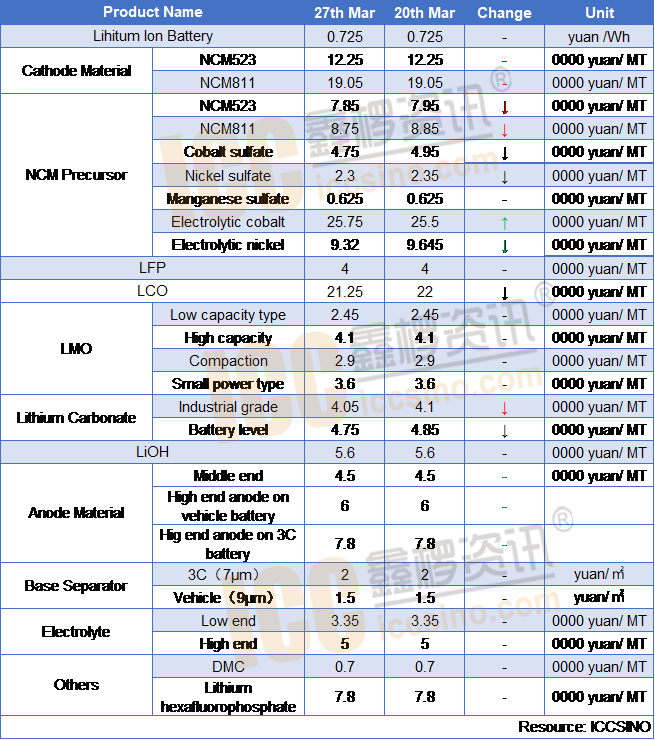

Lithium ion battery:

Recently the battery industry is still weak. Epidemics abroad have intensified and Guangdong's foreign trade business has been affected. The impact is expected to begin in April. At the same time, although the domestic epidemic situation has basically ended, the demand side has not completely started up. The second quarter of previous years was the peak season for digital batteries. In terms of energy storage, an iron-lithium energy storage company stated that demand was good and production arrangements were full. In terms of power batteries, mainstream manufacturers have maintained about half the operating rate, which is lower than expected at the beginning of the month.

Cathode material:

Ternary materials: The overall price of domestic ternary cathode materials this week was weak and stable, and did not continue last week's decline. However, as far as downstream demand is concerned, the overall market performance is still significantly poorer than expected at the beginning of the month. At present, the performance of power ternary materials is not satisfactory. Although the demand for digital ternary materials is relatively good, competition is fierce and profit margins are limited. In addition, the continued expansion of the overseas epidemic situation has led to the suspension of overseas car companies and battery factories, which has also damaged the export expectations of ternary materials. In the case of poor domestic demand and export expectations, domestic ternary materials companies are cautious in restarting production and are not willing to purchase precursors and other raw materials.

Ternary precursors: Although the price of domestic cobalt nickel prices gradually stabilized this week, due to the weak downstream demand, domestic prices of cobalt sulfate and nickel sulfate continued to decline this week. Affected by this, the domestic ternary precursor prices also showed a decline this week. For the time being, it is difficult for the downstream demand to pick up suddenly. It is expected that the short-term ternary precursor prices will continue to be weak.

LFP: Lithium iron phosphate has not changed much this week. Although the demand in March was lower than expected, it is still in a recovery state compared to February, and it is expected to improve in April. Compared to other materials, lithium iron phosphate is more used in the B-side, and is mainly sold domestically. The impact of the epidemic is relatively small. In addition, 5G energy storage is expected to explode this year, so the industry's confidence is still not overly pessimistic. .

LMO: The supply of lithium manganate market is basically stable this week. However, in terms of downstream demand, according to Xinyi, some downstream battery cells and finished products have been exported to India, Europe and the United States and other markets. Due to the impact of the epidemic, the order reduction has begun to be reflected in the lithium manganate market. It is expected that manganese in April Downstream demand for lithium acid has shrunk, and market competition has become more intense. It does not rule out that some companies will cut prices in order to compete for orders.

Lithium carbonate: The price of lithium carbonate continued to be weak this week. From the perspective of market supply, the shortage of industrial-grade lithium carbonate in Jiangxi has eased, and there is sufficient supply in Qinghai. It is difficult for the market to support the price; the supply of battery-grade lithium carbonate is stable. In terms of downstream demand, due to the relatively weak market demand for ternary materials and lithium cobaltate, the market atmosphere of battery-grade lithium carbonate is still weak.

Anode material:

Recently, the performance of the anode material market has been satisfactory. Most manufacturers have basically the same shipment expectations as the beginning of the month, and they have shown an overall upward trend. However, there are also gaps between individual manufacturers and the gap between reality and ideal. Overall, the recovery of the digital market in the downstream market is not as good as expected. The largest leader in the power battery market is still in the nest. Although the energy storage market is the biggest hot spot in the recent market, it still takes time for the demand to be realized. Other segments There are also outstanding performances, but they have limited impact on the entire lithium battery market. And with the outbreak of overseas epidemics in full, Tesla's plant stopped production for 2 weeks, and the successive shutdowns of LG, Samsung, and Panasonic plants in the United States will be gradually transmitted to the domestic anode material market, which will break the original psychological expectations of domestic manufacturers: April There will be a full recovery and a climbing trend. Therefore, it is difficult for most domestic anode material manufacturers to make a turn in April. In terms of product prices, the new unit prices of anode material manufacturers in March did not fully land. Some manufacturers are still pricing the previous year and are currently at the stage of negotiating new unit prices. Some manufacturers have started to make profits, and the price has dropped by about 5%.

Electrolyte:

The performance of the electrolyte market has been mixed recently. Almost no manufacturers started in February and their orders have basically recovered to 60% to 70%. The performance of major mainstream manufacturers this month is still satisfactory, especially in terms of export growth, but with the overseas epidemic situation It is expected that both the end market and the material manufacturers will have different degrees of impact in April. The price of products is basically stable. At present, the prices of raw materials lithium hexafluorophosphate and solvents are relatively low. The price of some electrolyte products with serious homogenization will continue to be very limited. The sluggish demand in the downstream market and the overall outbreak in the overseas market have greatly affected market confidence. The goal of some manufacturers this year is to: survive!

Separator:

This week, the domestic diaphragm market is temporarily stable and leading enterprises are operating at full capacity, but some separator companies still have difficulty in releasing their output. Affected by the spread of the global epidemic, some downstream customers of some diaphragm companies have been affected. It is reported that a diaphragm company can only start half of its production capacity. The industry view of the diaphragm market in April is different, but in the long run, the industry has high expectations for the development of the diaphragm. According to Enjie's calculations, by 2025, the company's major customers expect the overall lithium battery production capacity to exceed 544GWh. Enjie has increased its capital by 5 billion to expand the Jiangxi and Wuxi diaphragm projects to match the major future expansion plans of major downstream customers. After the project is completed, the Wuxi base is expected to add an annual output of 520 million square meters of lithium battery separator base film and an annual output of 300 million square meters of lithium battery coating film; the Jiangxi base is expected to add 400 million square meters of lithium battery separator annual capacity. The total production capacity can reach 920 million square meters.

CONTACT US

CONTACT US ICC APP

ICC APP