Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

Over the past four months, overseas battery demand has increased significantly, while domestic progress in replacing ternary iron and lithium is continuing, and the battery industry has also been clearly subdivided: high-end and low-end products are selling well, while mid-end products are selling well.

Lithium iron phosphate (LFP):

The lithium iron phosphate market continues to perform well. At present, low-priced iron-lithium resources are gradually withdrawing from the market. The mainstream quotation of power has been raised to above 50,000, and the quotation of major manufacturers has even reached 55,000/ton. The overall price range has moved up significantly, and the industry has returned to normal profitability. According to the current production and sales situation, the annual output of iron-lithium is expected to hit 350,000 tons, a growth rate exceeding expectations.

NCM Material:

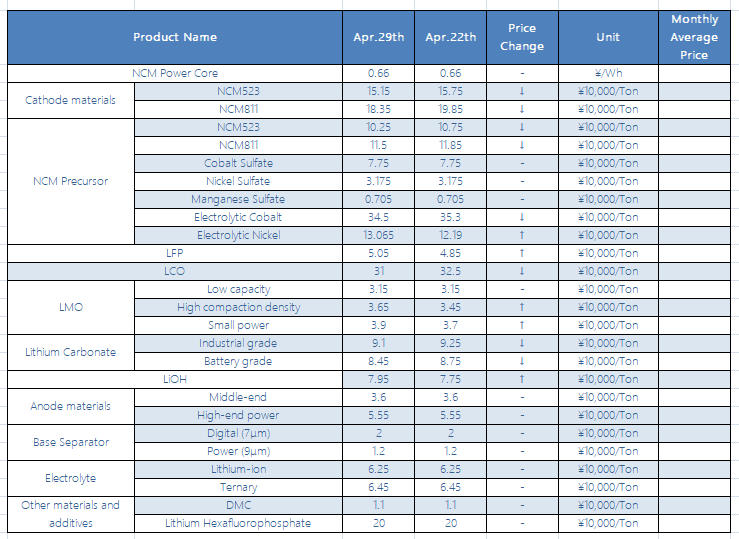

Except for some models, the domestic ternary material prices have slightly decreased this week, and the overall changes have been relatively small. From a market perspective, the focus of ternary materials tends to be the power market. The mainstream production companies are basically operating at full production, the order volume is saturated, and the bulk order shipment situation is improving when the long-term order is guaranteed, while the market conditions of small power and digital consumer products are relatively weak. Therefore, it is expected that stability will prevail in the short term. In terms of price, the current nickel 55 type ternary material is reported to be between 145,000 and 150,000/ton, a decrease of 2 million/ton from the same period last week, and the NCM523 digital ternary material is reported to be between 1.5-155,000/ton. In the same period last week, it fell by 2 million yuan/ton, and NCM811 ternary materials reported between 190,000 and 199,000 yuan/ton, a decrease of 4 million yuan/ton from the same period last week.

NCM Precursor:

This week, the domestic ternary precursors were affected by the previous price pullbacks of raw materials, and all models fell slightly from last week, and some models fell below 100,000 yuan/ton. From the market point of view, on the one hand, compared with raw materials, the downstream end has a lagging response to price adjustments. Although the domestic inventory of nickel has declined this week and the rebound in external demand has rebounded, 1# electrolytic nickel has increased by nearly 9,000 yuan/ton, but the price trend is still unclear at this stage, and the market wait-and-see sentiment dominates in the short term. On the other hand, in the case of competing lithium iron phosphate splitting up the market share, the advantage of digital ternary materials in the consumer market has weakened, and the shipment of its precursors has also been affected. In terms of prices, this week’s conventional 523-type ternary precursors reported between 100-105 thousand/ton, a decrease of 5,000 yuan/ton from the same period last week, the price of cobalt sulfate reported between 75-80 thousand/ton, nickel sulfate reported to be between 3.1-3.25 million/ton, manganese sulfate reported between 0.68-0.73 million/ton.

In April, the price of anode material finally ushered in the stagnation of the purchase price of major manufacturers. Although the increase was not large and could not fully transmit the pressure brought by the price increase of raw materials and graphitization, it was better than nothing. Graphitization production capacity is still a hot spot in the anode market, and the short-term problems are difficult to solve. Major factories who want to increase must use eighteen martial arts to grab single graphitization production capacity. Enterprises with high graphitization self-proportioning rate are at this stage. In the short term, it is expected that the supply of anode materials will remain tight in May, the shortage of graphitization is difficult to alleviate, and the prices of raw materials will continue to be high.

Electrolyte:

Recently, the electrolyte market has continued to improve, and the price has remained stable at a high level. After the price of lithium hexafluorophosphate has been raised by major manufacturers, the overall transaction center of the market has shifted upwards, and the current market is reported to be 230,000-280,000 yuan/ton. Solvent prices remain stable, and the supply side fluctuates little. In general, electrolyte is still a relatively scarce material in the current market, and the price continues to be high.

Separators:

This week, the domestic diaphragm market performed stably, the head diaphragm companies continued to operate at full capacity, and the downstream demand situation was improving. CATL recently announced that it intends to jointly fund two joint ventures with ATL to engage in the R&D, production, sales and after-sales service of medium-sized batteries used in household energy storage and electric two-wheeled vehicles, as well as energy storage and electric two-wheeled vehicles. Strong demand will drive the shipment of dry process diaphragms to increase significantly.