|

||

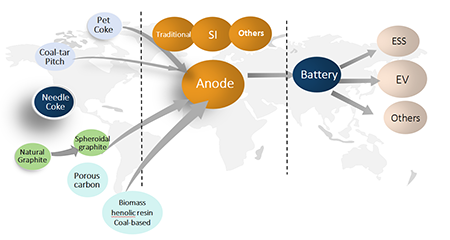

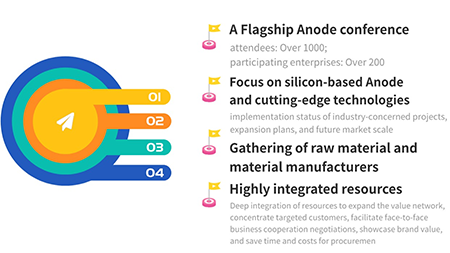

According to ICCSINO's data, global LIB production has reached 2,297 Gwh in 2025, with a growth rate of 34.6% in 2025. Among them, the growth rate in the energy storage sector has reached 70%, presenting a grand scenario of "dual-wheel-driven demand from both China domestic and overseas markets and coordinated outbursts across the upstream and downstream industrial chains". This powerful wave injects tremendous momentum into the LIB industry, significantly driving up demand for battery cells, the four major upstream main materials, and anode materials. In 2025, China's anode material production will reach 3.0466 million tons, a year-on-year increase of 46%. However, judging from the current effective production capacity, there are certain supply gaps in the long-term supply of battery cells, various materials, and anode materials. Given the clear supply gap, ensuring a stable and efficient supply chain has become the key to seizing this round of certain growth. To grasp the development opportunities in this round of the LIB industry, ICCSINO will host two significant conferences consecutively from March 18 to 19, 2026 (with registration on the 18th). From March 18 to 19, the "2026 (19th) Synthetic & Natural Graphite Conference (SNGC)" will be held in Changzhou. This conference focuses on the anode material sector. Through a variety of forms such as technology sharing, business negotiations, exhibition displays, and brainstorming sessions, it aims to promote research and development updates, technological iterations, supply-demand cooperation, and industrial progress across the entire LIB anode industrial chain. It will strengthen exchanges in multiple aspects including academic research, process practice, equipment application, and industrialization construction, building a good communication platform for the in-depth integration of the LIB anode industry and helping anode enterprises seize opportunities in this new round of upward cycle. |

|

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|