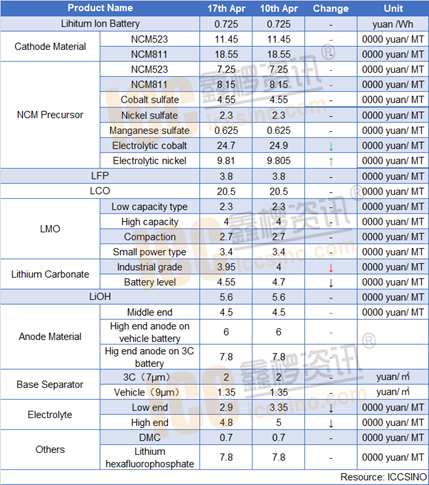

Lithium ion battery:

The lithium battery market was relatively flat. Mainstream companies have many stocks in March, but the actual shipments were lower than expected, which led to high inventories. Production arrangements have decreased since April. However, downstream car consumption has rebounded significantly since the end of March, and it is expected to return to a higher level in April. The stock digestion process of power batteries is expected to come to an end at the end of the month.

Cathode Material:

NCM: Chinese NCM market has not changed much this week. The price of ternary material remained flat compared with last week, and some ternary material companies still dumped goods at low prices in order to recover the money. In terms of downstream demand, due to the impact of overseas epidemics, both power and digital demand have weakened, severely restricting the pace of domestic ternary materials companies to resume work. Therefore, the operating rate of domestic ternary materials has not continued to rise recently.

NCM Precursor: This week's domestic demand for ternary precursors performed generally, as the end-user demand has not recovered. On the export side, due to COVID19 spread in EU and US, which affected the demand of Japanese and South Korean battery companies, the subsequent export of Chinese precursors is at risk of decline. In terms of prices, domestic nickel prices rebounded this week while cobalt prices fluctuated. Nickel sulfate prices seem to have a rebound trend in short term, which has formed a certain support for the price of ternary precursors.

LFP: This week LFP market was stable. After some battery manufacturers cut orders and reduce volume, LFP production was stable now, mainly digesting pre-orders. It is understood that Model 3 installed with LFP will be launched around June, and it is expected that the demand for LFP will increase significantly by May at the latest.

Lithium carbonate: The price of lithium carbonate has been slightly lowered this week. Although the market of ternary materials, lithium iron phosphate and other positive electrode materials has been stable recently, the total market demand is relatively weak. The supply of lithium carbonate market remains high, and the contradiction between supply and demand is difficult to improve in the short term.

Anode Material:

Recently, anode market was good but it's still lower than expectation. Small and medium-sized manufacturers perform weakly. Affected by the poor shipment of downstream battery manufacturers, the repayment situation was poor. In terms of product prices, battery manufacturers began to enter substantive negotiations from mutual testing in April. Chinese small and medium-sized manufacturers basically began to negotiate and implement new order prices in March, and major manufacturers have also begun to take substantial actions this month, especially It is a mid-to-high-end anode material product. Since the end of the year, the prices of needle coke and graphitization foundries at home and abroad have declined, allowing battery manufacturers to cut prices with a big knife. At present, domestic low-end anodes are 21000-25000 yuan/ ton. Mid-end anode materials reported 35000-50000 yuan / ton. High-end power products reported 50000-70000 yuan / ton. High-end 3C products reported 60000-87000 yuan / ton. In the downstream market, the performance of the power battery market is average, the performance of the energy storage market is fair, and the performance of the e-cigarette market is particularly glaring.

Recently, anode market was good but it's still lower than expectation. Small and medium-sized manufacturers perform weakly. Affected by the poor shipment of downstream battery manufacturers, the repayment situation was poor. In terms of product prices, battery manufacturers began to enter substantive negotiations from mutual testing in April. Chinese small and medium-sized manufacturers basically began to negotiate and implement new order prices in March, and major manufacturers have also begun to take substantial actions this month, especially It is a mid-to-high-end anode material product. Since the end of the year, the prices of needle coke and graphitization foundries at home and abroad have declined, allowing battery manufacturers to cut prices with a big knife. At present, domestic low-end anodes are 21000-25000 yuan/ ton. Mid-end anode materials reported 35000-50000 yuan / ton. High-end power products reported 50000-70000 yuan / ton. High-end 3C products reported 60000-87000 yuan / ton. In the downstream market, the performance of the power battery market is average, the performance of the energy storage market is fair, and the performance of the e-cigarette market is particularly glaring.

Electrolyte: Recent electrolyte market was not good. Under the influence of the market demand for power batteries is significantly lower than expected, the digital market slump, shrinking export orders and other factors, the domestic vacant capacity began to impact other market segments, especially the large supply The factories have also begun to perform in the digital, small power, energy storage and other markets. In the raw material market and the solvent market, the recent propylene market has rapidly increased, causing the price of the solvent to increase within a narrow range, with an increase of around 500 yuan / ton. According to a solvent manufacturer, the company's shipments in April were steady and rising, and the supply of DMC and EC was tight. The 6F market remained stable at a low level, and the overall shipment situation did not change much.

Separator: This week, there is no dominant fluctuation in Chinese separator market, the operating rate of the company has slightly increased. Downstream procurement volume is stable, and the focus of market negotiations is temporarily stable. According to ICCSINO, the current capacity utilization rate of domestic head separator companies has basically recovered to about 40%, and some small and medium-sized enterprise production lines have also started to increase slightly. In terms of downstream demand, it is reported that domestic power battery companies have a backlog of inventories. The production schedule in April is not significantly changed from that in March, and there is no increase in the volume of diaphragm purchase orders. According to the latest corporate financial report, Semcorp ’s first-quarter profit fell 25-38% Y-O-Y. Senior Technology ’s first-quarter profit fell 67.19% -80.31% year-on-year. The reason is that the sales volume of the company ’s separator has not reached expectations. The fierce competition in the market has resulted in a drop in product prices, which has affected the company's profitability. The impact of the overseas COVID19 in Chinese separator market has not yet been reflected, but there are still uncertainties in the market from May to June.

CONTACT US

CONTACT US ICC APP

ICC APP