Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

The battery industry has recently entered a sensitive period. The built-in digital battery is affected by the cost, and some small battery factories take orders on demand, resulting in a slow production season. Instead, the performance of new energy vehicles in the first quarter is eye-catching, but the continued strong demand still needs to be observed. The quarterly auto market has decreased in the off-season. The market outlook needs to be cautious while optimistic.

Lithium iron phosphate (LFP):

The lithium iron phosphate industry is operating steadily, and some companies have successively launched new production capacity, and production is in a small increase. At present, both the price and production of iron and lithium have entered a stable period. Compared with last year, it can be clearly seen that the gross profit of the company has increased, and the profit this year is relatively guaranteed.

NCM Material:

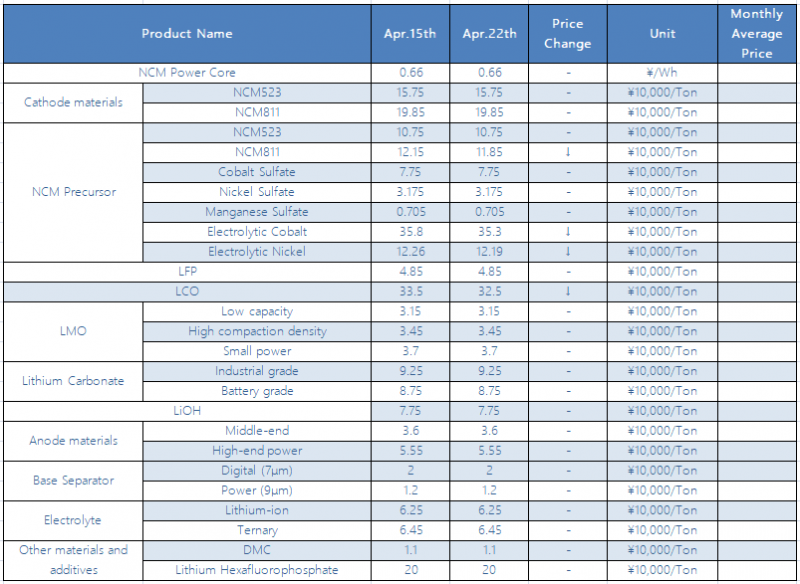

The price trend of domestic ternary materials was relatively stable this week. Compared with the price correction of ternary precursors, the price of ternary precursors was weaker. Only some power-type ternary materials declined slightly, with a range of about 5 million yuan/ton. From a market perspective, the weak price of raw materials has not changed. Affected by this, the current situation of bulk order negotiation and long-term delivery of power-type ternary materials will continue for a certain period of time in the future, and digital ternary materials The weak demand for materials will continue its sluggish market atmosphere. In terms of price, the current nickel 55 type ternary material is reported to be between 147 to 152 thousand per ton, the NCM523 digital ternary material is reported to be between 152 to 157 thousand per ton, and the NCM811 ternary material is reported to be between 196,000 to 201,000 per ton.

NCM Precursor:

This week, the domestic ternary precursor price maintained a slight downward trend due to the continuous decline in the price of raw materials, and the general quotation fell in the range of 100,000 to 120,000 yuan/ton. However, from a market perspective, the decline in the price of ternary precursors did not inject too much impetus into the shipment transaction: On the one hand, some downstream companies, except for rigid demand, are not willing to purchase, and maintain a wait-and-see attitude in the current downward price trend. On the other hand, the market share of lithium iron phosphate for power batteries will affect the shipment of ternary precursor materials to a certain extent. In terms of prices, this week’s conventional 523-type ternary precursors reported between 10.6-109,000/ton, cobalt sulfate reported between 75-78 thousand/ton, nickel sulfate reported between 3.1-322,500/ton, and sulfuric acid manganese reported between 0.68-0.73 million/ton.

Recently, mainstream manufacturers of anode materials have continued to be at full production, and the entire industry is thriving. Since the fourth quarter of 2020, the output of lithium battery anode materials has continued to show a strong momentum. According to statistics from ICC SINO, the domestic anode material output in the first quarter was 143,000 tons, an increase of 156.7% year-on-year. It is expected that the current state will continue in the second quarter. In terms of raw materials, the market continued last week. Low-sulfur coke remained strong. The price may not change significantly until the maintenance of Fushun and Dagang is completed. The overall price of needle coke has reached a new level compared with the previous year. In the case of high raw material prices Under the circumstances, some needle coke manufacturers are still hovering at the profit and loss line, and their production enthusiasm is not high. This is also an important reason why the price of needle coke continues to rise proudly this year. The substantial increase in cost caused a narrow increase in the price of anode materials in large factories in the second quarter, and the increase in some low-profit products was even more pronounced. On the whole, it is expected that the production and sales of anode materials will continue to be high in April, but the growth rate will be limited, and some small and medium-sized manufacturers will even reduce production due to insufficient graphitization.

Electrolyte:

The biggest hot spot in the electrolyte market this week is still raw materials. One more price increase announcement from Polyfluoride once again detonated the price of lithium hexafluorophosphate. In March, the mainstream domestic price of lithium hexafluorophosphate was around 200,000 yuan/ton. In April, some old customers of small factories sold prices. At 22-23 million yuan/ton, the new order price is around 250,000 yuan/ton. The transaction price of lithium hexafluorophosphate was pushed up again in April. However, due to insufficient supply of additives, it is difficult for electrolyte output to increase significantly in the short term. The current high electrolyte prices also provide support for the price increase of raw materials. In the short term, electrolyte is still one of the short-term raw materials for cell manufacturers, and the price will continue to rise, and the output will increase in a narrow range.

Separators:

This week, the domestic separator market has not changed much. The head separator companies continue to operate at full production. Judging from the production schedule of various diaphragm companies in April, except SEMCORP has a certain increase, other separator companies have production in April. The situation is basically the same as in March. In terms of prices, although the separator market is expected to increase prices, small and medium-sized separator companies have weak pricing power. The leading separator companies have no plans to adjust prices. Sinoma Technology recently announced that it achieved revenue of 3.941 billion yuan in the first quarter, a year-on-year increase of 36.40%; net profit attributable to parent companies was 581 million yuan, a year-on-year increase of 140.02%; leading industries such as wind power blades, glass fiber, and lithium battery separator are operating well, with production and sales volume And profitability have been greatly improved.