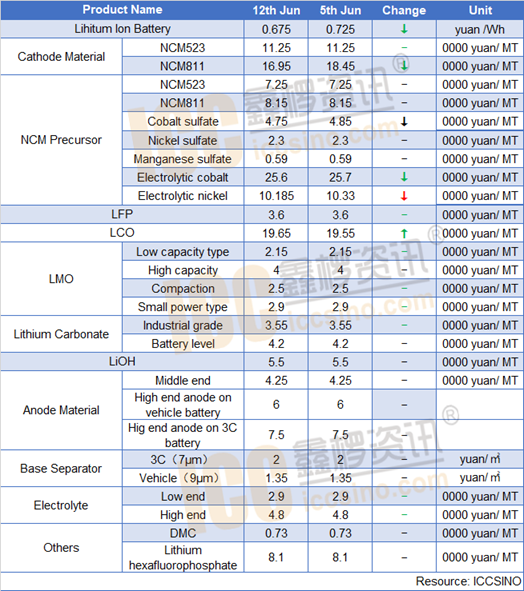

Lithium Ion Battery

Lithium ion market was warming up gradually, which was driven by e-bike and ESS market. Nevertheless, new energy market demand was weakening. According to ICCSINO, mainstream battery enterprises have resumed production and we estimate that battery production & sales would reach top level. Lithium ion battery price has been declining in past 6 months, which was caused by raw material price decreasing. Furthermore, it’s dominant that lithium ion batteries gradually replacing lead acid batteries in ESS and e-bile field.

Cathode Material

NCM: Chinese NCM market was weakening this week. NCM 523 price was stable, whereas NCM 811 price declined under the circumstance of poor demand. As end of H1 of June, Chinese NCM 811 prices was 160K yuan/MT. In terms of downstream demand, newly added demand is from low-end 3C market including portable fan.

NCM Precursor: Chinese NCM precursor market was weakening this week. Under the circumstance of poor demand from China and overseas, Chinese leading precursor enterprises’ operational rate was lower than expected. Electrolytic cobalt price slight declined since purchase intention was not strong and tight supply of upstream raw materials was released.

LFP: LFP market performance was good in both production and sales. Price was stable which was around 36,000 yuan/MT. According to ICCSINO research, LFP orders from base station and energy storage market was increasing.

LMO: market was stable this week. In terms of supply, some LMO enterprises have resumed production in June. In terms of demand, there is dominant increase in low end 3C market orders. ICCSINO estimates that LMO market would continue to strengthen.

Lithium carbonate: market was stable recently. Demand gradually warms up driven by LFP & LMO demands improve.

Anode material:

Chinese anode material market was lower than expectation this week. High-end 3C, ESS and small power market brought new demands for anode material. New energy vehicle market has gradually recovered. Some leading anode enterprises are negotiating prices. ICCSINO forecasts that middle-high-end anode material price might decline.

Separator:

Chinese separator market was stable this week. According to ICCSINO research, wet process and dry process separatory orders have increased in June driven by e-bike and ESS market.

Electrolyte:

Electrolyte market was stable this week. Shipments in new energy vehicle market was growing this month. With more battery enterprises participating in ESS bidding, electrolyte price expectation lowered.