Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

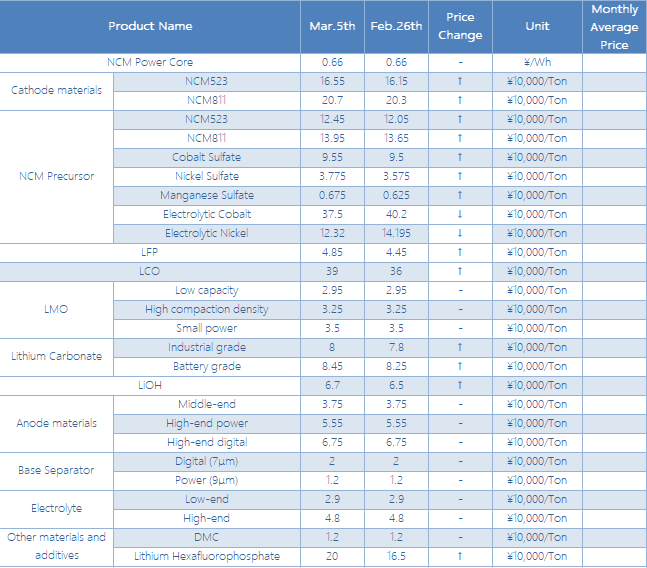

Recently, the cost of lithium batteries is still in a stage of rapid increase. The sharp rise in the price of raw materials in the early stage is gradually transmitted to the battery factory. Overall, it is estimated that the cost of raw materials has risen by about 15% from the lower point. From the downstream point of view, the price increase of digital and small power batteries has been relatively smooth, and the cost has basically been transmitted. However, the price of vehicle power batteries has not yet been increased. The enterprises are digesting themselves and the operation is in trouble.

Lithium iron phosphate (LFP):

The price of LFP continues to maintain an increasing trend. Since March, the transaction price has reached around RMB50,000/ton. Although the price of iron-lithium has increased rapidly, compared with NCM materials, the price-performance advantage of iron-lithium is still obvious, and battery factories are willing to get goods. It is difficult to change the shortage of iron and lithium in the short term.

NCM Material:

As the price of NVM precursors is stable and the price of lithium salt is still strong, the domestic price of NCM cathode materials this week is still dominated by stable and strong prices. In terms of market transactions, the performance of downstream demand in the first half of the week was acceptable. Because some battery factories had just replenishment demand, there were sporadic high-priced transaction orders in the market. In the second half of the week, market transactions have weakened, because battery manufacturers are concerned about subsequent decline in the price of cathode materials.

NCM precursors:

Although the prices of cobalt and nickel metals have fallen sharply this week, the price drop effect has not been transmitted to the precursors. Therefore, the price of NCM precursor in China have stabilized this week, and the output of various companies has also been steadily rising. In terms of cobalt sulfate and nickel sulfate, prices this week are dominated by stabilization after a small increase. Because the recent metal futures prices are mainly affected by bad news, the actual supply and demand relationship in the sulfate market has not changed, and the supply of goods in the hands of the holders is not changed. Many suppliers have a strong willingness to stand up for the price for they do not possess much goods.

In March, the production and sales of the anode material market continued to improve. Large factories were basically at full capacity, and orders for medium-sized enterprises were basically at a new high. After the Spring Festival, the price of raw materials in the anode material market continued to rise. The price of needle coke continued to increase by ¥1,000-2,000/ton, and the price of low-sulfur coke increased by ¥500/ton, and as the maintenance plan of low-sulfur coke enterprises spreading, the market is getting more uneasy. Some manufacturers will begin to discuss prices in the second quarter this month, and the willingness to increase prices is relatively strong. From the perspective of upstream and downstream industries, it is expected that the prices of some manufacturers of anode manufacturers will increase by about 10% for some products.

Electrolyte:

Recently, electrolyte manufacturers have continued their "sandwich" life. The price of lithium hexafluorophosphate has exceeded the ¥200,000 mark after the Spring Festival. Some electrolyte manufacturers have received quotations as high as ¥230,000 /ton. In addition, the shortage of VC has caused some small factories to stop production. Electrolyte companies are facing such a severe raw material supply situation, for the cost pressure is conducted smoothly. Except for some large factories, the current electrolyte companies generally are only accepting cash. It is expected that the shortage of raw materials in the electrolyte market in the first half of the year will be difficult to improve.

Separators:

This week, the domestic separator market continued to show a positive trend, downstream orders were saturated, and leading separator companies reached full production. In terms of market negotiation prices, according to some separator companies, prices are mainly stable at this stage, and there is no price adjustment plan for the time being. The proportion of coated separator will be further increased. SEMCORP's online coating production line is being put into operation one after another, and PUTAILAI also plans to invest in the construction of an integrated base film and coating project of 2 billion square meters.