also performed poorly. Not only that, because the domestic ternary precursor industry is very dependent on exports, it is more seriously affected by the overseas epidemic. The short-term Chinese NCM precursor industry operating rate shows a downward trend. However, the prices of upstream raw materials such as cobalt sulfate and nickel sulfate are relatively stable, because the prices of metals such as cobalt nickel and nickel have not fluctuated much, and the quotations of the holders are firm.

LFP: The performance of LFP market is still very weak. Some companies have begun to lower quotations in order to take the volume. In recent times, the overall quotation in the market has been confusing. Enterprises expect market demand to rebound in May, mainly due to short-term weakness. The current mainstream tax-included quotation is 34000-38000 yuan / ton.

LCO: Relative to other cathode materials, recent LCO shipment is still good, and the shipment of some high-voltage LCO is particularly optimistic. Affected by the good shipment of LCO, the recent domestic cobalt tetroxide market has also performed well, with prices quoted over 170,000 yuan/ ton. However, it should be noted that the market demand for terminal e-cigarettes has recently deteriorated. In the case of shipments of 3C products such as mobile phones that are difficult to recover quickly, the market situation of LCO in the future market may also be affected to a certain extent.

LMO: LMO price continued to decrease this week. Due to the sluggish demand in 3C market, orders have shrunk significantly, and the competition in LMO market has become fiercer. Many companies have lowered their quotations to secure orders, and the market atmosphere is relatively weak. LMO price continues to be under pressure when short-term demand is unlikely to pick up.

Lithium Carbonate: Lithium carbonate prices fell this week under pressure. Cathode material manufacturers have transmitted to lithium carbonate companies out of cost reduction requirements, and lithium carbonate prices have been forced to follow the downward adjustment.

Anode Material:

Recently, anode material market has undergone a smooth transition, and some manufacturers are still adjusting the product prices. At present, domestic low-end anode material are 21,000-25,000 Yuan/ MT, mid-end anode materials are reported at 35,000-50,000 yuan / ton, and high-end power products are reported 50,000-70,000 yuan / ton. High-end anode installed in 3C products are 60,000-87,000 yuan/MT. The shipments of small and medium-sized manufacturers are in general, some manufacturers' orders are not as good as last month, and the sluggish downstream market has also restrained the growth of the output of head companies. The short-term anode market is expected to continue the current tepid pattern.

Electrolyte:

In April, electrolyte market performance not very good. Not only small and medium-sized manufacturers strived for orders, but large manufacturers began to attack various domestic market segments to gain more shipping opportunities. According to an electrolyte manufacturer, at present, as long as the direct manufacturing cost is not lost, the order will be received, otherwise, after the customer is lost, there may be no order to receive in the future. In the raw material market, the head companies in the solvent market have recently delivered acceptable products. Although the price is willing to increase, it is difficult to continue to rise sharply under the circumstances that the price of the electrolyte is generally lowered and the profitability is weak. The market for lithium hexafluorophosphate remains stable at a low level, but mainstream manufacturers say they expect orders this month to be worse than last month.

Separator:

This week, there is no dominant fluctuation in Chinese separator market, and downstream procurement is temporarily stable. The operating rate of Chinese leading companies is still in the gradual increase stage. Chinese separator industry is concerned about market demand in May. In the long run, with the introduction of the new policy for new energy vehicle subsidies in 2020, it will become a major benefit for the development of the new energy vehicle industry, and it will also drive the long-term demand for lithium battery separators. In terms of corporate dynamics, according to the latest corporate financial report, Sinoma Technology ’s first-quarter profit increased by 11.52% year-on-year, and it has basically achieved a turnaround. The company said that separator production capacity will reach 1.6 billion square meters in 2020. It is expected to rise in volume.

CONTACT US

CONTACT US ICC APP

ICC APP