Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium battery:

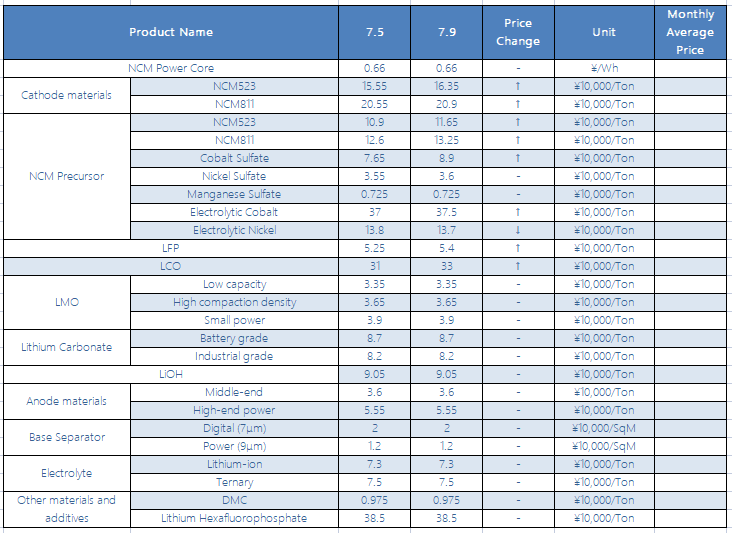

The sales volume of new energy vehicles in the first half of the year was 1.103 million, an increase of 774,000 vehicles or 234.9% compared with the same period last year; and an increase of 473,000 vehicles or 74.9% compared with the first half of 2019, a record high. Recently, the battery has maintained a high level, and the newly added production capacity of the head company has continued to rise. What can be seen is that the head battery factory has a very good interim report; but the domestic PMI data has been declining for 4 consecutive months. Beware of the lack of peak season; the demand for the traditional peak season isn't optimistic.

Lithium iron phosphate (LFP):

With the overall stability of the yellow phosphorous market, the front-end raw material iron phosphate production capacity has tightened and the price has increased, driving the price of lithium iron phosphate transactions of mainstream process companies to rise. At this stage, the leading enterprises of lithium iron phosphate maintain full production operation, and the downstream market is in short supply. According to the latest statistics, the output of lithium iron phosphate reached a new high in June. However, the pace of expansion of iron phosphate is slow, and the impact of environmental protection policies is superimposed on the supply and demand of the two in the future. The gap may gradually expand, and the market is bullish; the energy storage market is temporarily maintaining stable operation. In terms of price, the current mainstream power lithium iron phosphate quotation is between 52,000 and 56,000 yuan/ton, an increase of 15,000 yuan/ton from the same period last week.

Ternary Material:

This week, the domestic ternary material market rose, the front-end raw material market fluctuated, and the trend of higher ternary prices for different models varied. From a market perspective, the low-medium nickel ternary is affected by the rise in cobalt prices, and the cost has risen significantly; high nickel's dependence on cobalt is weak, but the price of lithium hydroxide continues to be high, and the downstream bullish sentiment is growing, and the external quotations of high nickel materials are corresponding Adjustment. According to the latest statistics, the increase in ternary output in June is mainly due to the high volume of high nickel, and downstream demand will increase significantly around the fourth quarter. In terms of price, the current price of nickel 55 type ternary material is between 155,000-160,000/ton, an increase of 5 million/ton from the same period last week; the price of NCM523 digital ternary material is between 160,000-165,000/ton, which is higher The price of NCM811 ternary materials was between 206,000 and 212,000 per ton, which was an increase of 3,500 per ton over the same period last week.

NCM Precursor:

The price of nickel and cobalt metal at the raw material end fluctuated higher this week, and the price of precursor products adjusted accordingly. Recently, Indonesia's epidemic has intensified, and the Southeast Asian nickel ore supply side market has been disturbed again; domestic cobalt prices continued to rebound this week. Digital consumer demand is expected to have a positive stimulus to the market, and the focus of cobalt product transactions continues to rise. Under the pressure of cost, the precursor manufacturers are not willing to make profit, and the bulk orders are limited, and more long-term customers are supplied. In terms of price, the quotations of conventional type 523 ternary precursors this week are between 114-119 thousand/ton, an increase of 75 thousand/ton from the same period last week; the quotation of cobalt sulfate is between 80-86 thousand/ton, compared with the same period last week. Increased by 6,500/ton; nickel sulfate was quoted between 35,000 and 37,000/ton, an increase of 5,000/ton from the same period last week; manganese sulfate was quoted between 7000-7500/ton.

Lithium manganese oxide:

Recently, the lithium manganese oxide market has been weak due to the sharp drop in demand for digital batteries. Large digital battery manufacturers have reduced production significantly, and many small factories have even stopped production, causing some lithium manganese oxide manufacturers that mainly supply digital battery factories to follow a decline in output. Due to reduced demand, shipments are difficult. Although external quotations are temporarily stabilized, it is not ruled out that some companies sell at low prices in order to win orders.

Recently, the anode material market has undergone a smooth transition, and large factories have continued to reach full capacity, and they are weak in demand for new orders. At present, the industry's graphitization resources appear to be concentrated in the head, and it is difficult for small and medium-sized anode material manufacturers to grab foundry resources. In addition, due to the off-season of the digital market, demand in some low-end markets has shrunk, which is not good news for the main consumer market. In addition, some manufacturers are affected by the continued tight supply of negative electrodes and the continuous rise of graphitization prices. The increase is more obvious, and some manufacturers are expected to increase.

Electrolyte:

This week’s electrolyte price is about 100,000 yuan for the new power ternary order; lithium iron phosphate electrolyte is about 90,000 yuan, and the price of the electrolyte rises with the price of lithium hexafluorophosphate; the current price of LiPF6 is about 400,000 yuan, and the price of solvent Weekly prices have not changed much, and market estimates are still tight. In terms of VC, Yongtai Technology is expected to start production in September; however, the tension of electrolyte this year is difficult to alleviate. There are long orders based on long orders, and none can only be ordered. According to the quotation after the purchase; as the production capacity of the head battery factory climbs, the market supply will give priority to satisfying the large customers; the second and third-tier companies cannot accept the price and cannot get the raw materials.

Separators:

In July, with the successive commissioning of new production capacity of various battery factories, orders for diaphragms increased significantly compared with June, and the production schedules of major diaphragm companies increased to varying degrees in July. In terms of prices, the prices of large diaphragm orders remained stable, and some small and medium-sized orders experienced price increases. In order to meet the strong demand of downstream battery factories, various diaphragm companies are actively expanding production. It is expected that the diaphragm market will continue to maintain a tight balance between supply and demand in the second half of the year. Putailai announced that it intends to establish a wholly-owned subsidiary to invest in the construction of diaphragm coating production and lithium battery equipment projects. The planned total investment is about 5.2 billion yuan. The project includes an annual output of 4 billion square meters of diaphragm coating production base and lithium battery automation equipment manufacturing base.