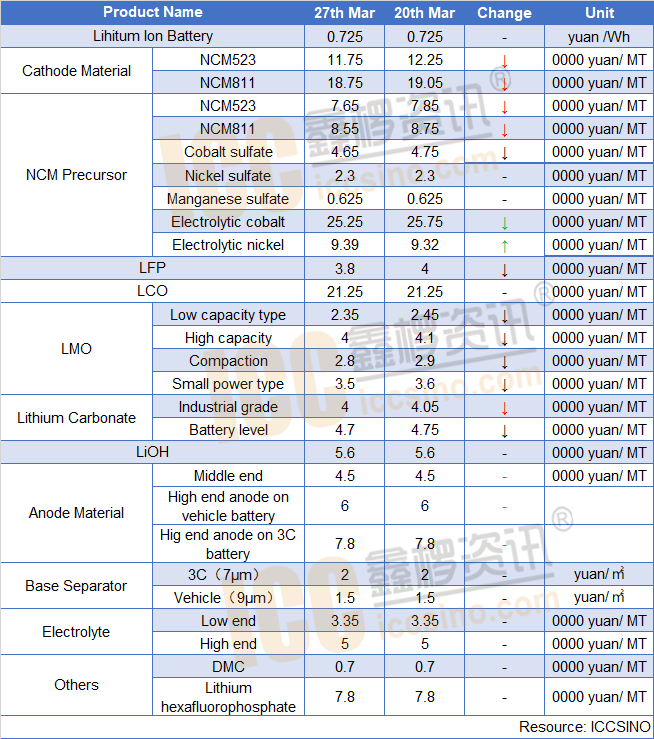

Lithium Ion Battery

Lithium ion battery market demand has not changed much and remains weak. Compared with past few years, it would continue until June, which is the peak season for 3C batteries, and there has been no obvious recovery so far this year. At present, companies are more worried that the impact of COVID19 will continue until in H2 2020. In terms of power batteries, the demand for LFP batteries is better than NCM batteries, and it is expected to remain a recovery in April.

Cathode Material

NCM: affected by the lower-than-expected downstream demand, the price of domestic ternary cathode materials this week has fallen compared with last week, and the prices of 3Cl NCM523 materials are particularly cheap. According to ICCSINO, this is mainly affected by poor foreign trade demand. Some NCM materials in China are applied in small power and low-end 3C battery, and then exported to India, Southeast Asia and other regions. The recent epidemic situation in these areas has become increasingly serious. For example, India has announced that it has closed the country for 21 days, and many electronic products exported from China to India cannot be sold normally, which has greatly affected the production of domestic small lithium battery companies. The order of digital ternary materials has also been greatly affected.

NCM Precursor: Prices are also weak, but the decline is limited because of limited decline in the prices of upstream raw materials such as cobalt sulfate and nickel sulfate.

LFP: Lithium materials are relatively stable. Although the production volume of mainstream companies in March was lower than the expected value by about 20%. From the enterprise planning, it still increased compared with March. In terms of price, although the raw materials were relatively stable, with the increase in ESS demand, the average price of LFP is still lower, and the mainstream price is currently reported 36000-40000 yuan/MT

LMO: This week, LMO price decreased slightly. At the end of the month, according to statistics, the production of LMO enterprises in March recovered gradually, and the supply of lithium manganate market basically stabilized. On the downstream side, consumer battery markets such as charging battery have significantly reduced demand due to epidemic factors. Export orders for various types of batteries and finished products have begun to decrease, and short-term recovery is weakening.

Lithium Carbonate: The start of the lithium salt plant has gradually resumed. The tight supply of industrial grade lithium carbonate in Jiangxi has basically eased, and the supply of battery grade lithium carbonate continues to stabilize. In terms of downstream demand, domestic power batteries, consumer batteries and other demand have not improved significantly. Orders in the overseas terminal market have further shrunk, and the overall situation is still showing a weak trend.

LCO: Recently, the overall demand of LCO market has performed relatively well, and the downstream demand is acceptable. Some manufacturers said that LCO production scheduling is expected to improve in April, because the orders of downstream battery factories are still increasing. In terms of cobalt tetroxide, the recent transaction situation is relatively good, but the price trend is weak. The market transaction price has fallen below 180,000 yuan/ ton, and there may still be some room for decline in the short term.

Anode Material:

In March, Chinese domestic anode material market recovered significantly from last month, especially the increase in the output of Tier 1 and Tier 2 enterprises. According to ICCSINO, the output of leading enterprises, M-T-M up 69% and Y-O-Y 27%. In terms of product prices, the new unit prices of anode material manufacturers in March did not fully land. Some manufacturers are still adjusting their price. It is expected that the new prices will be implemented in April; Some manufacturers will begin to make profits this month. The decline was around 5%. In March, the overall operating rate of the domestic lithium battery market was around 50%, but it was significantly higher than in February. Therefore, domestic anode material manufacturers' shipments also generally increased, especially domestic leading companies, with an increase of more than 40%. With the outbreak of overseas epidemics in full, Tesla's plant stopped production for 2 weeks, and the successive shutdowns of LG, Samsung, and Panasonic plants in the U.S. also gradually transmitted to the domestic anode material market. The shipment volume of anode manufacturers in the supply chain of art battery plants was earlier than the beginning of the month A certain amount of decline is expected. In April, it is expected that the domestic market demand will still show a steady upward trend, but overseas markets, especially the US market, will be directly affected, and the European market is uncertain.

Electrolyte:

Recently, the electrolyte market is steadily improving, and most manufacturers believe that the domestic market will be better in April than in March. European and American markets has been fully affected by the outbreak, which will have a certain impact on the export of domestic electrolyte companies. In terms of prices, the current domestic electrolyte prices are hovering at a low level, and continued downward space is hindered. In the raw material market, the recent shipments of the solvent market are acceptable, and the price position is stable. The mainstream DMC report is 6500-7500 yuan / ton, the EMC report is 118,000 yuan / ton, and the DCE price is12,000 yuan / ton. The market of lithium hexafluorophosphate was mediocre, and only a few manufacturers performed well. The shipments, mainly small and medium electrolyte manufacturers, were not optimistic. In terms of price, it has maintained a stable position. It is currently reported to be around 75,000 to 80,000 yuan /MT, and is reported to be 105,000 yuan /MT.

Separator:

This week, domestic separator market continued steady. Affected by the plunge of international crude oil, the prices of upstream raw materials PP / PE have declined, and the cost of separator has fallen. The enthusiasm of separator companies to start construction is acceptable, and the overall construction has slightly increased. It is reported that the production of LG, CATL and BYD has not been affected by the epidemic, and there is no adjustment to the separator procurement plan. Overall, the downstream battery companies' demand for separators is temporarily stable. ICCSINO estimates that battery separator market will continue to maintain stable in the short term. In the long run, the construction of 5G base stations is accelerating in 2020, and various energy storage projects have been launched in various places. The industry has indicated that lithium iron phosphate batteries will usher in a new dividend period, and the cost advantages of dry separators are greater, which has promoted the dry The demand of the French diaphragm market, the dry process separator market may usher in a development opportunity 2020.

CONTACT US

CONTACT US ICC APP

ICC APP