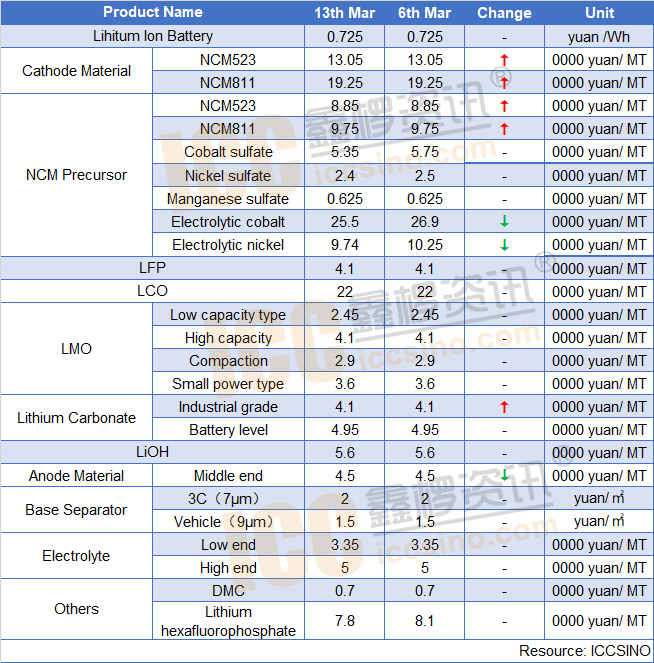

LIB: This week the leading battery enterprise has completely resumed production and expanded operations. LFP operation is expected to be better than that of NCM, and the demand for high nickel and digital batteries is better. Overall, the industry is expected to recover to 70% -80% of normal levels in March

Cathode material:

NCM & NCA: Chinese domestic NCM & NCA market is warming up in March. Some ternary materials companies have stated that they have received orders from some downstream customers. It is expected that companies will gradually resume normal operations around the end of March. In terms of specific models, the shipments of high-nickel ternary materials and digital ternary materials are relatively good, while the shipments of power-type ternary materials are slightly worse. In terms of prices, domestic ternary material prices have remained stable this week, but given the recent weak performance of upstream raw material prices, it is expected that the market price will have some room for decline.

NCM & NCA Precursor: The quotation of the Ternary Precursor has not changed much this week, and there are not many transactions, and the downstream market price is bearish. In terms of raw materials, due to the recent plunge of cobalt nickel metal prices, the prices of cobalt sulfate and nickel sulfate both fell this week, and the actual market price was much lower than the quoted price. It is expected that the short-term sulfate price will not stop falling quickly, and the market outlook may drag down. Precursor prices are down.

LFP: Lithium iron phosphate production is on track this week, and the epidemic situation in Hubei has gradually dissipated. When subway lithium production enterprises have also begun to resume work. The price is affected by lithium carbonate, and the company's willingness to keep the price is relatively strong, without major changes.

LMO: It is understood that since March, the operating rate of lithium manganate enterprises has significantly increased, and the market supply has basically returned to normal. In terms of downstream demand, some companies reported that the operating rate of downstream battery companies has recovered approximately 70% to 80%, and battery plant purchase orders in Guangdong and Henan have increased significantly. Although logistics has not fully recovered, market activity has increased significantly.

Lithium Carbonate: Lithium salt prices remain stable this week. Since March, with the resumption of ternary materials, lithium iron phosphate and other cathode material plants gradually improving, the purchase of industrial grade lithium carbonate has increased significantly. The supply of industrial grade lithium carbonate in Jiangxi has been tight, and the offer has been relatively strong. Some ternary materials and lithium cobaltate companies have not resumed work as expected, and the market transaction atmosphere is relatively weak.

Anode material:

Recently, the operating rate of the anode material market has increased significantly. It is expected that the operating rate of the anode material market will reach about 80% this month. Product prices are generally still implemented before the holiday, but some early quotations are high, and the price of conventional products with severe homogeneity fell by about 5%. The procurement plan for downstream battery plants this month has generally improved compared to February, and the number of start-up companies has also increased significantly. The current overseas epidemic outbreak, but the export orders of domestic anode manufacturers in March still showed a steady and rising state. The increase in the price of raw coke has begun to come into effect. The anode manufacturers mainly rely on their own digestion, and also increase the bargaining rate for the negotiation of new unit prices. In short, the overall outlook for negative electrode output in March is more optimistic.

Electrolyte:

The recent start-up situation of electrolyte manufacturers is obviously good. From the current order volume of each company, it has basically recovered to 60% -70% of the average monthly level last year. It is expected that the output will rise significantly this month. Electrolyte prices have not changed much this week. The raw material market has remained stable at a low level, and the operating rate of solvents has also increased. Now domestic battery-level DMC reports about 70,000 yuan / ton, DEC reports about 125,000 yuan / ton, and EMC reports about 12,000 yuan / ton. Except for China Blue Hongyuan Pharmaceutical, mainstream manufacturers of lithium hexafluorophosphate have resumed production, but they are generally not full. Product prices have not changed much. The mainstream price is 75,000-9 thousand yuan / ton, and some are lower than 70,000 yuan / ton.

CONTACT US

CONTACT US ICC APP

ICC APP