Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

lithium battery:

Little changes in battery cell companies. It is reported that although the price of power batteries has not risen, it has received more preferential measures in other aspects such as business conditions with automakers, which indirectly increased the price and slightly eased the pressure on raw materials. CIBF2021 was officially launched in Shenzhen this week, and the scale of exhibitors and exhibitions has reached a new high, reflecting the high prosperity of the industry.

Lithium iron phosphate (LFP):

The production and sales of lithium iron phosphate are booming, and the transaction price of the power type is about 50,000/ton. Recently, new production capacity has been released one after another, yet still short in supply. According to statistics from ICCSINO, the output of iron and lithium in February exceeded 20,000 tons, and the annual output is expected to hit 300,000 tons. The year-on-year growth rate is expected to exceed 100%, and the prosperity is relatively high.

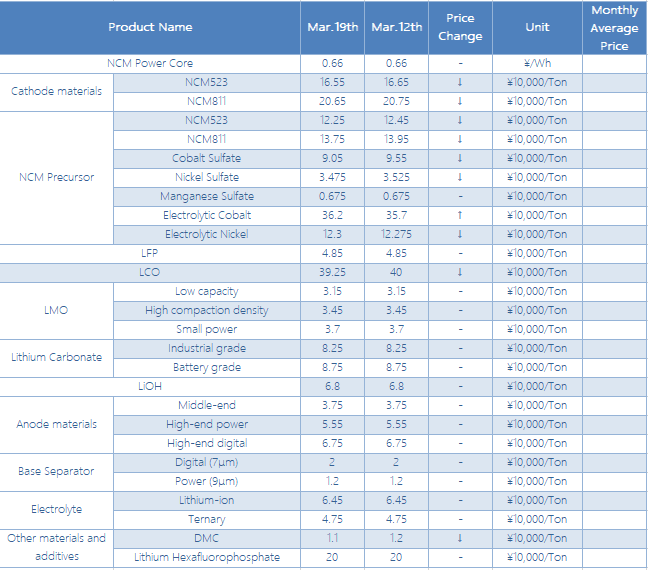

NCM Material:

This week, the domestic ternary material prices began to show a downward trend, and the willingness of downstream battery manufacturers to inquire prices rose, but the actual purchase willingness was average, because of concerns that subsequent prices would continue to fall. In terms of production, under the stimulus of peak season demand, the output of the ternary materials market continues to climb, and the increase in leading enterprises is particularly obvious, and the trend of centralization of the ternary materials market is becoming increasingly obvious.

NCM precursors:

Driven by the continuous decline in raw material prices, the domestic ternary precursor price has entered a downward channel this week. The price of the 5-series ternary precursor has fallen below 120,000 yuan/ton, and the actual market transaction price is lower. In terms of raw materials, domestic nickel sulfate and cobalt sulfate prices fell simultaneously this week. The price of nickel sulfate fell below 35,000 yuan/ton, and the price of cobalt sulfate fell below the first line of 90,000 yuan/ton. This week, the price of manganese sulfate remained stable with little change.

Recently, the anode material market has continued to improve. Although anode manufacturers are not short of orders, the pressure from cost is constantly escalating. The prices of needle coke and petroleum coke have continued to rise. After Fushun and Dagang have released 40-day maintenance plans, The price of low-sulfur coke has risen sharply for two consecutive weeks, with a cumulative increase of about 700 yuan/ton. Needle coke prices continue to rise as the prices of raw materials continue to rise, the industry's operating rate is still low, but the demand continues to improve, and the price is also rising. Compared with the raw materials, the graphitization foundry is even more aggressive, and the quotations continue to reach new highs. It is expected that the anode market in the second quarter will face greater cost pressures, as well as supply tightening conditions, and small and medium-sized battery cell manufacturers' anode purchasing pressure will increase.

Electrolyte:

Electrolyte is still one of the raw materials snapped up by battery factories. The sharp increase in prices has been the consensus of the industry, and small and medium battery manufacturers are cash, even advance payment for delivery. In terms of the raw material market: the price of lithium hexafluorophosphate is consolidating at a high level. It is currently around 200,000 yuan/ton, and the high reported 230,000 yuan/ton; the price of solvents has been adjusted within a narrow range, and the decline is about 1,000 yuan/ton, mainly due to the release of new production capacity. Now DMC The mainstream price is 1-11,500 yuan/ton. It is expected that the electrolyte market in the first half of the year will be one of the materials that will be focused on by battery manufacturers.

Separators:

This week, the domestic separator market supply is still tight, especially the head diaphragm companies of SEMCORP, Senior Materials, and Sinoma have been producing at full capacity, and the supply increase is limited. The strong downstream demand drives the second and third echelon separator companies continue to increase volume. It is expected that SEMCORP's shipments this year will reach more than 2.2 billion square meters, doubling year-on-year, and its production capacity will reach more than 4 billion square meters.