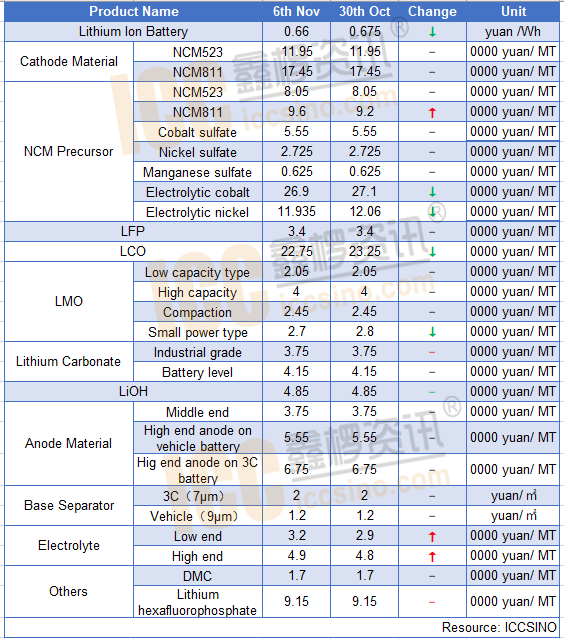

Lithium-ion Battery:

Battery manufacturers showed a trend of increasing production this month. The phenomenon of rushing for production was quite evident. ICCSINO estimates that mainstream manufacturers would maintain a production output similar to last year's. As NiO launched the 100kWh version, and LG and Panasonic continued to adjust battery models for Tesla, high-energy-density NCM battery is expected to be the short-run focus. Next year, LFP and high-nickel NCM batteries will become the focus.

Cathode Materials:

NCM: The domestic NCM prices remained stable this week. The prices did not follow the rebound of lithium salts for two reasons. Firstly, NCM prices were affected by weak NCM precursor prices. Secondly, there was excess supply capacity in the NCM industry, preventing NCM prices from rising. From the demand side, ICCSINO expects domestic NCM material shipments to continue to grow in November, mainly due to the hot EV battery market and good export performance of consumer 3C market. Only the small power market shows a slight downturn.

LFP: the market trading volume of LFP has increased steadily. Leading manufacturers have been operating under full production capacity but still could not meet all demands. The inventory has been used to supplement shipments, and there is an obvious peak season. As lithium carbonate's cost continues to rise, the loss of LFP production is aggravated, and manufacturers are in an urgent need to solve the problem through cost reduction or price increase.

LMO: The price quotes of LMO remained stable recently. Some manufacturers are rushing for completing their annual production goal, so they are willing to lower their product prices for shipments despite the rising raw materials costs. Although the market demand remains relatively strong, the market competition was more intense than the previous period, and hence price would remain stable in the short term.

Lithium Carbonate: the price of lithium carbonate remained stable this week, and the price quotes of various manufacturers were firm. In recent months, due to the improvement in the market demand for cathode materials, especially NCM, the market supply of battery-grade and industrial-grade lithium carbonate has been slightly tight. In November, the downstream market has not shown any obvious sign of fading demand. ICCSINO forecasts that lithium carbonate prices will remain at a high level in the short term.

Anode Materials:

The anode materials have performed well recently, and the market demand continues to be hot. In particular, leading battery manufacturers have increased production and significantly boosted anode shipments. It is expected that shipments this month will reach a high point.

Anode material prices are relatively stable. Domestic price quotes of needle coke are rising with 500-1000 yuan/ton this week. The rising price of low-sulfur coke is creating price increase potential for needle coke. The purchasing price of low-sulfur coke has increased substantially, but anode manufacturers are in price competition, so the rising cost would not be passed onto end products in the short term.

Separator:

Domestic separator demand continued to improve. ICCSINO estimates that domestic separator production will continue to increase by about 8% in November. Leading manufacturers would experience an increasing number of domestic and overseas orders, mainly from CATL, BYD, LG, Panasonic. Besides, Shenzhen Senior Technology Material wet-process production capacity would continue to be released, and increasing supply for downstream customers like CATL, BYD, and LG. At present, domestic separator companies are showing an optimistic attitude towards market demand in November and December. ICCSINO estimates that demand will continue to rise, but prices remain stable.

Electrolyte:

The electrolyte market has performed well recently. The shipments of all manufacturers have increased to the extent that some leading companies have reached full production capacity. The price increase began in mid-to-late September and has gradually been transmitted to downstream users after one month. The actual increase to downstream users was about 10,000 yuan/ton. In the raw material market, the tight supply of solvents has improved, but the price has not yet adjusted substantially; the price of lithium hexafluorophosphate has been suspended at around 105,000 yuan/ton, but after CAPCHEM's acquisition, some manufacturers in the market are more concerned about the market tension next year. It is expected that the increase in lithium hexafluorophosphate will continue next year.