Lithium ion battery:

According to the mainstream battery companies' production schedule, starting from mid-March, there will be a high recovery in overall production. Some companies such as BYD have significantly higher production schedules due to replenishment. According to feedback from enterprises in Hubei, it is expected that Wuhan, Hubei, Africa will start to resume work gradually after March 10, and the impact of the epidemic will be significantly reduced. In addition to the automotive sector, this year's energy storage sector is favored by major battery factories, and demand is gearing up.

Cathode:

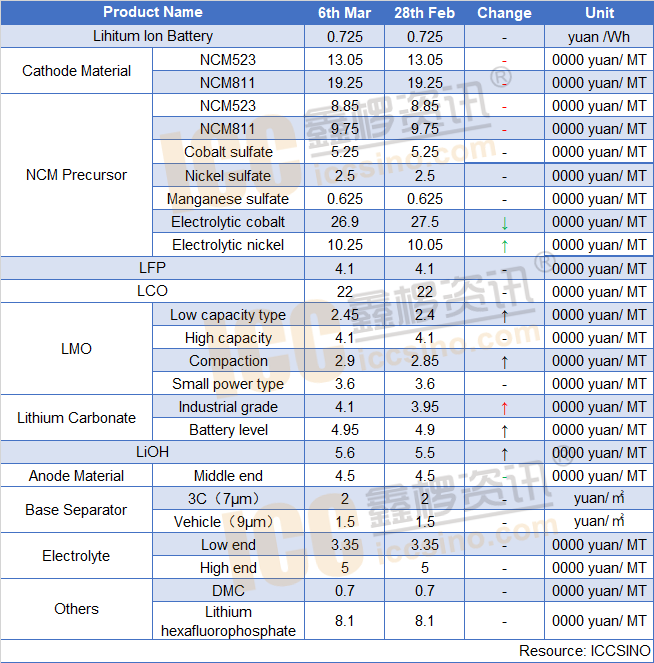

NCM & NCA: This week, the ternary material market has returned to stability. The mainstream prices have remained stable compared to last week. In terms of downstream demand, some battery factories have returned to the sidelines after replenishment in small quantities, which has weakened market transactions again. On the whole, the demand side of the digital market is in an orderly recovery process, and the demand side of the power market is not performing well. Only some leading companies such as CATL resumed production well.

NCM & NCA Precursor: Chinese domestic ternary precursor prices this week were stable compared to last week

LFP: Recent production starts have continued to improve. As the actual start of mainstream enterprises in February is only about a week, March production is expected to be significantly better than February. However, demand for downstream battery plants has not recovered as expected, and overall output in March is expected to reach 50% of its peak.

LMO: LMO manufacturers this week have resumed production this week, but affected by orders and not all personnel in place, the operating rate is 50-60%. Due to poor start-up conditions and lower-than-expected demand, most companies mainly deliver orders before the year, and lithium manganate companies mostly digest year-old inventory. In terms of price, due to the increase in the price of raw materials lithium carbonate, logistics has not been fully restored. Although high-speed tolls are free of charge, it is also affected by the resumption of personnel.

Lithium carbonate: The price of lithium carbonate has risen this week. The price of battery-level lithium carbonate is mainly driven by the price of industrial-grade lithium carbonate, and the offer price has been raised. In terms of supply, Jiangxi Industrial Grade Lithium Carbonate is mainly due to the late resumption of work. In the early stage, the inventory was mainly digested. At present, the inventory is low. In addition to the impact of logistics, product quotations have been increased. . In terms of demand, cathode materials companies are gradually recovering. The market sentiment has improved significantly this week compared to February. It is expected that the market will recover to about 70-80% in mid-late March.

Anode material:

Recently, the pace of resumption of the lithium battery anode material market has accelerated, and the operating rate of enterprises has increased. The operating rates of key anode manufacturers are expected to exceed 60% this month. Small factories have also begun to resume work. Head battery manufacturers are expected to increase their purchases this month. There are varying degrees of growth. In terms of product prices, most manufacturers still order directly before the holiday, and the price has not yet fluctuated significantly. At present, the mainstream of domestic low-end anode materials is reported at 21,000-26,000 yuan / ton, and the mainstream of mid-range products is reported at 42-55 thousand yuan / ton. Product mainstream reported 70,000-90,000 yuan / ton. This week's raw material market is still non-stop, low-sulfur coke manufacturers' listing prices have risen, and traders are still feeling strong prices; needle-shaped coke Jinzhou Petrochemical raised 500 yuan / ton this week.

Electrolyte:

Recently, the operating rate of electrolyte manufacturers has continued to rise, and some companies that have not started in February have resumed work this month. There has not been any significant fluctuation in product prices, and most of the new order prices have implemented pre-holiday prices. In terms of shipments, driven by the increase in operating rates of leading companies this month, in the raw material market of some manufacturers, there is ample supply in the solvent market. Although the price of PO has risen, it is difficult to increase the price of solvents. The current operating rate of electrolyte manufacturers is not comprehensive It is restored, and the inventory is fully stocked at a low price before the holiday. The current DMC mainstream is about 7,000 yuan / ton. The operating rate of the lithium hexafluorophosphate market is also increasing. The mainstream manufacturers, have already started construction, and the price has maintained the pre-holiday level.

Separator:

This week, the production of domestic separator companies has gradually returned to normal, and the production lines of leading companies such as Semcorp, Sinoma have basically reached full production levels. According to a company, downstream orders have increased significantly. Although the production line is full, some urgent orders cannot be delivered in advance. It is reported that Hubei is expected to resume work around March 10, and the impact of the epidemic is expected to start to decrease significantly in the middle of the year, and most of it will be restored in the latter part of the year. It is expected that the domestic diaphragm production increased significantly in March.

CONTACT US

CONTACT US ICC APP

ICC APP