Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

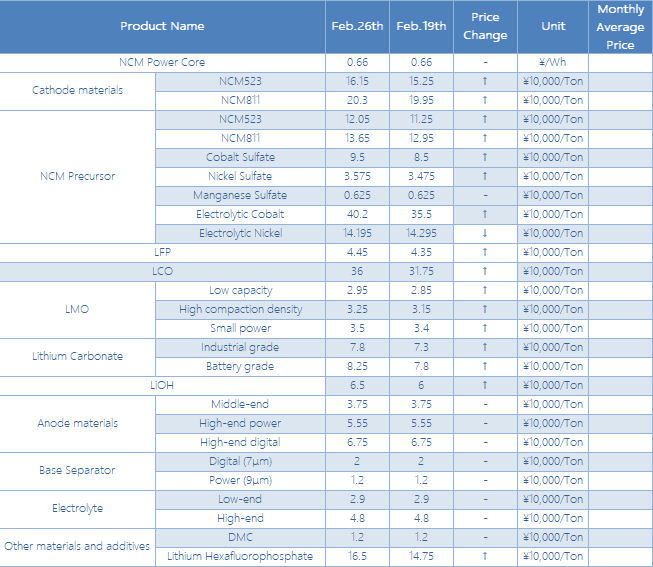

The lithium battery market is booming both in production and sales. With the further price increase of raw materials after the holiday, many small digital battery cell factories have been unable to withstand the cost pressure and have begun to increase the price of battery cells on a large scale. The downstream industries have been accepting slowly. Power battery companies continue to be at full production, major companies are facing difficulties to delivery for they have too many orders from the downstream, and pressure on raw material supply is also increasing. The peak season continues.

Lithium iron phosphate (LFP):

The shortage in the LFP market has become more and more vital. Due to the maintenance and shutdown of some lithium iron companies in February, the overall supply of LFP decreased instead of increased. After using up the previous inventory, recent supply has become tight, and downstream battery factories are actively rushing for supplies. In terms of price, the latest price of LFP is close to ¥50,000/ton, and the market transaction price is expected to exceed ¥50,000 in March.

Driven by the continuous increase in raw material prices, domestic NCM material prices rose sharply this week. The prices of various types of NCM materials generally rose by about ¥10,000/ton, and the price of high-nickel NCM materials rose slightly. The cash price of current 811 model is around ¥200,000/ton. In terms of market transactions, after the domestic battery factories of various sizes resumed production this week, downstream demand shows signs of picking up. However, due to the rising price of NCM materials, battery factories mostly enter the market with inelastic demand. Despite the frequent inquiries, the volume of purchase is not large.

Recently, the price of anode materials has risen steadily, and the willingness of middle and low-end anode materials to increase is strong, but the price increase of mainstream battery manufacturers will lag behind. Raw material prices continue to rise. This week, the price of needle coke has generally increased by about ¥1,000/ton, and the mainstream domestic needle coke is now at ¥7,000-9,000/ton. OEMs for graphitization has received vast number of orders, and their expansion projects are stepping up construction. It is expected that new production capacity will be gradually released around October.

Electrolyte:

Recently, the quotations of new electrolyte orders have generally been increasing, the price of lithium hexafluorophosphate has reached a new high, and the shortage of additive VC continues. These topics are something that the electrolyte market cannot avoid, which is nonetheless repetitive. At present, the cost of electrolyte is relatively smooth, especially for small and medium-sized battery manufacturers. The shortage of raw materials makes the electrolyte supply tight. It is expected that the tight supply of raw materials may be relieved after the second quarter.

Separators:

Recently, the mainstream transaction prices of domestic separators have been stable, and leading separator companies have no price adjustment plans for the time being, and some small and medium-sized separator companies have increased by ¥0.1/sqm. Most of the leading separator companies have reached full production, and they have not stopped production during the Spring Festival, meeting the requirements for downstream orders. SEMCORP released a performance report: In 2020, the company's production and sales of wet-process lithium battery isolation films will continue to grow steadily, achieving total operating income of ¥4.283 billion, a yearly increase of 35.56%; net profit attributable to shareholders of listed companies is ¥1.11 billion, a yearly increase of 30.65%.