Disclaimer: The above data information origins from ICCSINO, for reference only, not as a basis for trading.

Lithium Battery

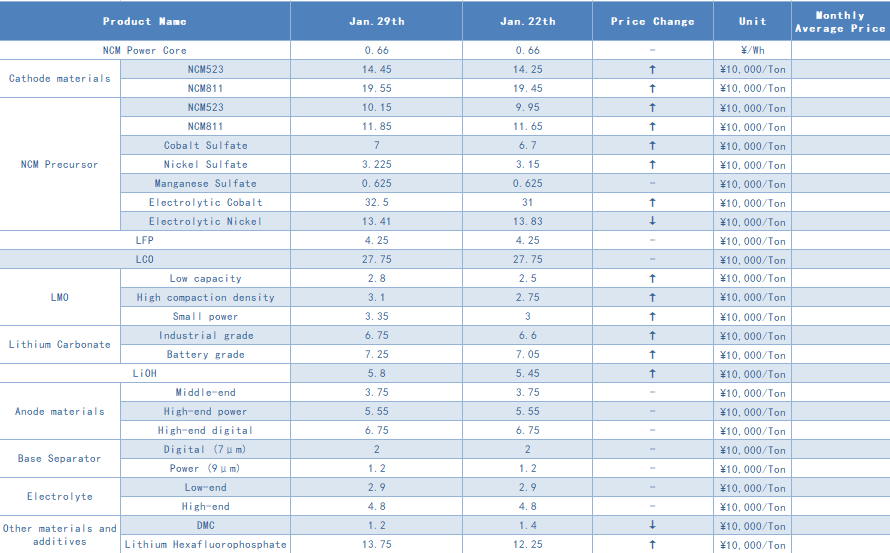

The continuous increase in raw material costs has begun to affect the battery cell. Recently, battery cell manufacturers with small digital and small power as their mainstayhave successively issued price adjustments. With the increase ranging from ¥0.3-¥0.5 per battery cell, but the actual transaction has not yet landed, and it is expectedthat with the increase of new orders. The price increase will be implemented. It is worth noting that there is a serious shortage of imported batteries inthe market, and the market is in a state of undersupply. The price of powerbattery is relatively stable, continuing the boom in supply and demand.

Lithium iron phosphate (LFP): The LFP market is highly stable, as the market continues to be out of stock. At present, the prices reported by enterprises in February are generally raised, and the lithium iron phosphate of ¥45,000/ton will become the norm in the short term. From the perspective of enterprise expansion plans, it is expected that the large-scale launch of new product will have to wait until the second and third quarters, and the overall shortage will continue for a long time.

In the last week of January, the domestic NCM materials market has been relatively weak. However, from the sporadic transactions in the market, the domestic NCM materials market prices continue to rise, and the transaction prices of some 5 series NCM materials has even risen to more than ¥150,000/ton. Looking at the market outlook, with the gradual suspension of logistics in various places, it is expected that the transaction in the NCM material market will fall into silence. However, judging from the production schedule of various enterprises, the NCM market will most likely still maintain a high operating rate in February.

This week, seldom domestic manufacturers of NCM precursors have quoted externally, and the prices of a few transactions have followed the price of raw materials. The prices of 5-series NCM materials are generally above ¥100,000/ton. Some NCM precursor companies suspend work for maintenance during the holiday season. Therefore, in order to maintain the return of employees, some companies have advanced their holiday plans. However, more NCM precursor companies indicated that they will maintain a higher operating rate during the holiday season. In terms of upstream raw materials, the prices of various sulfates have strong performance recently. The high quotation of cobalt sulfate has jumped to around ¥75,000/ton. The market is in a state of undersupply.

This week, the price of lithium carbonate continued to increase. Although the Spring Festival is approaching, due to the recent maintenance of large factories and the continued bullish market for lithium carbonate, downstream cathode material companies are still willing to restock. In addition, due to the tight supply of manufacturers, mainstream cathode material companies still have high production schedules in February, and some cathode material companies are waiting for shipments from lithium carbonate plants. It is expected that domestic lithium carbonate prices will continue to remain high in February, and the supply shortage will be difficult to improve in short-term.

Recently, due to the sharp increase in raw material prices, LMO manufacturers have been forced to increase product prices. Downstream battery cell factories have gradually begun to accept the increase in material prices. The phenomenon of battery cell factories locking orders in advance is more obvious than in the previous period. Some enterprise has received orders until March. It is expected that the production of these companies will not be suspended during the Spring Festival. However, a few companies choose to take holidays in advance because the price of LMO is not as high as the increase in raw material costs. The overall operating rate during the holiday period is higher than in previous years, and the price of LMO will also be adjusted further after the holiday as the price of raw materials rises.