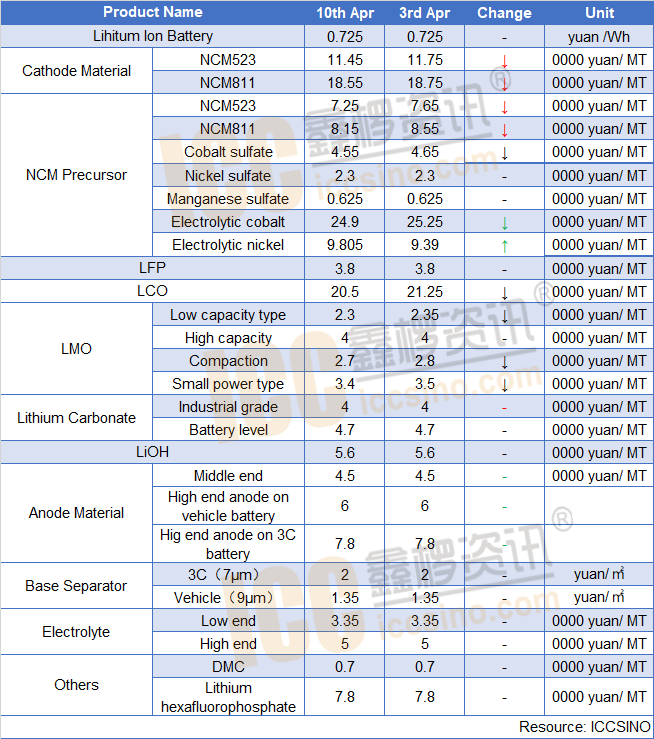

Battery:

Recent demand for vehicle battery market is poor. Judging from the production and sales data of new energy vehicles, decline rate reached 40%, and the degree of recovery was not as expected. Affected by this, in March, power battery companies have seen a markedly high inventory phenomenon, and have recently begun to adjust the operating rate. In addition, in order to reduce battery costs, some car companies have recently tried to transition from 8-series ternary to 5-series ternary. Obviously, the topic of this year's new energy industry will focus on cost reduction.

Cathode Material:

NCM: After entering 2nd quarter, demand of battery is still poor, and Chinese ternary materials industry has been slower in recovery. At present, overseas demand in vehicle battery and 3C market has weakened. Affected by the sluggish demand, many small and medium-sized NCM companies have been shipping poorly recently. Due to financial pressure, they have no choice but to dump the goods at low prices, which has led to the price of some 5 series ternary materials falling below 100K yuan/ MT. In the short term, the overseas epidemic situation is difficult to improve suddenly, and it is expected that NCM market would continue to keep weakening.

NCM Precursor: The price of NCM precursors also showed weakness this week due to the poor downstream performance. However, due to the recent stabilization of the prices of metals such as cobalt and nickel, ternary precursor manufacturers have no intention to continue to lower their quotations and shipments. It is expected that the short-term conventional 523 precursor prices will remain above 70K Yuan/ MT. In terms of cobalt sulfate and nickel sulfate, the recent trend is mainly weak and stable, and the decline is limited, mainly supported by concerns about supply-side contraction. South Africa has extended the closure of the city for two weeks, and the export of raw materials in nickel-producing countries such as Indonesia is also expected to tighten, all of which will support metal prices.

LFP: This week the market has a weakening trend. Recently mainstream battery companies began to cut orders, requiring LFP companies to delay delivery. At present, it is unlikely that LFP would further increase, waiting for the downstream market to recover. The price has remained stable, with mainstream 36,000-40,000 yuan/ MT.

LMO: LMO prices continued to decline this week. Affected by further reduction of overseas orders and domestic demand for small polymers and mobile power supplies, contradiction between supply and demand in the market has become more prominent. Some companies have chosen to lower quotations for more orders. Although the price is close to the cost line, it is still difficult to stabilize in the short term.

Lithium Carbonate: Lithium carbonate prices remained low this week. As the downstream cathode material market such as NCM, LFP and LMO continues to weaken, the demand is further reduced. On the market supply side, although some lithium carbonate plants have resumed operations as expected, the market oversupply is difficult to improve in the short term and prices are temporarily weak.

LCO: Recently, market has performed well, and shipments have increased steadily. Although the price has fallen from the previous period, it can still stabilize at 200K yuan/ MT. The positive performance of the lithium cobalt market is because 3C products such as mobile phones are mostly sold online, so it is less affected by COVID19. The export situation of batteries applied on electronic cigarettes and medical devices has performed well.

Anode material: Since entering April, the overall market situation has not been as expected, and the full outbreak of the overseas epidemic has inevitably impacted the domestic market and is reflected in the expected orders in April, especially the decline in exports to US battery factories. However, the operating rate of domestic battery companies has increased from March, and demand has increased from last month. In terms of product prices, a new round of price tug-of-war started in April. Battery manufacturers are strongly eager to suppress prices, and they generally demand a 5-10% decline. Some anode manufacturers have begun to make price concessions of about 5%. At present, domestic low-end anodes are 21-25,000 tons / ton, mid-end anode materials are reported at 40,000-50,000 yuan / ton, high-end power products are reported at 50,000-70,000 yuan / ton, and high-end digital products are reported at 60,000-90,000 yuan / ton. In the near future, the market will still be a transition period, and domestic market demand is gradually being released. Although this year's market is very uncertain, it still does not hinder the industry's optimism about the new energy industry. It is reported that Hunan Yide New Energy Co., Ltd. plans to build and put into production two anode material production lines in 2020, and the production line is expected to be in April. It can be put into use, mainly in the middle and later stages. Two production lines will be added to the second phase in 2021, and two more lines will be added to the third phase in 2022. After all are completed, the anode material production capacity can reach 30,000 tons.

Electrolyte: Recently, electrolyte market has been performing tepidly. The shipments of small and medium-sized electrolyte manufacturers have rebounded slightly. The main reason is that domestic small and medium-sized battery manufacturers have begun to resume work one after another, and the demand has increased. The increment is limited. In terms of product prices, the current status of domestic electrolyte prices remains stable. The prices of main raw materials remained stable at low levels, the downstream market demand was not ideal, and the prices of electrolytes would naturally not change significantly.

Separator: This week, the domestic diaphragm market continued temporarily. Semcorp said in a conference call recently that the company ’s Q1 separator shipments was 120 million square meters, of which shipments in March were about 50 million square meters, and overseas demand was stable; In April, Semcorp scheduled production of 70 million square meters, and it is expected that domestic orders will increase by 60-70% M-T-M. Overseas orders fell by 20% month-on-month; Affected by the epidemic, some small orders overseas were discontinued, but major orders from Japan and South Korea were shipped normally, and no adjustment notice was received. According to ICCSINO, the current domestic production data of the major separator companies in April is slightly better than that in March. Domestic demand is slowly increasing. There is still uncertainty in overseas demand. The industry is cautiously optimistic about the market outlook.

CONTACT US

CONTACT US ICC APP

ICC APP